ITFA fintech leader André Casterman on the metaverse, distributed ledger technology and NFTs

The digitization of trade finance has led to significant changes in the market in recent years.

The shift towards technology has had many positive effects; increase operational efficiency, reduce paper-based processes and minimize costs. Moreover, digital innovation shows no signs of slowing down, opening up the commerce ecosystem to endless possibilities.

To learn more about this ever-changing sector, Trade Finance Global’s (TFG’s) Annie Kovacevic sat down with André Casterman (AC), founder and CEO of Casterman Advisory and fintech chair of the fintech committee at ITFA.

TFG are proud media partners for ITFA’s annual trade conference, which will cover the latest advances in trade finance Fintech. Find out more here.

Can you tell us a bit more about the fintech committee at ITFA?

AC: The Fintech Committee has created a trade finance fintech community, producing tradetech innovations, which will be showcased this week at Porto.

Given that innovations emerge from collaboration between fintech members, this community truly exemplifies “collaboration at its best.”

How does your role as ITFA head of fintech activities fit into this ecosystem?

AC: My current priority is to scale the adoption of innovations, primarily focusing on strategic market ambitions such as the Model Law on Electronic Transferable Records (MLETR) and automated distribution strategies; this includes digital negotiable instruments (DNI) and trade finance initiatives (TFD).

Early adopters of such initiatives will present their credentials throughout the Porto conference. These include; Lloyds Bank, Accelerated Payments, XDCTEQ, Mitigram, Traxpay, Tradeteq, Enigio, Mitigram and more.

AC: The Metaverse is a natural development of our digital practice. I see the current use of Microsoft Teams and Zoom as an analogous practice – the experience is limited and not user-friendly.

In contrast, the metaverse will be much more immersive, completely digital and engaging. In Porto, we will discuss the metaverse’s potential to support the development of business objectives for financial institutions (FIs) and fintechs.

What are the biggest changes that have taken place in this area in recent years?

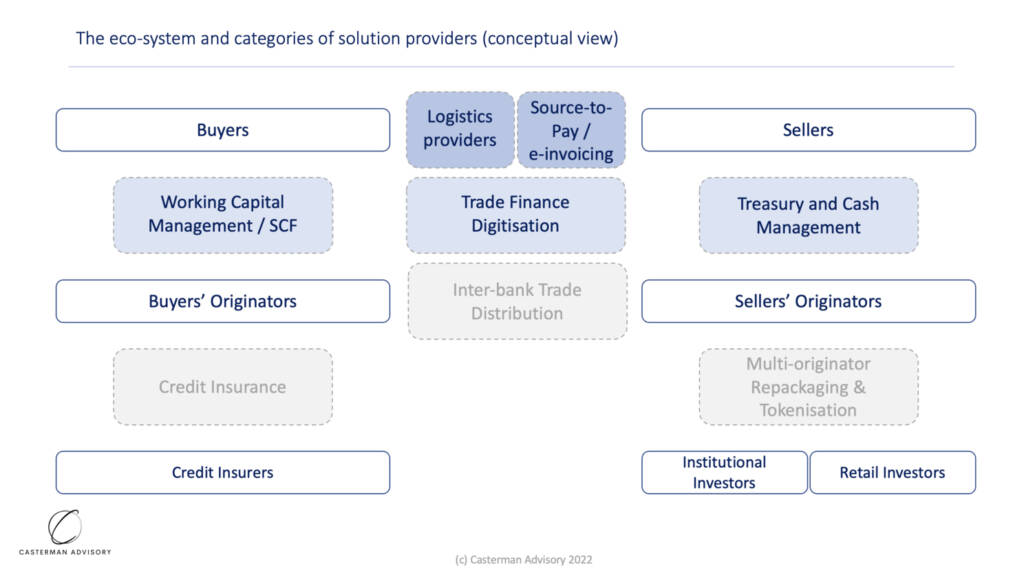

AC: Back in the early days (2018) of the fintech committee, my goal was to clarify the overall position of the fintech space for the ITFA core membership, i.e. emphasize a goal of collaboration as opposed to competition.

It’s a completely different dynamic compared to payments, where most of the new entrants are fighting banks. Trade finance is a more complex business and therefore fintechs generally do not want to enter the regulated FI space.

Banks recognize that they will not be able to close the trade finance gap on their own, as they need more automation to both run their business more efficiently (eg making greater use of DNI under the DNI initiatives) and expand it with success (e.g. automated distribution to institutional investors pursuant to TFD initiatives).

However, it is much more preferable to address specific pain points and work with banks to succeed together. The approach works perfectly for those who dare to specialize and invest in creating technological leadership positions.

How has DLT developed in recent years?

AC: DLT created something of a “hype” between 2016-19, which caused industry expectations to rise without generating many concrete results. But things are now improving, with DLT positioned to support specific functions as opposed to merely acting as a core technology.

This year’s Porto conference will demonstrate how distributed ledger technology (DLT) adds value to trade finance and how we can put transaction data to work for environmental, social and governance (ESG) initiatives.

Both the DNI initiative and the TFD initiative have production uses of DLT, which allow tracking the lifecycle of a tradable instrument (eg Lloyds Bank using Enigio for digital promissory note) or to bring retail liquidity into the trading investment class (eg XDCTEQ by Tradeteq using XinFin’s XDC network).

NFT has become a popular buzzword recently. What do you think is the driving force behind this?

AC: When you track a trade transaction (eg bill of exchange) on DLT, a non-fungible token (NFT) is created. This is because each transaction is unique, and thus traceable.

Public blockchain platforms such as XinFin’s XDC Network extend this capability, allowing industry members to access transaction statuses.

Over time, advanced smart contract options will also be used through FI automatic settlement. However, tracking unique transactions is one of the easiest things to do at this stage.

Mitigating other concerns around the AI space, such as fraud, is an additional priority at this point, with a view to improvement down the line. Preliminary steps have been taken in the NFT sector to promote fraud protection, including double funding. Despite these developments, we still need time and involvement from regulators to safely expand this field.

The fintech world has seemed to gain a reputation for disruption. How do you think AIs have revolutionized the supply chain, especially in light of this post-COVID world?

AC: I see no disruptions, only continuous improvement. Fintechs that succeed recognize the need to integrate with existing technologies.

Most notably, there has been a shift in mindset regarding the value of reliable transaction data. Transaction details feed into risk models and decision-making processes, giving those with access to authenticated data a competitive advantage.

Overall, however, the market is welcoming new technologies, new types of originators, new business models and new bridges across spaces (e.g. capital markets); all of these developments offer ways to achieve more, as opposed to disrupt.

Do you think AI development will help assess the creditworthiness of SMEs? Will this help the trade finance gap or add more obstacles?

AC: Yes, the development of artificial intelligence (AI) is essential to improve the visibility of transactions and their context. Predicting credit events requires contextual analysis around a transaction, and this is what rich transaction data and AI can achieve together.

Using these reliable new technology initiatives will therefore benefit businesses that might otherwise have been overlooked, boosting trade and hopefully closing the trade finance gap in the process.

However, it is important not to forget the value of AI also as an anti-fraud tool, as this is probably the biggest concern for lenders.

AC: The key takeaway from the ITFA Porto metaverse panel will be the exciting opportunities in the evolving digital world; not least the financing possibilities and rapidly growing economic activity in the metaverse.

Not unlike other digital innovations that have appeared in the market in recent years, the main focus for companies in the space should be the business case.

This new space of opportunity will also require payment and lending services, which traditional banks will be happy to get involved in, given the market’s upward trajectory.

The metaverse appears to be a promising new frontier for economic growth, one whose opportunities and challenges will be thoroughly discussed this week at ITFA, Porto.