Is Applied Blockchain (NASDAQ:APLD) Using Too Much Debt?

The external fund manager, backed by Berkshire Hathaway’s Charlie Munger, Li Lu, doesn’t care when he says “The biggest investment risk is not price volatility, but whether you will suffer a permanent loss of capital.” So it seems the smart money knows that debt – which is usually involved in bankruptcies – is a very important factor when assessing how risky a company is. As with many other companies Applied Blockchain, Inc. (NASDAQ:APLD) uses debt. But the real question is whether this debt makes the company risky.

When is debt a problem?

Debt and other obligations become risky for a business when it cannot easily meet these obligations, either with free cash flow or by obtaining capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. Although not very common, we often see indebted companies permanently draining shareholders because lenders force them to raise capital at a difficult price. Of course, many companies use debt to finance growth, without any negative consequences. When we think about a company’s use of debt, we first look at cash and debt together.

check out opportunities and risks within the US software industry.

How much debt does Applied Blockchain have?

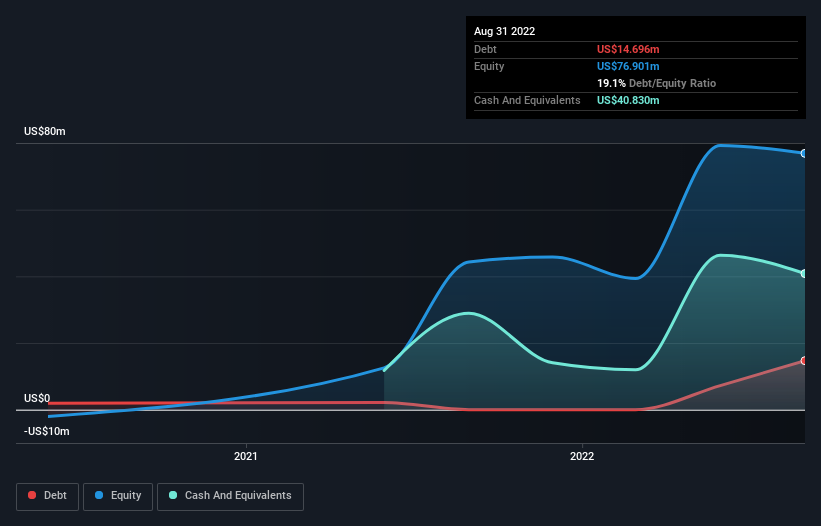

You can click on the graphic below for the historical numbers, but it shows that as of August 2022, Applied Blockchain had $14.7 million in debt, an increase of none, over a year. But it also has $40.8 million in cash to offset this, meaning it has $26.1 million in net cash.

How healthy is Applied Blockchain’s balance sheet?

According to its most recently reported balance sheet, Applied Blockchain had US$48.7 million in liabilities due within 12 months, and US$20.4 million in liabilities due beyond 12 months. Offsetting these liabilities, it had cash of $40.8 million as well as $50,000 worth of receivables due within 12 months. So its liabilities outweigh the sum of cash and (current) receivables by USD 28.1 million.

Given that Applied Blockchain has a market cap of US$229.3 million, it’s hard to believe that these liabilities pose much of a threat. But there are sufficient commitments that we would certainly recommend that shareholders continue to monitor the balance sheet going forward. Despite its notable liabilities, Applied Blockchain has net cash, so it’s fair to say it doesn’t have a heavy debt load! The balance sheet is clearly the area to focus on when analyzing debt. But it is future earnings, more than anything else, that will determine Applied Blockchain’s ability to maintain a healthy balance sheet going forward. So if you are focused on the future you can check this out free report showing the analysts’ profit forecasts.

Although it hasn’t turned a profit, at least Applied Blockchain posted its first revenue as a publicly traded company in the last twelve months.

So how risky is blockchain?

We have no doubt that loss-making companies are generally more risky than profitable. And the fact is that over the past twelve months, Applied Blockchain lost money on earnings before interest and tax (EBIT). In fact, at the time it burned through $61 million in cash and posted a $13 million loss. Given that it only has net cash of $26.1 million, the company may need to raise more capital if it doesn’t break even soon. In summary, we are a little skeptical about this one, since it seems quite risky in the absence of free cash flow. When analyzing debt levels, the balance sheet is the obvious place to start. However, not all investment risk lies within the balance sheet – far from it. For example, we have identified 3 Warning Signs for Applied Blockchain (2 are significant) you should be aware of.

If you’re interested in investing in businesses that can grow profits without the burden of debt, check this one out free list of growing businesses that have net cash on their balance sheets.

Valuation is complex, but we help make it simple.

Find out about Used blockchain is potentially over- or under-rated by checking out our extensive analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.