Is Bitcoin Dead? Critics say one thing, metrics say something else

Bitcoin has been going down for several months now. It has fallen more than 70 percent since the highest record in November 2021 at $ 69,000 and is currently trading at $ 20,501.

This is a slight increase from the sale on June 14, 2022, where BTC tested the $ 17,700 mark for the first time in several years. Although this has meant nothing more than pain for Bitcoin investors, critics have had a field day during the meltdown.

Bill Gates recently came out against cryptocurrencies and NFTs, and even said he would short Bitcoin “if it was an easy way to do it”. Other critics predicted further pain for the world’s oldest cryptocurrency.

Internationally acclaimed financial analyst, CEO of Euro Pacific Capital Inc and well-known Bitcoin opponent, Peter Schiff, surprised the crypto industry with a tweet predicting that BTC would fall to a low of $ 3000 in the future.

“If #Bitcoin can collapse by 70% from $ 69,000 to under $ 21,000, it could just as easily fall another 70% down to $ 6,000. Given the exaggerated influence of #crypto, imagine the forced sale that would take place during a sale of this “$ 3,000 is a more likely price target,” he tweeted.

Also read:

The phrase “Bitcoin is Dead” is also gaining momentum on the internet. Data from Google Trends shows that web searches for ‘Bitcoin dead’ reached a record high level after BTC fell below the $ 18,000 mark.

However, crypto enthusiasts were quick to refute these claims, highlighting the previous 400-plus cases where people asked for Bitcoin’s death. Yes, that’s right – in its short life, Bitcoin has had 452 obituaries on the cryptocurrency news and learning platform 99Bitcoins.

Each of these obituaries represents a recipe on the internet that states that Bitcoin is or will be worthless in the future. And remember, 99Bitcoins only rates content produced by remarkable numbers and sites with significant traffic for this statistic.

It’s not just enthusiasts who support cryptocurrency. Several calculations on the chain also point to a Bitcoin revival. One of them is the 200-week moving average (MA), which has historically served as a solid level of support for Bitcoin.

In the past, Bitcoin has hit back and taken off every time it has hit the 200-week MA. This happened in 2015, 2019 and 2020, as shown in the graph below:

The price of Bitcoin tends to fall briefly below its 200-week MA and then slowly work its way up, starting a new uptrend. This is an encouraging sign, given that BTC is trading very close to its 200-week MA after short stints below it. Based on previous patterns, BTC may also fall below the 200-week MA, but not too far below and not for too long.

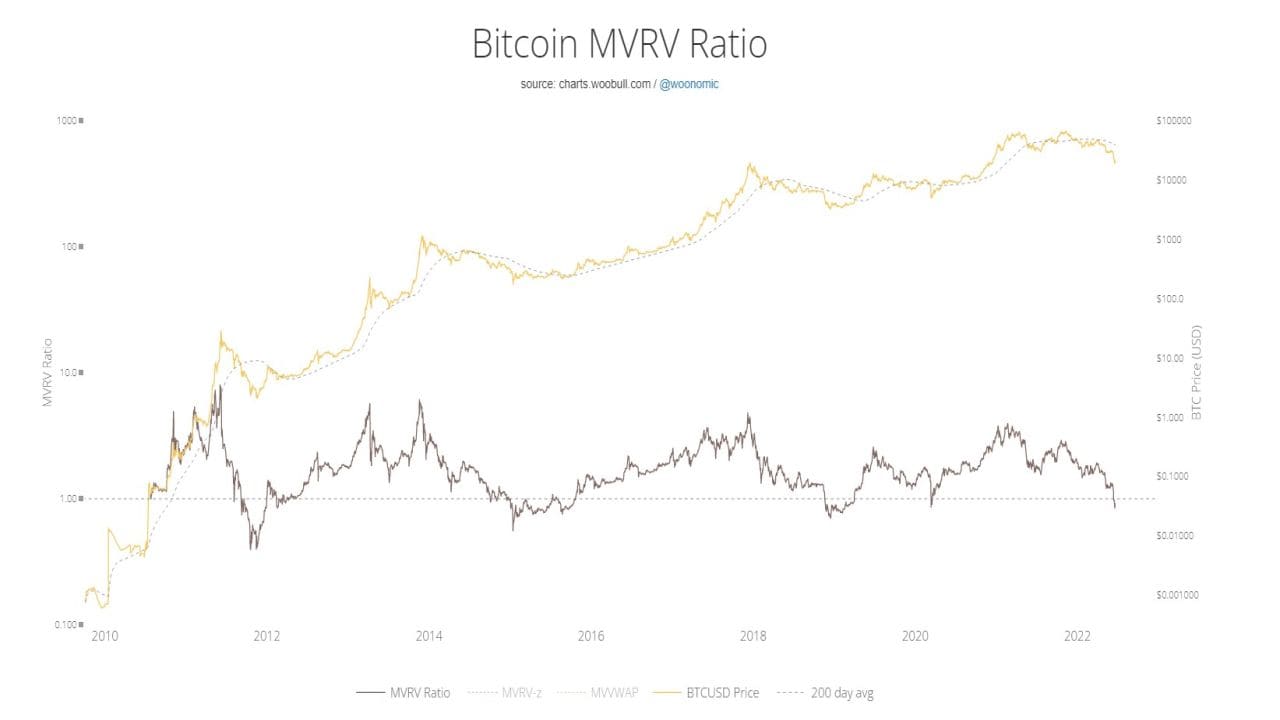

In addition to the 200-week moving average, the market value-to-realized-value ratio (MVRV) suggests that the worst is behind us, and the current break is unlikely to continue in the long run. This means it’s the perfect time to buy dip and start collecting BTC.

Let’s look at the chart to get a better idea:

Bitcoin’s MVRV score has only fallen twice in the last four years. First in 2018 and then later in March 2020. If this pattern continues, the price of BTC may fall briefly, but an upward trend should follow.

Although prices are falling, experts have pointed to several historical levels of support at which Bitcoin may fall back. In December 2020, BTC reached a support level of $ 21,900 before climbing to $ 41,000. Bitcoin’s historical performance also indicates $ 19,900 and $ 16,500 as additional support levels should BTC fall below $ 20,000, as it has done in recent weeks.

So, as you can see, there is good reason to believe that Bitcoin is not dead. Moreover, judging by these chain calculations, Bitcoin should see an upward swing in the future.

First published: IST