Is the market rewarding Complii FinTech Solutions Ltd (ASX:CF1) with negative sentiment as a result of its mixed fundamentals?

It’s hard to get excited after looking at Complii FinTech Solutions’ (ASX:CF1) latest results, when the stock has fallen 23% in the past month. However, we decided to study the company’s finances to find out if they have anything to do with the price drop. Long-term fundamentals are usually what drive market performance, so it’s worth watching closely. In this article, we decided to focus on Complii FinTech Solutions’ ROE.

Return on equity or ROE is a test of how efficiently a company increases its value and manages investors’ money. Put another way, it reveals the company’s success in turning shareholder investment into profit.

Check out our latest analysis for Complii FinTech Solutions

How to calculate return on equity?

Return on equity can be calculated using the formula:

Return on equity = Net profit (from continuing operations) ÷ Equity

So, based on the formula above, the ROE for Complii FinTech Solutions is:

1.0% = AU$115k ÷ AU$11m (Based on the last twelve months to June 2022).

The “return” refers to a company’s earnings over the past year. Another way to think about it is that for every A$1 worth of equity, the company could earn A$0.01 in profit.

What does ROE have to do with earnings growth?

We have already established that ROE serves as an effective profit-generating measure of a company’s future earnings. Depending on how much of these profits the company reinvests or “retains”, and how efficiently it does so, we can then assess a company’s earnings growth potential. In general, all other things being equal, firms with high return on equity and retained earnings have a higher growth rate than firms that do not share these characteristics.

Complii FinTech Solutions’ revenue growth and 1.0% yield

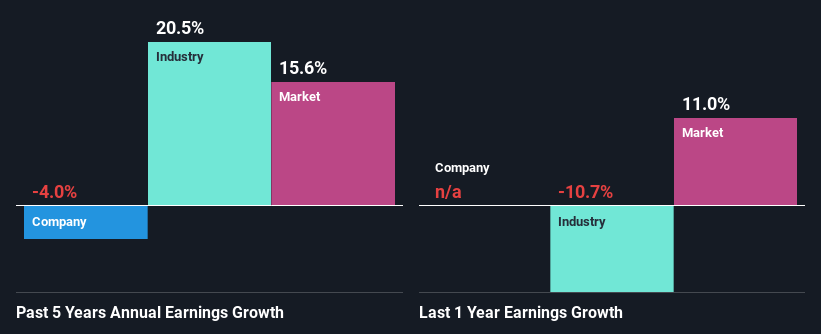

It’s hard to argue that Complii FinTech Solutions’ ROE is much better on its own. Not only that, even compared to the industry average of 9.7%, the company’s ROE is completely unremarkable. Given the circumstances, the significant 4.0% decline in net income seen by Complii FinTech Solutions over the past five years is not surprising. However, there may also be other factors that cause earnings to fall. For example, the company has a very high payout ratio, or is facing competitive pressure.

However, when we compared Complii FinTech Solutions’ growth to the industry, we found that while the company’s earnings have shrunk, the industry has seen earnings growth of 20% over the same period. This is quite worrying.

Earnings growth is a big factor in share valuation. What investors must decide next is whether the expected earnings growth, or lack thereof, is already built into the share price. By doing so, they will have an idea if the stock is heading into clear blue water or if swampy water awaits. If you’re wondering about Complii FinTech Solutions’ valuation, check out this price-to-earnings ratio gauge compared to the industry.

Is Complii FinTech Solutions using its earned income effectively?

Complii FinTech Solutions pays no dividends, meaning the company keeps all of its profits, which makes us wonder why it keeps its earnings if it can’t use them to grow its business. It seems that there may be other reasons to explain the deficiency in this respect. For example, the business may be in decline.

Summary

Overall, we’re a bit ambivalent about Complii FinTech Solutions’ performance. While it appears to retain most of its profits, given its low ROE, investors may not benefit from all that reinvestment after all. The low income growth suggests that our theory is correct. Ultimately, we would proceed with caution with this company, and one way to do that would be to look at the risk profile of the business. Our risk dashboard will have the two risks we have identified for Complii FinTech Solutions.

Valuation is complex, but we help make it simple.

Find out about Complii FinTech solutions is potentially over- or under-rated by checking out our extensive analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.