Is Bitcoin price lower than 5 years ago or has it doubled?

Bitcoin (BTC) prices during the coldest winter in crypto history have been very discouraging for investors. At certain points, prices were lower than they were almost five years ago. Still, this does not mean that the Bitcoin price is degrading if we zoom out.

If we look at significant price drops and Bitcoin’s recovery rates throughout history, it becomes clear that Bitcoin recorded new highs at the end of each bear cycle.

Price feature

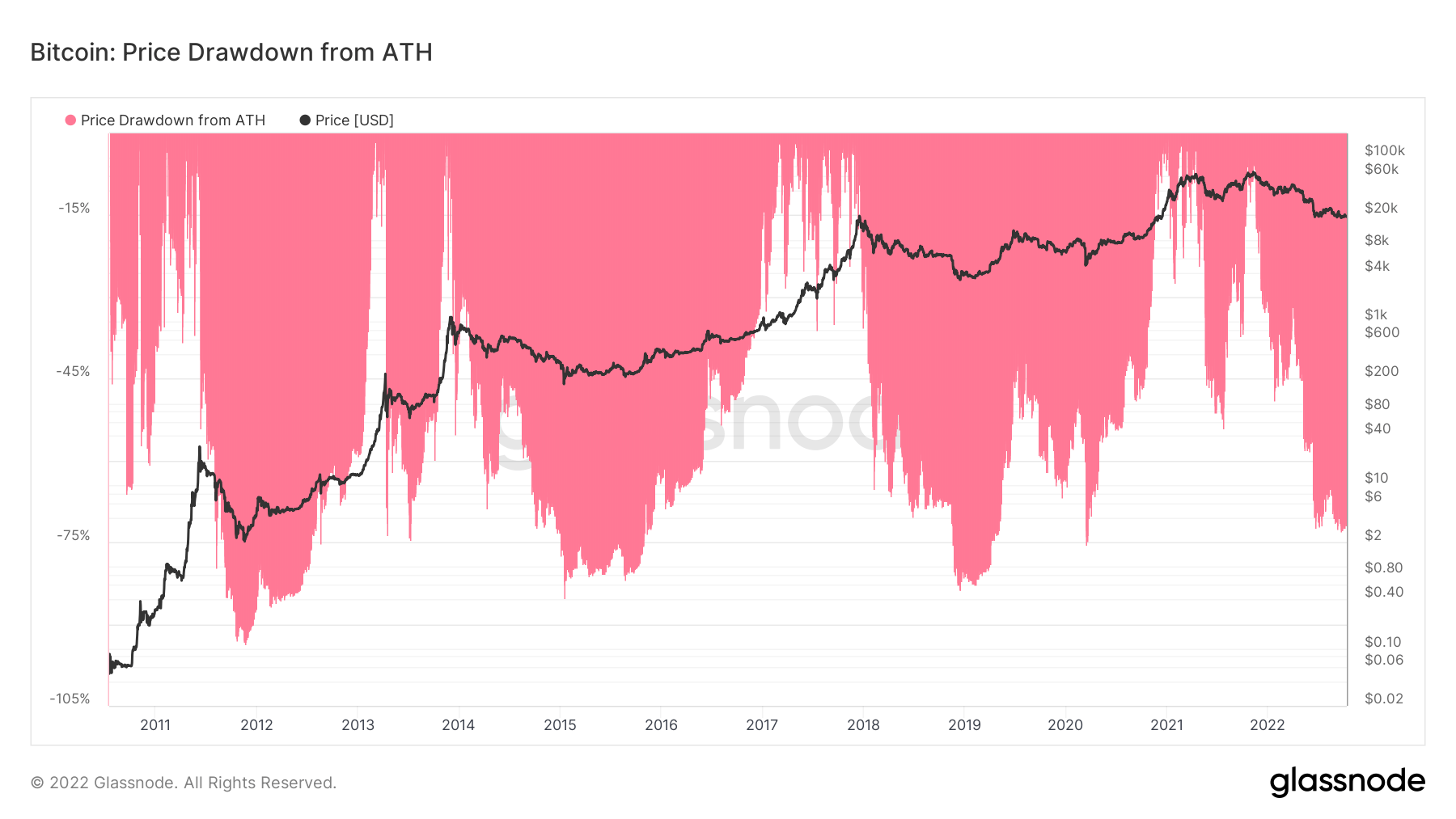

Bitcoin’s current price is hovering around $19,300, which is about 72% from the all-time high (ATH) recorded on November 10, 2021 at $69,045. However, it can be said that this change is relatively normal for Bitcoin since it went down around 75% to drop as low as $17,600 by June 2022.

As can also be seen in the chart above, the same drop of 75% or more was recorded in 2011, 2015, 2019 and 2020. These changes indicate significant volatility. However, the Bitcoin price won each time and recovered to new records.

Bitcoin price broke its infamous $20,000 support in late August 2022. $20,000 was the ATH point of the 2017 bull run. Breaking the top of a previous bull run is something Bitcoin has never done before, which can irritate investors.

Is $20,000 the right benchmark?

$20,000 was actually recorded as the ATH of the bull run in 2017. However, upon closer examination, it becomes clear that the Bitcoin price was only $20,000 for a couple of hours. The average price at the peak of the 2017 bull run was between $8,000 and $10,000.

For the years 2018 to 2020, however, the average price is just over $8,000. The peak price level on December 17, 2017 was $20,000. This lasted for a couple of days and the price went back to $10,000 in early January 2018.

As a result, the average price between 2018 and 2020 seems to be almost $8,800, which would be the right benchmark to consider.

Artificial $20,000

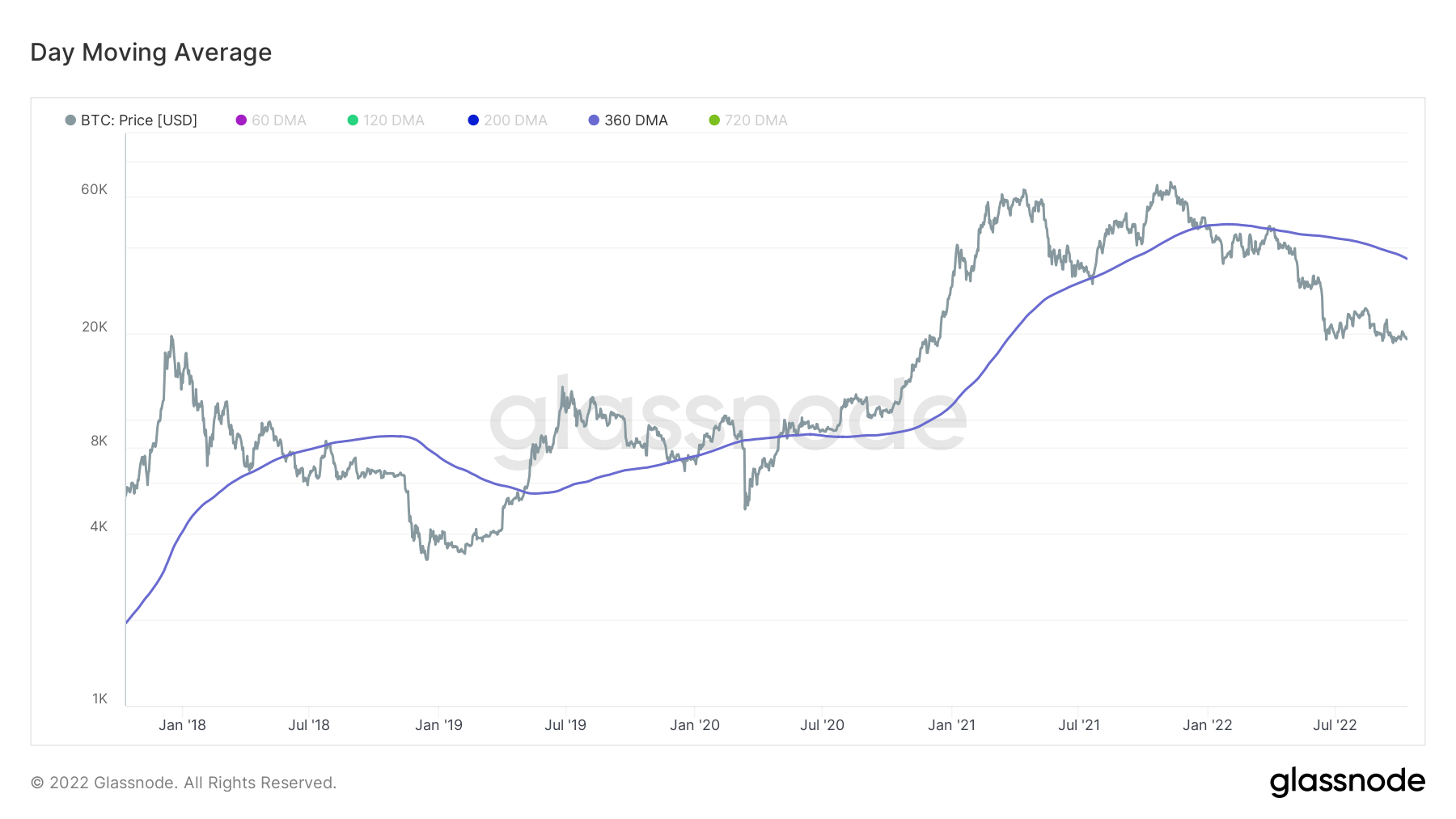

The 360-day moving average chart for Bitcoin shows that the BTC price does not deviate far from the 360 DMA from 2018 to 2020.

The December 2017 high of $20,000 is shown in the chart above as a significant separation from the 360 DMA. This deviation indicates that the Bitcoin price was artificially pumped to reach $20,000.

Looking at the average price and 360 DMA at the end of 2017, it is clear that Bitcoin reverted to its average price range of about $10,000 and below after the effect of the pump wore off.

Under $10,000 to $20,000

All things considered, to claim that Bitcoin’s current trajectory is doomed just because it breached the ATH of the previous bull run by falling below $20,000 is not entirely true.

The $20,000 price level reached after an artificial pump can be registered as an ATH at that point. However, the data indicates that the average price in 2018 was between $8,000 and $10,000.

Considering that the Bitcoin price is hovering around $20,000 today, this indicates a 2x increase compared to 2018.