Islamic Coin claims it will scale like Bitcoin and reach $1 trillion in value

Islamic Coin (ISLM) is an emerging Sharia-compliant cryptocurrency. The founders of the coin have come up with a wild claim. Their Muslim-focused asset could scale like Bitcoin (BTC) and reach the equivalent of more than $1 trillion in value.

“We know the adoption will happen gradually,” Mohammed Alkaff Alhashmi, co-founder of Islamic Coin, told BeInCrypto. “But if only 3-4% of the Muslim online community will hold Islamic Coin, it will become a bitcoin-scale crypto-asset. It will generate a trillion dollars for the holders, and $100 billion for the Evergreen DAO,” he added.

The language sounds incredibly bombastic, if not incredible. That is considering that ISLM has not yet penetrated the market to the level of say Ethereum. ETH is the second largest crypto asset with a market capitalization of $157 billion. And that doesn’t even mention Bitcoin.

It’s not even listed on major exchanges yet. But Alhashmi is confident in the product his company is building. He says they are playing the long game as they try to tap into the $2.88 trillion Islamic finance sector.

Islamic Coinage: What is it?

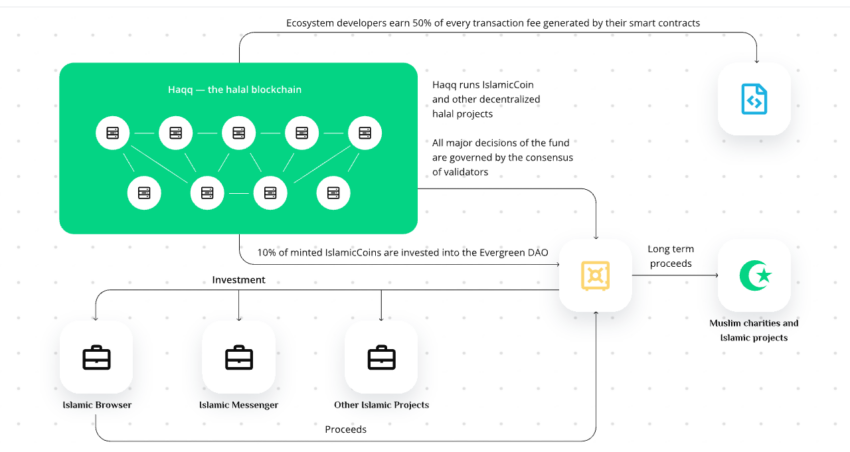

According to Alhashmi, Islamic Coin is the original token of Haqq, the proof-of-stake (PoS) blockchain that operates on Cosmos via the EVMOS protocol. Translated as “truth” in Arabic, Haqq “strictly follows Islamic views and traditions on finance”.

The idea behind the ISLM coin was to provide the global Muslim faithful with an instrument through which they could participate in the digital economy. Islamic coin, described as a Halal property, is said to be Sharia compliant.

This means that it is in accordance with the basic principles that govern Islamic life and by extension the law, around matters of morality and modesty. Alhashmi said the Islamic coin was specifically designed to facilitate philanthropic acts.

“Islam is the world’s second largest religion with almost 2 billion followers: that’s about a quarter of the world’s population,” Alhashmi, a computer science engineer, told BeInCrypto.

“Muslims make up a majority of the population in 47 countries, we designed Islamic coinage to provide a lasting, powerful impact for one of the largest communities in the world.”

Islamic Coin was launched on the Haqq blockchain in May. In June, the token received a religious declaration, or a “Fatwa”, from Muslim leaders. This confirmed that it met the religious standard that frowns upon problems such as gambling. Thus, Muslims were free to interact with the coin.

A month later, Islamic Coin raised $200 million in a private sale. This is a feat considered remarkable in a bear market. The token is overseen by a board of prominent Islamic bankers, software engineers and scholars under the Swiss-based non-profit Haqq Association.

And still. Something to consider is that people in the Middle East are loosening their ties to Islam, especially in countries like Iran. Young people in particular do not identify with the strict orthodoxies as they used to.

Islamic Coin Toconomics

According to the white paper, Islamic Coin’s supply is limited to 100 billion tokens. Every two years (called an era), the coin’s emission rate is reduced by 5%. The release will stop in 100 years from the first block of the first epoch, it says. 20 billion tokens were minted in the genesis block.

Mohammed Alkaff Alhashmi said that ISLM is used for payments, network management, staking and to pay for costs of transactions over the network. “One of the main purposes of ISLM is to drive progress and charity work,” he said.

Every time new coins are minted, 10% of the issued amount goes to Evergreen DAO, a non-profit “focused on long-term sustainability and community impact.” The coins are deposited in the DAO “to be invested in Islamic Internet projects or given to Islamic charities.”

Between 1% and 5% goes to a block proposer and its delegates. The rest is distributed proportionally to all bound validators and their delegators. As proof of stake, Islamic Coin uses a system of delegators of bound validators.

These are rewarded in proportion to the amount of ISLM tokens they have staked to help secure the network and process transactions. Rewards are distributed to the delegators minus the validator’s own commission.

Holders of ISLM can lock their tokens by linking them to validators in a process known as “staking”. By tying coins, ISLM holders delegate voting rights to validators and become delegators. This entitles them to earn rewards and participate in governance.

Bitcoin-style scaling

Alhashmi, the Islamic coin founder, claimed that cryptoassets “are the first Shariah-compliant digital money that can be used by followers of Islam without any restrictions.”

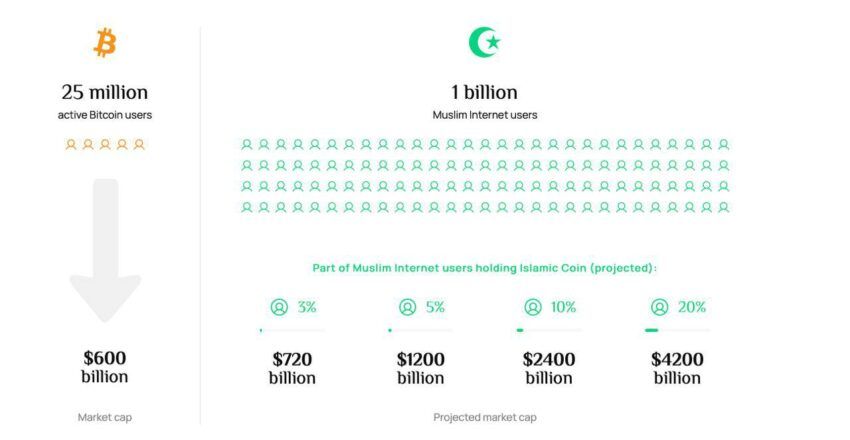

He sees a future where 3% to 4% of the existing one billion Muslim internet users adopt the Islamic currency. The token would be in a position to scale like Bitcoin (BTC), the first and largest cryptocurrency.

At 3% adoption, Islamic Coin will have a value of 720 billion dollars in capitalization. Its value will reach $4.2 trillion with a 20% adoption rate, four times the existing global crypto market cap.

The token’s “enormous potential is supported by the global influence of the Muslim world,” the Islamic coin says website.

According to the Global Islamic Economy Report, the volume of the Islamic finance sector was $2.88 trillion in 2020 and is expected to grow to $3.69 trillion by 2024. This is led by the growth of digital technologies and mobile communications.

Alhashmi’s estimates may be comparable to Willy Woo’s estimates of Bitcoin reaching one billion active users in three years. But let’s put Islamic Coin’s market value into perspective with current calculations.

With a market cap of $1 trillion, Islamic Coin will have a value that is more than the value of all the existing 19,000+ cryptocurrencies combined. According to Coinmarketcap, the global market cap for crypto is $916 billion. This is down from a peak of over $3 trillion in November last year.

Bitcoin accounts for 40%, or $366 billion of the total. BTC is followed by Ethereum, Tether (USDT) at $68 billion, USD Coin (USDC) ~ $45 billion and Binance Coin (BNB) at $44 billion.

Sharia compliance

Shariah compliance is an important customer need and regulatory requirement in several Muslim markets. But the legitimacy of crypto-assets like Bitcoin is still the subject of great controversy.

Prominent Islamic leaders have branded bitcoin “haram”. This means that it is prohibited under Sharia law on the basis that the asset can be used for illegal activities such as money laundering, gambling and fraud, which are prohibited in the Koran.

There is also some concern over the lack of central authority and how digital currencies strip governments and central banks of their power over national monetary systems.

In November 2021, a leading Islamic scholar from Indonesia, Asrorun Niam Sholeh, issued a religious declaration, or fatwa. It warned followers against crypto investing, saying, “it’s like a gambling game.”

Ethics

Alhashmi and his co-founders believe their project can play a role in ensuring blockchain technology adopts a strong value system. “I think that DeFi will benefit from taking on a system of values and some of these ethics,” he said.

“Shariah finance is based on ethics and values. The financial school does not support interests, gambling and so on. To ensure compliance, each project goes through our Shariah board, which has more than 45 years of experience in Islamic finance.”

ISLM has begun to receive support from powerful members of the Islamic community. Top Emirati Sheikh Khalifa Bin Mohammed Bin Khalid Al Nahyan was recently added to Islamic Coin’s advisory board.

Co-founders include Hussein Mohammed Al Meeza, Mohammed Alkaff Alhashmi, Andrey Kuznetsov and Alex Malkov.

Will Islamic Coin be the next Bitcoin? Or will it slide into anonymity like thousands of other crypto hopefuls? Let’s look at this space.

Do you have something to say about Islamic coinage or something else? Join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook or Twitter.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.