Is Bitcoin Rally Dead or Alive?

On May 3 and 4, 2022, the Federal Open Market Committee (FOMC) meeting decision to raise interest rates rippled through the crypto market. This led many to believe that the Bitcoin rally would not continue to the all-time highs seen in November 2021.

One year later, it is important to examine the ongoing relationship between fixed income, equity and cryptocurrency markets.

The evolving crypto landscape

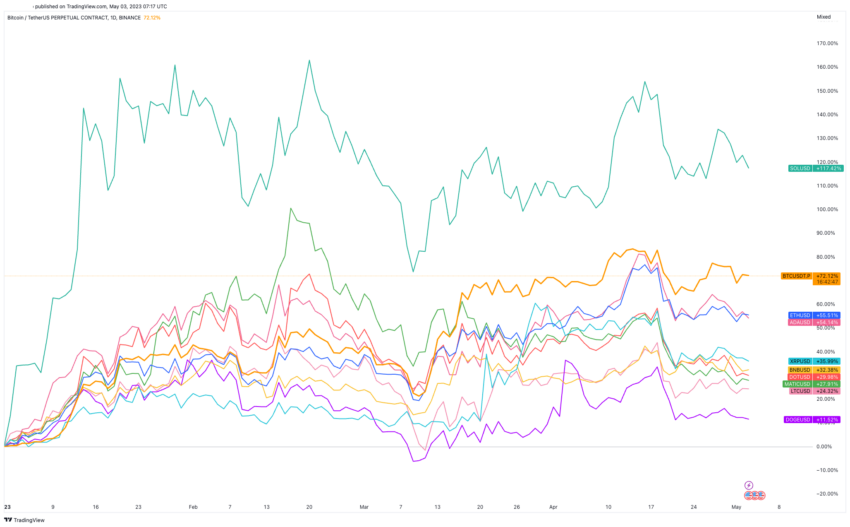

Despite the initial shock, the Bitcoin rally started and prices managed to climb over 70% since the start of the year. However, the past 30 days have seen assets diverge from each other, charting unique trajectories.

This provides opportunities for those who are closely involved in the chain and social statistics. It helps them make informed decisions before one coin pumps and another one dumps.

Bitcoin and stocks: a growing correlation

The crypto market has shown an increasing correlation with the US stock market. This trend may be influenced by the FOMC’s consistent rate hikes over the past year. Around Fed rate decision time, the correlation between these two sectors tightens.

Higher interest rates lead to increased borrowing costs, and reduce consumer and investor spending. This could negatively affect stock markets and in turn reduce the demand for cryptocurrencies.

On the other hand, lower interest rates can increase spending, stimulate economic growth and have a positive impact on both stocks and crypto.

Market analysts closely monitor the Fed FOMC decisions and their impact on the broader economy and financial markets, including the cryptocurrency sector.

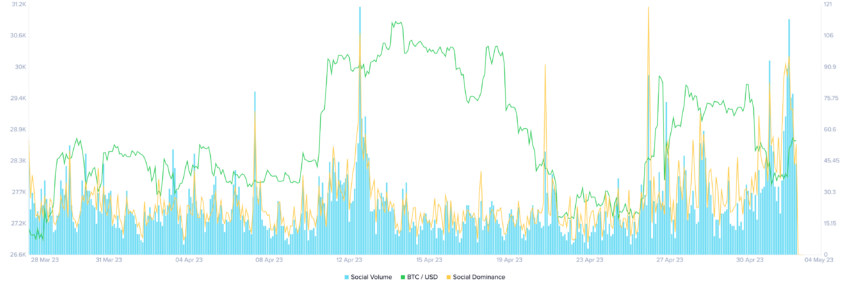

Crypto Community’s Sensitivity to Interest Rate Decisions

The crypto community is highly tuned into upcoming FOMC decisions and will likely react sensitively to the results. An increased focus on money-related topics such as banks, tax, money, fees and stables indicates that society follows financial policy closely.

One positive result of the heightened concern that “we may have peaked” is that Bitcoin has become a more significant focus.

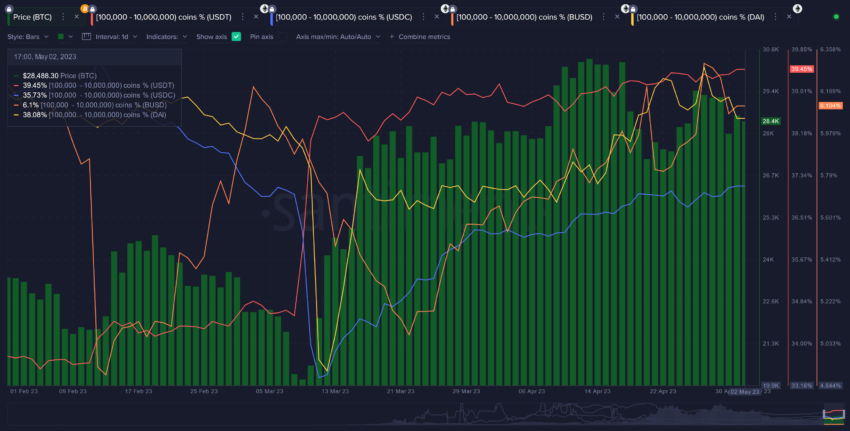

Bitcoin sharks and whales, with between 100 and 10,000 BTC, had rallied back to where they started when they started selling in late March.

Meanwhile, stablecoin accumulation, especially USDT (red line) and USDC (blue line), has been increasing since the beginning of June.

This market behavior suggests that more organic money is returning to crypto with less than a year until the 2024 halving of Bitcoin.

Bitcoin rally in trouble as network activity slows

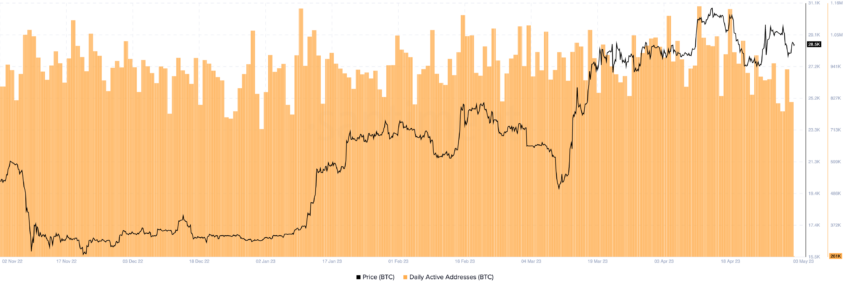

Despite the positive signals, there are concerns about the lack of unique addresses interacting on the BTC network.

Over the past two weeks there has been a strange drop in active addresses per day. The tool needs to remain stable to confirm that a breakout could happen along with other bullish signals.

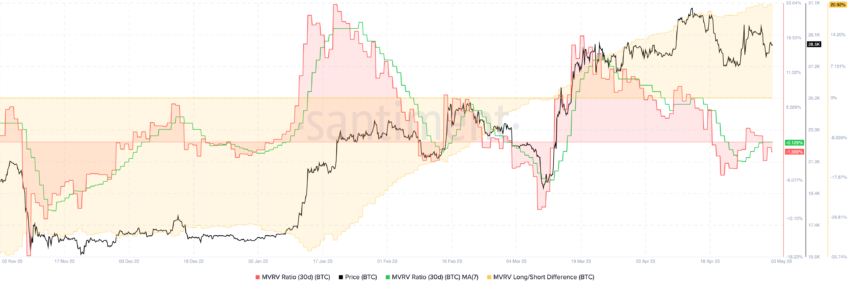

The 30-day MVRV ratio (in red) is back below 0%, meaning the average trader over the last 30 days is down again. When this happens, there is a lower risk than average for being in crypto.

Still, the long-term 365-day MVRV (in yellow) is still at +25%.

All eyes on the Fed

The relationship between the Fed’s interest rate decisions, the stock market and the cryptocurrency market continues to evolve. As the FOMC continues to influence the broader economy, the cryptocurrency community remains sensitive to changes in fiscal policy.

The growing concern about unique addresses and network activity could take a toll on the Bitcoin rally. Still, as the 2024 Bitcoin halving approaches, the crypto market’s response to interest rate decisions will still be crucial.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.