Is There a Bitcoin–Macro Disconnect?

The market value of cryptocurrencies has grown rapidly in recent years. This blog post analyzes the role of macro factors as possible drivers of cryptocurrency prices. Taking a high-frequency perspective, we focus on Bitcoin since its market cap dwarfs that of all other cryptocurrencies combined. The main finding is that, unlike other asset classes, Bitcoin has not reacted significantly to US macro and monetary policy news. This disconnect is puzzling, as unexpected changes in discount rates should in principle affect the price of Bitcoin.

Background

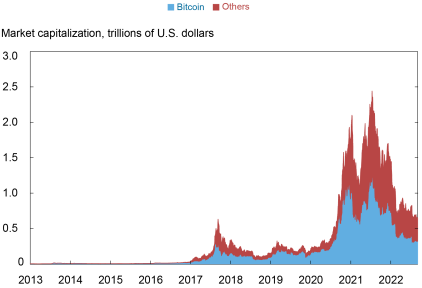

Before the recent downturn, the market cap of cryptocurrencies reached a staggering $2.5 trillion, and Bitcoin crossed the $1 trillion mark. In addition, Bitcoin represents the lion’s share – between 50 percent (today) and 90 percent (in 2016) – of the total capitalization of the digital currency market.

Market value of Bitcoin and other cryptocurrencies

Notes: The chart plots the market values of Bitcoin and twenty-two other cryptocurrencies (Aave, BinanceCoin, Cardano, ChainLink, Cosmos, CyrptocomCoin, Dogecoin, EOS, Ethereum, Iota, Litecoin, Monero, NEM, Polkadot, Solana, Stellar, Tether, Tron, Uniswap, USDCoin, WrappedBitcoin and XRP). The market value is calculated by multiplying the total number of coins in circulation by the price.

Given their increasing relevance, it is natural to study the drivers of cryptocurrency prices. This blog post focuses on macroeconomic news and monetary policy surprises. We interpret cryptocurrencies as assets whose current price should depend on the expected discounted value of future values. This characterization implies that from a macroeconomic point of view, developments affecting current and future interest rates, either directly (news on monetary policy) or indirectly (news on macroeconomic conditions), should affect the value of cryptocurrencies.

We use a new and comprehensive set of intraday data to identify the effects of this news. By relying on high-frequency data in a short enough window around a macro announcement, the data release is (most likely) the only information that systematically hits the market. Therefore, by looking at the response of asset prices in that time window around various announcements, this blog post conducts the empirical finance version of a natural experiment.

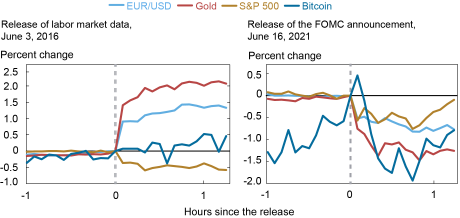

As an example, the chart below shows the response of several US asset prices around two types of news: news about the real economy, such as the Bureau of Labor Statistics’ employment situation report (left panel), and news about monetary policy, specifically the FOMC meeting (right panel). The June 2016 labor market report contained a lower-than-expected nonfarm payrolls figure, compared to the Bloomberg consensus. Consequently, the dollar immediately weakened against the euro by about 1 percent, stock prices fell by about 0.5 percent, and gold prices rose by 2 percent. Bitcoin on the other hand moved sideways. At the June 2021 Fed meeting, the FOMC signaled that interest rates would need to rise faster and faster than market participants had expected. Again, the dollar, gold and stock prices reacted immediately to the release, but Bitcoin did not react in a systematic way.

Response of US asset prices to macroeconomic and monetary policy news

Notes: Responses have been normalized to zero at the time of the press release. The horizontal axis shows the hours before/after the release. EUR/USD refers to the Euro/Dollar exchange rate, defined as the amount of US dollars needed to buy one Euro.

Analysis and results

We systematically analyze the response of the EUR/USD exchange rate, gold, the S&P 500 and Bitcoin to ten sets of macro announcements that have been identified as important in the academic literature. When studying the responses of selected asset prices to macroeconomic and monetary policy news, we focus on the period 2000-2022 for all assets except Bitcoin, for which we selected a limited (more meaningful) sample starting in 2017. (For more information on analysis, see our related staff report on the subject.) We collect various macro news covering the real economy and inflation, as well as monetary policy surprises. For monetary policy news, we consider three distinct dimensions. The first indicator, Goal, captures unforeseen changes in the current federal funds rate target. The second indicator, Path, captures unforeseen changes in the future policy. The third indicator, LSAPcaptures unanticipated announcements of future large asset purchases.

Our priors are based on a simple asset pricing model for Bitcoin. We model Bitcoin as an asset with no intrinsic value, whose present value depends on the discounted value of its future price (for our beloved wonks, a “stochastic bubble”). We also accommodate the possibility that the asset has no value with a probability that depends positively on current and future interest rates. Since monetary policy news affects both current and future interest rates, it should be associated with Bitcoin valuation, while macroeconomic news has an indirect impact through the monetary policy reaction function.

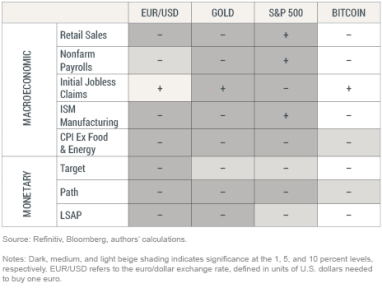

By relying on the regressions’ estimates, we can test the extent to which the response of an asset price to a given macroeconomic announcement is systematic. The table below reports the relationship between assets (columns) and selected macroeconomic and monetary news (rows). The shading indicates whether the response is systematic, with darker colors corresponding to more statistically significant effects. The symbol inside each cell indicates the sign of the correlation between the return on assets and news. We find that the EUR/USD exchange rate, gold and the S&P 500 react significantly to most macro and monetary news. In stark contrast, the response of Bitcoin is muted, and never significant at the 1 percent level, even when we focus on just monetary policy news.

Comparing asset price responses to news events

Conclusions

So… Is Macroeconomic News Driving Bitcoin? In this post, we conduct a systematic analysis of the impact of macroeconomic and monetary policy news on Bitcoin’s price. Unlike exchange rates and stocks, Bitcoin is largely unresponsive to macro news. More puzzling is the result that Bitcoin is also unresponsive to monetary policy surprises. At face value, our study casts some doubt on the role of discount rates in the pricing of Bitcoin. Given the short sample used in the analysis, the jury is still out on this one, and more evidence is needed to put the case to rest.

Gianluca Benigno is Head of International Studies in the Federal Reserve Bank of New York’s Research and Statistics Group and Professor of Economics at the University of Lausanne.

Carlo Rosa is assistant professor at the University of Parma (Italy).

How to cite this post:

Gianluca Benigno and Carlo Rosa, “Is There a Bitcoin Macro Decoupling?”, Federal Reserve Bank of New York Liberty Street Economics8 February 2023,

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).