It’s a Tsunami and Bitcoin is My Surfboard (BTC-USD)

MAXIM ZHURAVLEV/iStock via Getty Images

Summary of the assignment

Bitcoin (BTC-USD) has started the year with a bang, increasing by over 60%. “Risk-on” assets have had good results, which can be explained by the increase in global liquidity.

Although the Fed may still have some tightening left to do, from a global perspective, has liquidity bottomed out? And if this is the case, has Bitcoin bottomed out?

BTC is very strongly linked to liquidity, which is why it is so important to keep it under increasing liquidity.

Although a bottom may be in, we need more evidence and we will get it when Bitcoin begins its next pullback.

The liquidity tsunami

The tide has changed, and by 2023 global markets have seen a liquidity infusion of $1 trillion.

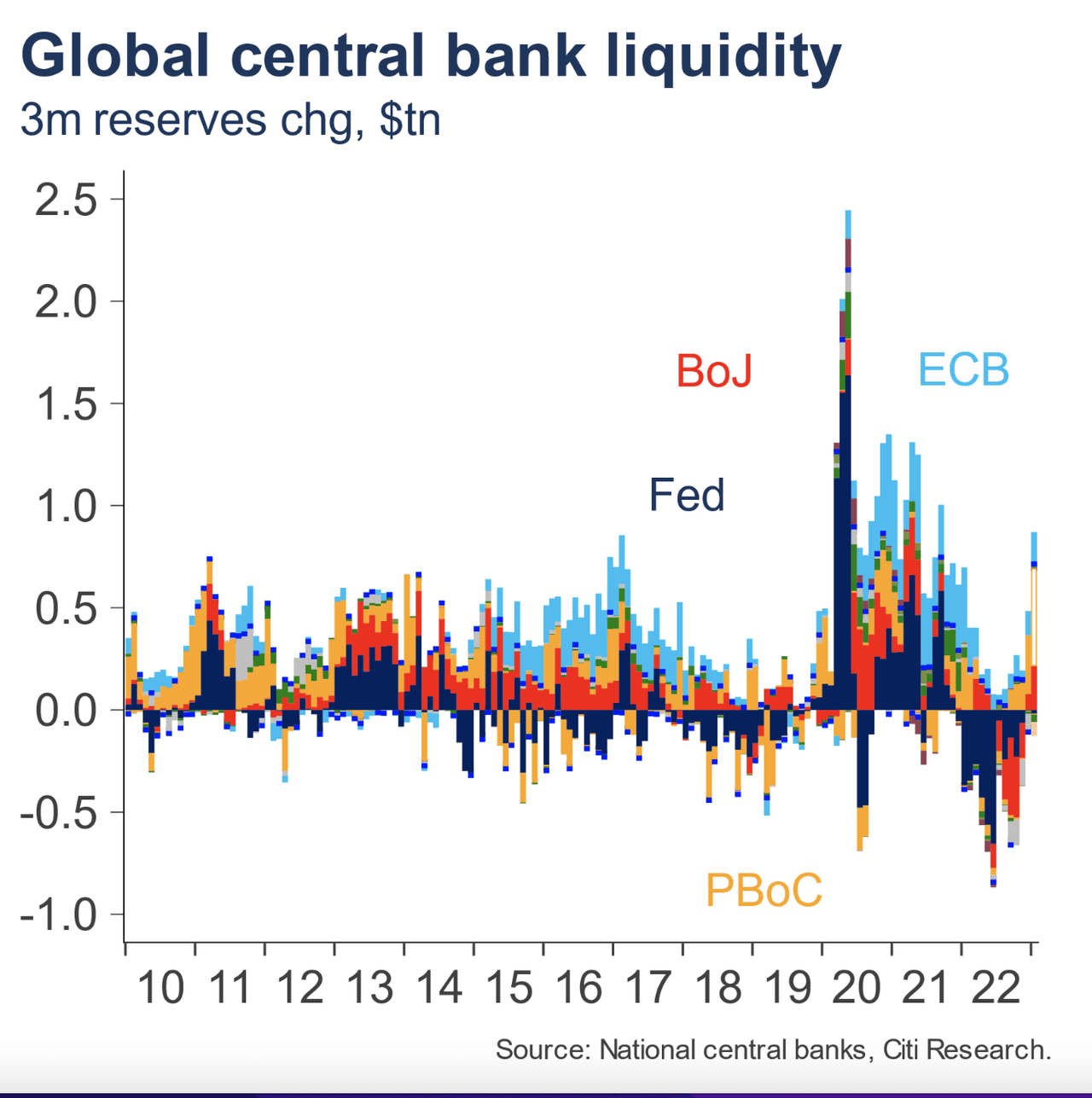

CB reserves (Citi Research)

This chart from Citi Research shows the change in global CB reserves over the years. So far in By 2023, we have seen central bank liquidity increase by $1 trillion, with the main culprits being China’s PBoC and Japan’s BoJ.

China is currently experiencing below-average inflation, and with a weakened economy, the country’s central bank has promised to keep monetary policy accommodative. Last week, the bank already injected 199 billion Yuan, $29 billion, via its medium-term lending facility. But that’s not all.

The central bank will further strengthen financial support for domestic demand and industrial systems and has pledged to expand the use of an instrument to support private companies’ bond financing, the PBOC said on Wednesday after a meeting on Friday.

Source: global.chinadaily.com

That much liquidity comes from China and will probably continue to flow in throughout the year.

What is less clear is what the BoJ will do:

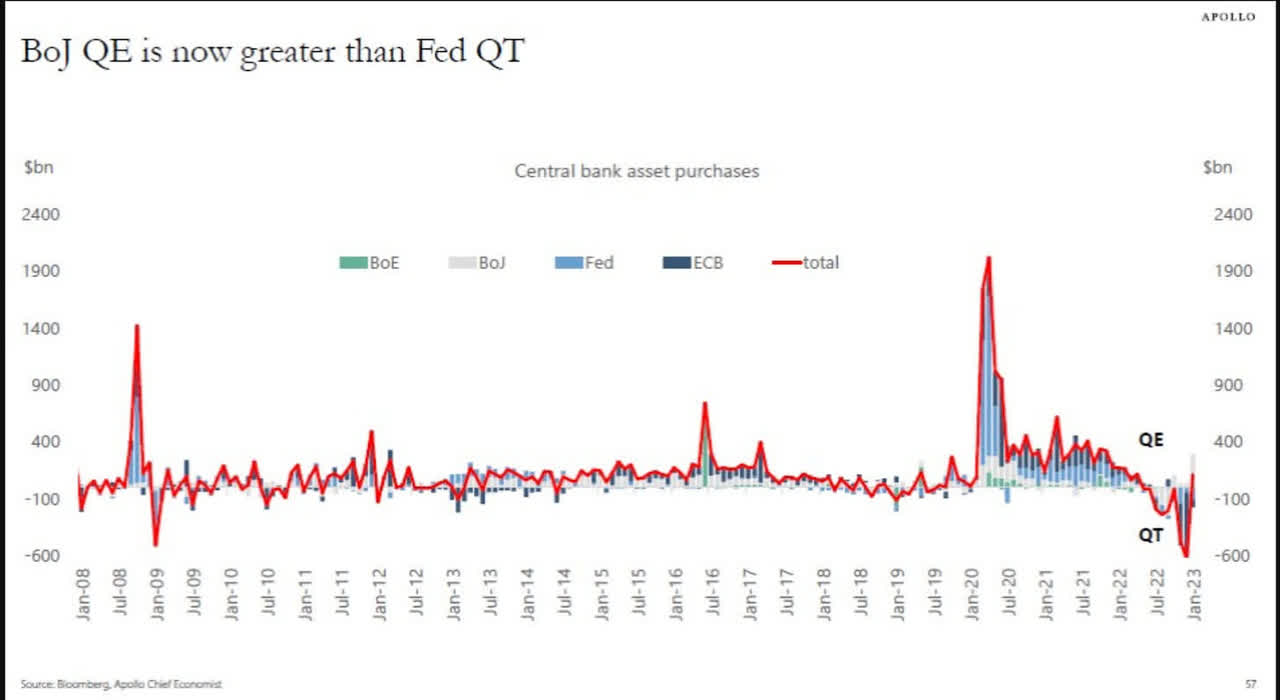

CB Asset purchase (Bloomberg)

The BoJ has been forced to aggressively buy Japanese government bonds because of its yield curve control program. As we can see in the chart above, the BoJ is adding more liquidity than the Fed is taking out at this point.

However, the BoJ’s leadership is changing, Kazuo Ueda is set to take the helm, and speculation is that he may scrap the YCC policy. We’ll see.

All in all, it appears that global liquidity could indeed have bottomed out already, or at least it could be close. While the Fed hasn’t stopped yet, it likely will this year, and we also have other factors in the US, such as the use of the Reverse Repo Facility, that could help loosen economic conditions.

Why you need Bitcoin

The idea that liquidity can turn for good was also recently shared by Michael Howell in an insightful YouTube interview.

Assuming this is the case, then where you want to be for the next year and maybe longer is in stocks and high beta exposure. In other words, “risk-on” assets.

Of these, Bitcoin is perhaps the best way to go:

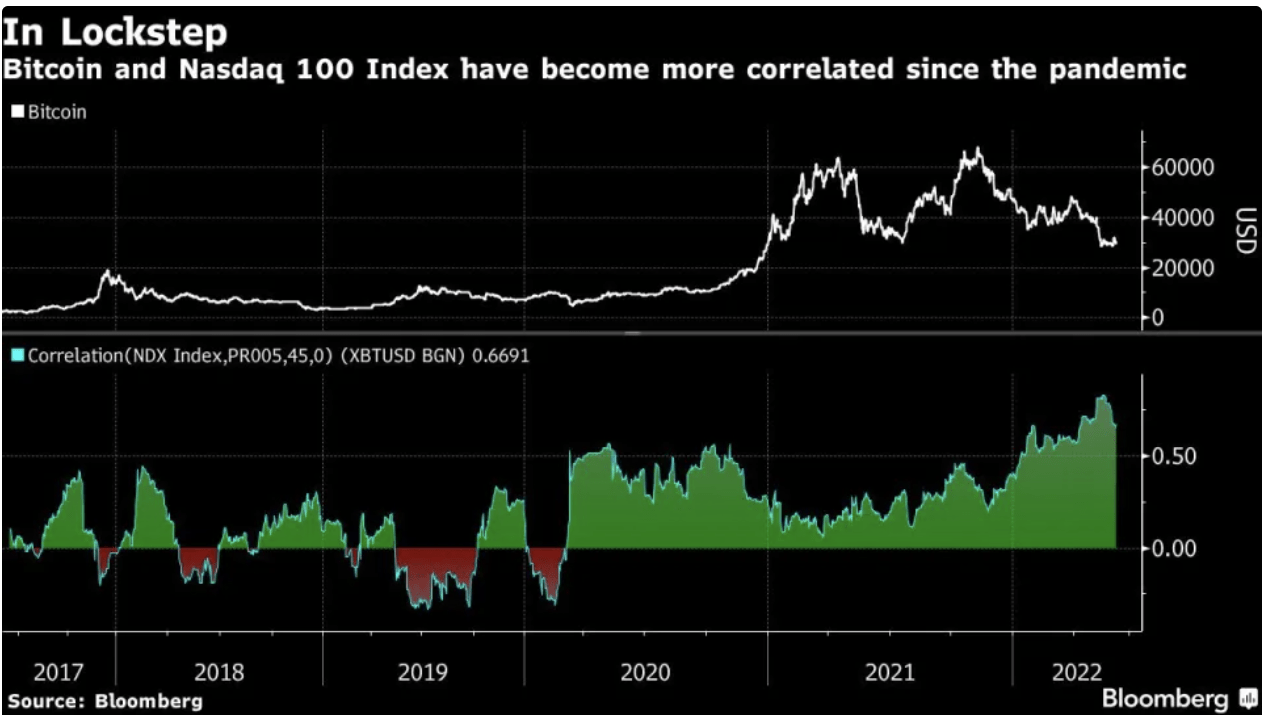

BTC and Nasdaq correlation (Bloomberg)

Bitcoin has become highly correlated with the Nasdaq (NDX), but offers a much higher return potential.

BTC and NDX performance (TradingView)

If we look at the performance since the COVID crash, even after +1 year of bear market, Bitcoin has performed 4 times as much as Nasdaq. At its peak, Bitcoin was up close to 700%, while NDX was up a “small” 75%.

In short, Bitcoin is perhaps the best asset to capture gains in an environment of increasing liquidity.

Bitcoin Outlook: Where Fundamentals Meet Technical

After a significant rally, I think we should see a selloff in the near future. This makes sense both technically and fundamentally.

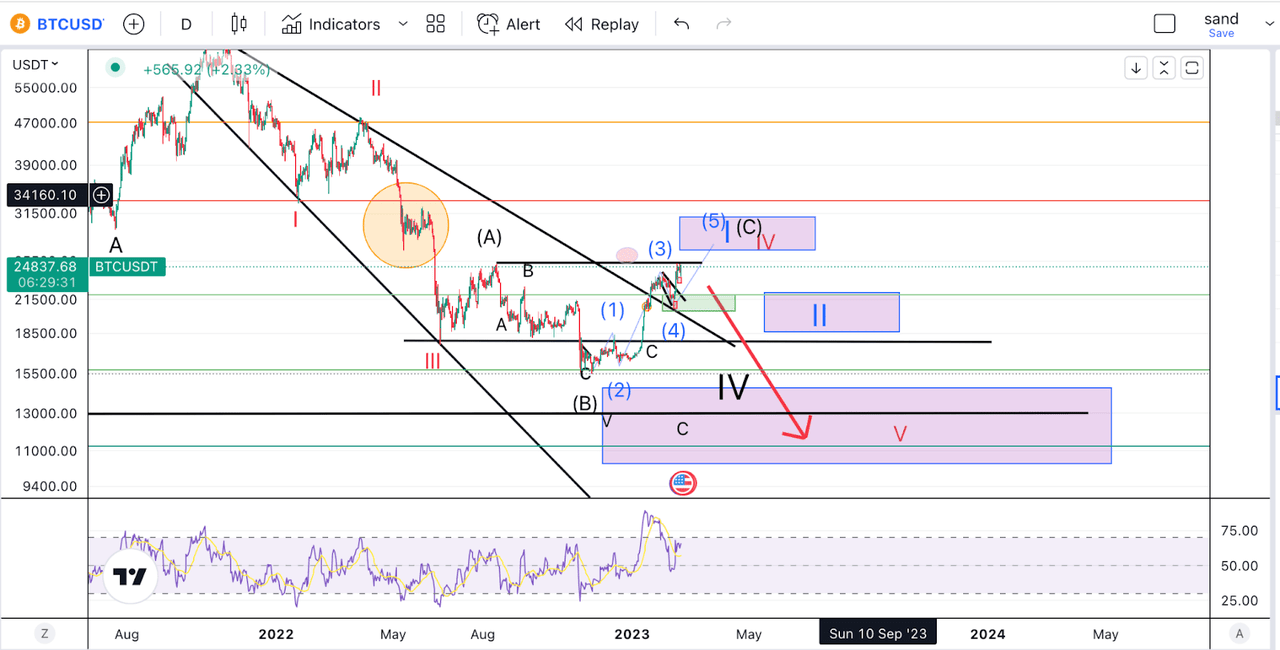

Bitcoin Outlook (Author’s work)

Looking at my EWT count, we have two possible scenarios on the table. On the bullish side, we can say that BTC has already completed five waves down. This would mean that the rise towards $25,000 where (A) is on this chart would be the top of our red wave IV and the low of $15,500 would be the end of five.

This now puts us in an initial impulse of the lows to complete a wave I of this new bull market rally. My target for this is around the $28,000 level based on fib extensions. After this, we should see a retracement in a wave II that could take us back below $20,000.

Alternatively, we can enter new lows, and count this entire structure formed since June 2022 as an ABC correction of wave IV.

The next pullback is what determines which count we are on. In either case, we should see some form of a short-term sell-off, followed by a rally.

This makes basic sense as well. Markets have risen sharply due to lower inflation and hopes for a central bank in the Fed. However, strong economic data and persistent inflation could prompt the Fed to raise interest rates as high as 6%. This is sure to shock the markets and likely lead to a sell-off.

However, the Fed will take a break in the medium/long term, and other central banks are already injecting liquidity into the system. This means we could be much higher over the next 6-12 months.

Remove

The bottom line is that liquidity is on the rise, and this is good news for Bitcoin stock, which is one of the best vehicles to capture returns in this environment. With that said, some of the altcoins and even crypto-related stocks can outperform Bitcoin. I cover all of these in my marketplace.

Ending with a note of caution, although I am increasingly bullish, there is no guarantee that Bitcoin has bottomed out, but I am paying close attention to the signals. The dip should be bought, but don’t forget to manage risk.