It’s Time to Start Paying Attention to Bitcoin (Technical Analysis) (BTC-USD)

The Aeon

It’s time to start paying attention to Bitcoin (BTC-USD).

There is an indicator in the crypto world called the MVRV Ratio, which is market value of a given token divided by realized value of the token. Let us break down the components:

Market value is simple, it is the market cap of a token, which is the total number of tokens outstanding multiplied by current the price of the token.

Realized value, in this context, it is unique to crypto (as opposed to traditional stock markets) as it is only accessible due to public data on the chain. Realized value is the aggregation of price paid for each token when it was acquired multiplied by the supply of tokens. Essentially provides realized value token’s overall cost base for all token holders.

Below are different levels of the MVRV ratio and what they indicate, using Bitcoin as an example:

- MVRV < 1: The collective Bitcoin holder is in a losing position. This usually coincides with a crypto bear market.

- MVRV = 1: The collective Bitcoin holder is at a breakeven level. The current bitcoin price is the weighted average price paid for each Bitcoin in circulation.

- MVRV = 2: the collective Bitcoin holder has doubled their investment

The highest Bitcoin MVRV ratio ever recorded was 8.08 on June 4, 2011.

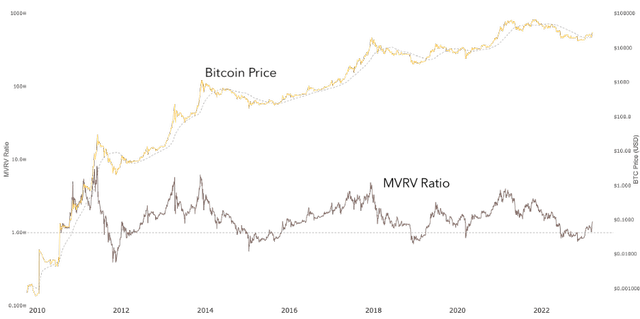

The MVRV ratio can be used as a reliable long-term signal to determine when Bitcoin (and the broader crypto market) is overbought or oversold. Below is the chart of the Bitcoin price and the Bitcoin MVRV ratio:

Bitcoin Price and Bitcoin MVRV Ratio (Woobul Charts)

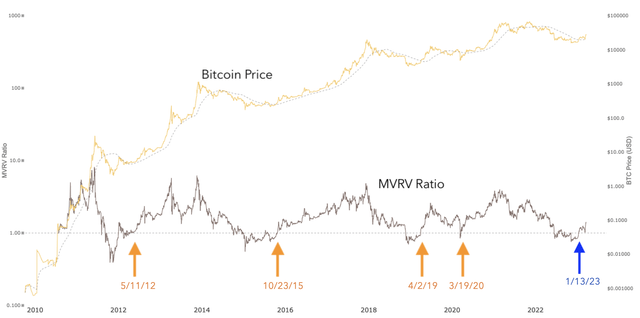

Currently, Bitcoin has maintained an MVRV ratio above 1 for more than 60 days

There have been four previous periods in Bitcoin’s history where the MVRV ratio has broken above 1 and maintained that support level for more than 60 days, similar to the period we are in now. See the orange arrows below:

Cases where Bitcoin broke through the MVRV threshold of 1 and sustained it for more than 60 days (Woobull Charts, OneJournal Research)

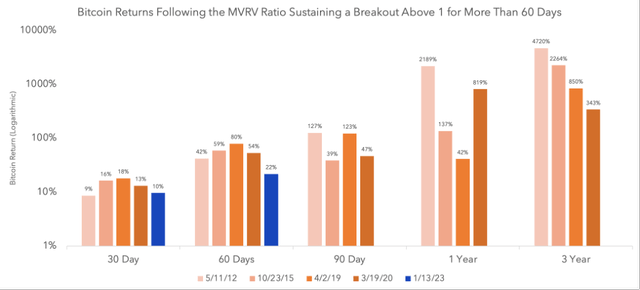

For each of these cases, as well as the current time period (in blue), the chart below summarizes Bitcoin’s returns over the subsequent 30-day, 60-day, 90-day, 1-year, and 3-year periods:

Bitcoin returns for every instance of MVRV>1 and maintains this level for over 60 days (DQYDJ, chart created by OneJournal Research)

The return speaks for itself. On average, the 90-day return is 84%, the 1-year return is 797%, and the 3-year return is 2044%.

Now is the point in the article where I have an obligation to say that past performance is no indication of future returns. The upside of Bitcoin today is also lower than it was when Bitcoin was in its infancy, a natural tendency for any maturing technology.

A note on technical analysis

We believe the only technical analysis worth paying attention to is long-term focused, and even then it is only a tool. If you are presented with technical analysis that is on a time scale of days and not months or years, run. Technical analysis can be as much art as it is science, and certain technical analysis trends hold until they don’t (see the Bitcoin Stock-to-Flow model).

Technical analysis cannot explain the fact that the Federal Reserve continues to raise interest rates by 0.25% even as the global banking system shows signs of weakness, including two significant crypto banks in Silvergate (SI) and Signature Bank (SBNY). That can’t account for Fed Chairman Jerome Powell noting at his news conference today that it is “the most likely case” that the Federal Reserve would not cut interest rates in 2023, sending risk assets into a late-afternoon selloff.

But with something like Bitcoin having no balance to perform fundamental analysis, and chain data providing new lenses to analyze an investment’s behavior, such as the MVRV ratio, technical analysis can help provide signals when Bitcoin stocks are overbought, oversold or in a long-term trend reversal.

Conclusion

With all disclaimers aside, the recent turmoil in the banking sector appears to have built on Bitcoin’s price momentum from earlier in 2023, and the long-term upside to Bitcoin remains significant. The MVRV ratio would indicate that the foundation for the next Bitcoin bull cycle may be forming as we speak.