Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

The Internal Revenue Service (IRS) has changed the crypto question asked on Form 1040, the tax form used by all US taxpayers to file an annual tax return.

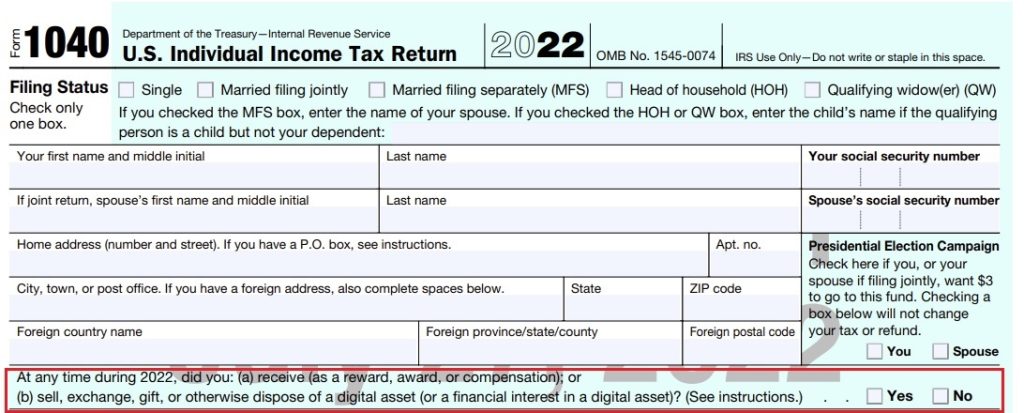

The Internal Revenue Service (IRS) published a draft Form 1040 for the 2022 tax year last week. Form 1040 is the tax form used for filing individual tax returns in the United States

The crypto question on the front of Form 1040 now reads: “At any time during 2022, did you: (a) receive (as a reward, prize or compensation); or (b) sell, exchange, gift or otherwise dispose of a digital asset (or an economic interest in a digital asset)?”

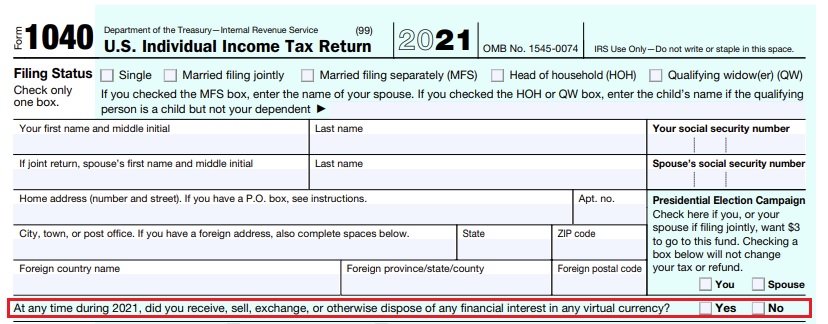

The new question expands on its previous version on Form 1040 for the 2021 tax year, which states: “Did you receive, sell, exchange, or otherwise dispose of any financial interest in a virtual currency at any time during 2021?”

In March, the IRS published a notice that said: “All taxpayers filing Form 1040, Form 1040-SR or Form 1040-NR must check one box that answers either ‘Yes’ or ‘No’ to the virtual currency question. The question must be answered by all taxpayers, not just taxpayers who engaged in a transaction involving virtual currency in 2021.”

The IRS explained that taxpayers can tick “no” if they only own cryptocurrency and have not engaged in crypto transactions at any time during the year. In addition, they can check “no” if their activities were limited to holding or transferring crypto within their own wallets or accounts, buying crypto “using real currency, including purchases using real currency electronic platforms such as Paypal and Venmo, ” and “engage in any combination of holding, transferring or purchasing virtual currency as described above,” the IRS detailed.

What do you think about the new tax issue? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.