Bitcoin is stuck in a relentless sideways channel, with the historically volatile asset proving significantly more stable than global equity markets.

BitMex’s Bitcoin Volatility Index, which tracks the 30-day historical volatility of Bitcoin against the US dollar, hovers near 18%. Just three months ago it was as high as 85%.

This, combined with weak trading volumes, is proving to be a worrying combination for bitcoin’s future prospects.

Forever sideways… When will BTC break out? – Source: currency.com

On the one hand, bitcoin has tended to rise in value after a prolonged period of volatility, but on the other hand, a lack of investor interest can create a negative feedback loop as more and more people pull out of their positions.

Also, if 2022 has taught us anything, it’s that we can’t rely on past norms.

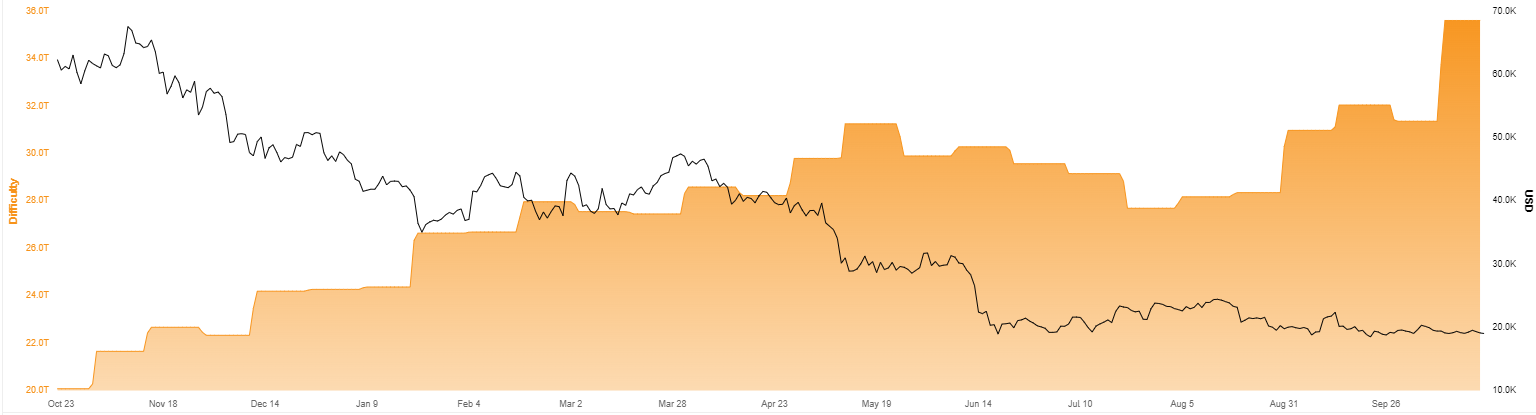

While the world’s largest cryptocurrency remains stuck in the $19,000-$20,000 range, there may be another fundamental factor to watch out for: Bitcoin mining difficulties, which just hit an all-time high.

Difficulty goes up, bitcoin goes down – Source: blockchain.com

Difficulty goes up, bitcoin goes down – Source: blockchain.com

A measure of the total amount of power used to secure the Bitcoin network, mining difficulty is a double-edged sword: On the one hand, high difficulty indicates that the network is highly secure; on the other hand, it means less rewards for the miners who do all the work.

Could today’s all-time high stakes spell bad news for investors calling for the next bitcoin bull run?

Only the brave can withstand the crypto winter

“The simple answer is yes – increased difficulty means less earnings for miners, forcing them to sell bitcoin to pay for power,” said Phil Harvey, CEO of digital asset management consultancy Sabre56.

As the head of over one gigawatt of crypto computing power and 25,000 servers, Harvey is in touch with ongoing mining trends.

“Growing bitcoin trading volume, or at least one that is maintained at a high level, reduces the bitcoin price – and sets up a negative feedback loop, where even more of the devalued bitcoin has to be sold into the market. It’s a perfect storm.

“As difficulties increase, less profitable miners will be forced to shut down. Typically we see this in a mining market after a few months, as miners sell all their bitcoin to weather the storm,” Harvey noted.

But reduced revenue serves a valuable purpose in itself: “This may not be a popular observation, but bitcoin mining revenue must remain at current levels until the next halving event in 2024 – weeding out uneconomic miners.”

Given the industry’s trajectory, Harvey reckons only the fittest will stay in the game as mining revenues drop, but it’s more nuanced than that.

Trimming the fat from the global network of miners means that even if the “revenue per energy” output will drop, the “revenue per miner” will likely stay within the historical range of $200 and $1,000.

Thriving in this ultra-competitive and unpredictable industry requires a certain mindset and acceptance of risk.

In Harvey’s view, listed miners deploying capital and preparing machine deployments with comfortable lead times while buying distressed assets are doing it right.

Alternatively, greedy market players who failed to deploy machines and bought recklessly in better times are struggling due to poor planning and execution.

“Unrealized revenue from delayed deployments, high capital costs and overpriced equipment will lead to their demise,” Harvey predicted, pointing to bankrupt miner Compute North as an example.

Since “greed is rampant in the industry,” Harvey reckons we could see many more bankruptcies eventually.

So it seems that bitcoin is experiencing downward pressure from a mix of antagonists right now, but as far as the mining sector is concerned, sober prices may force it to mature once and for all.