January monthly NFT report

January was the best month for token prices in nearly a year, with ETH, BTC and altcoins posting their sharpest gains since July. This naturally led to increased volume and market value in the NFT industry.

Some metrics were predictable, such as the number of closed investment rounds continuing to slide. The distribution of NFT volume by chain has remained the same, with Ethereum remaining the most important chain for NFTs, followed by Solana and Polygon.

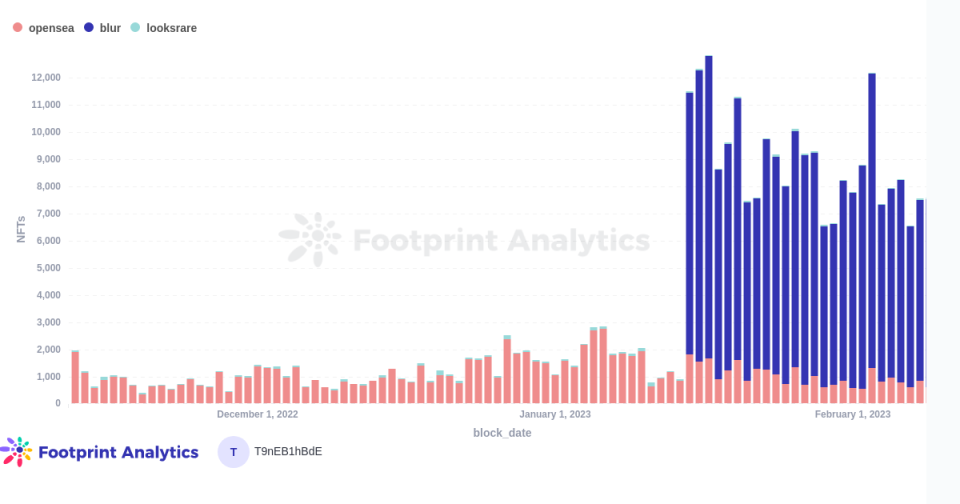

Other developments, however, were both significant and unexpected. While during the bull market, analysts and experts debated whether LooksRare or another marketplace would overtake OpenSea, NFT aggregators have become the dominant force in the industry. While we covered the rise of these platforms last Novembera new aggregator, Blur, has taken the sector by storm and become a leading player.

The main findings

Crypto macro overview

NFT Market Overview

-

The market capitalization of NFTs peaked on January 26 at $20 billion

-

Since November, the volume of NFT trading has increased steadily, reaching $989.9 million in January.

-

Weekly NFT users peaked at 127,887 on January 27, the highest since January and February last year.

Chains and marketplaces for NFTs

-

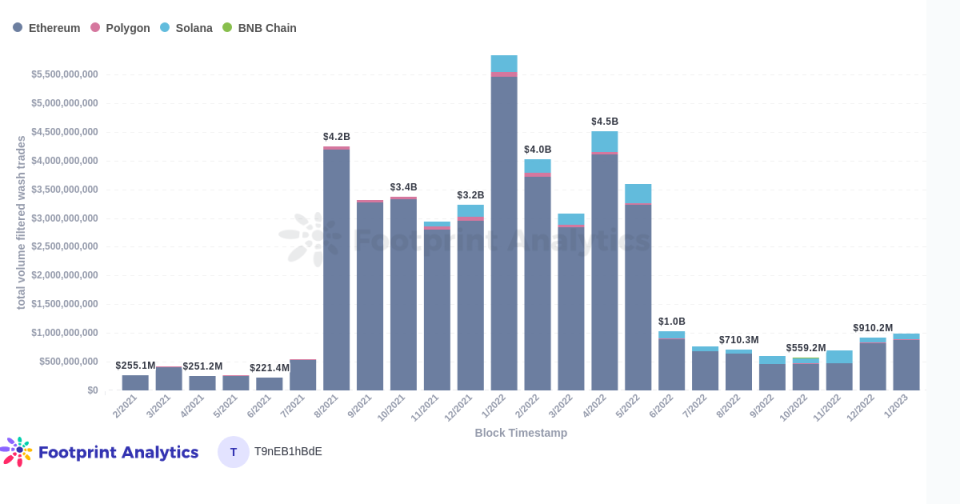

The market share per chain remained almost the same as before, with Ethereum in the lead, followed by Solana and Polygon.

-

The percentage of trading on Ethereum detected as wash trading was 22% of the total, up from 19% in December

-

LookRare was the second most profitable NFT marketplace after OpenSea, generating $553 million in platform fees

-

Aggregator platforms have become the best places to buy NFTs and Blur has become a leader in this field

NFT Investment and financing

-

The NFT category continued to witness a fall in rounds closed MoM, with 7 compared to December 5

-

Candy Digital, a sports NFT firm, closed the largest round with a $38 million Series A

Crypto macro overview

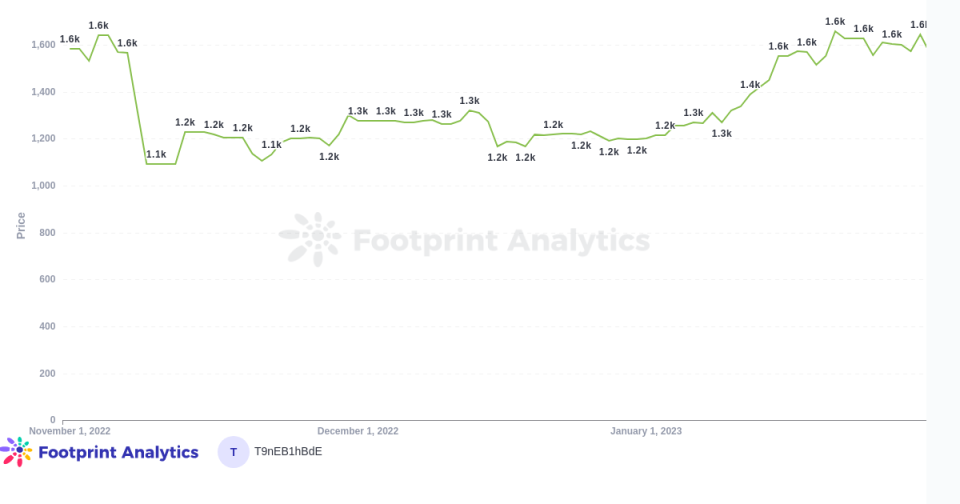

ETH rallied from the low-$1,200 zone in late December to a January high of $1,660.

Price of ETH January

In terms of token prices, January was a nice deadline after a year of significant downward pressure created by macroeconomic conditions and exacerbated by a series of collapses in crypto.

NFT Market Overview

The market capitalization of NFTs grew from $13 billion in December to $20 billion in January.

NFT market value and volume

This was the largest monthly increase since July. For reference, ATH for NFTs was $41 billion last April. The average per day was $18.9 billion.

Since November, the volume of NFT trading has increased steadily, reaching $989.9 million in January.

NFT volume by chain (with wash trade filtered)

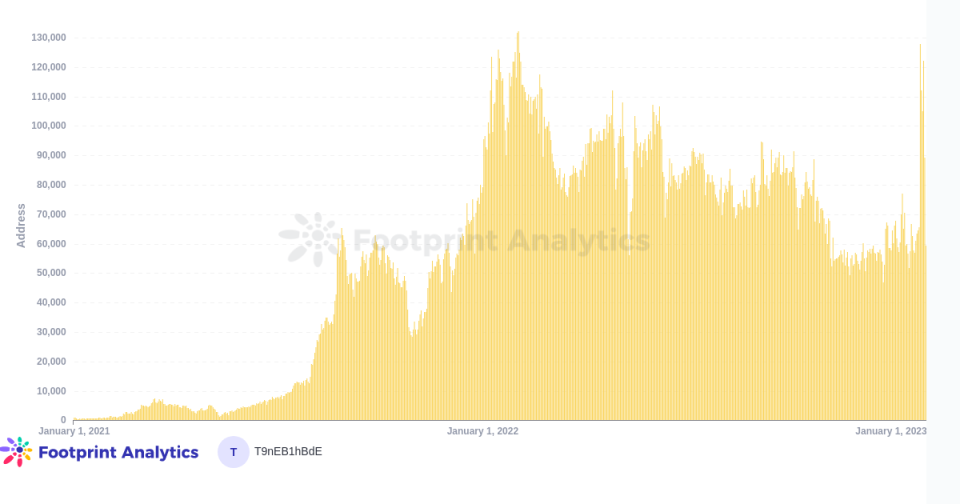

There were more weekly NFT users at the end of the month than at any time since January and February 2022, peaking at 127,887 weekly users on January 27.

Weekly users

The ATH for this calculation was February 2, 2022, with 132,139

Chains and marketplaces for NFTs

The market share per chain for volume remained roughly the same as in previous months.

NFT volume by chain (with wash trade filtered)

Ethereum remained far ahead in the lead, followed by Solana and Polygon.

LookRare was the second most profitable NFT marketplace after OpenSea, generating $553 million in platform fees

Top marketplaces

In the past, many attributed LooksRare’s success solely to wash trading. While much of the platform’s activity in the previous months was not real, recent analysis shows that it is a strong competitor to OpenSea with real trading.

Aggregator platforms have become the best places to buy NFTs and Blur has become a leader in this field

Blur Aggregator Daily Trading NFTs by Marketplace (Share)

NFT Investment and financing overview

The NFT category continued to witness a fall in closed rounds MoM, by 7 compared to December 5.

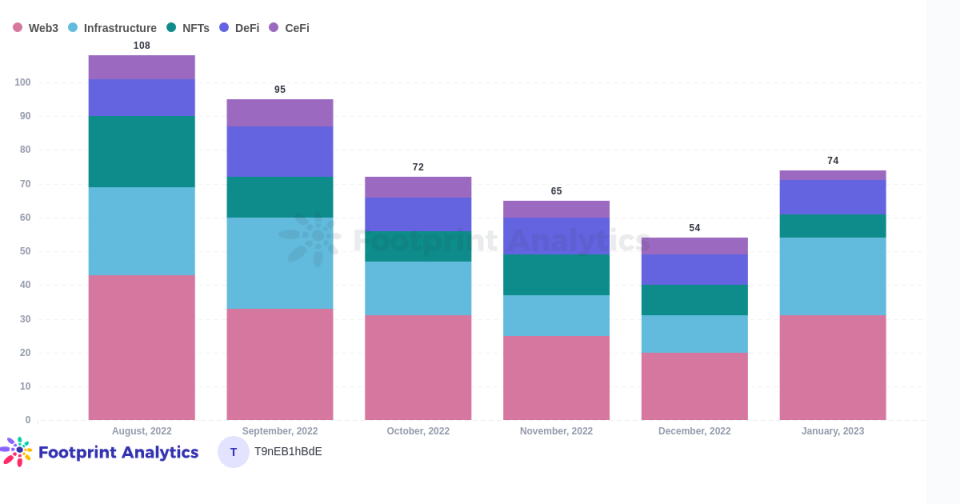

Investment by category (NFT report for January)

On the other hand, across the entire blockchain industry, January was the first in seven months to see an increase in the number of closed rounds in the blockchain industry (74 compared to December’s 54.) Candy Digital, a sports NFT firm, closed the largest round with a Series A of $38 million.

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Footprint website: https://www.footprint.network

Disagreement: https://discord.gg/3HYaR6USM7

Twitter: