Investors withdraw coins from Bitcoin funds

Join the most important conversation in crypto and web3! Secure your place today

This article originally appeared in First MoverCoinDesk’s daily newsletter that contextualizes the latest moves in crypto markets. Subscribe to get it in your inbox every day.

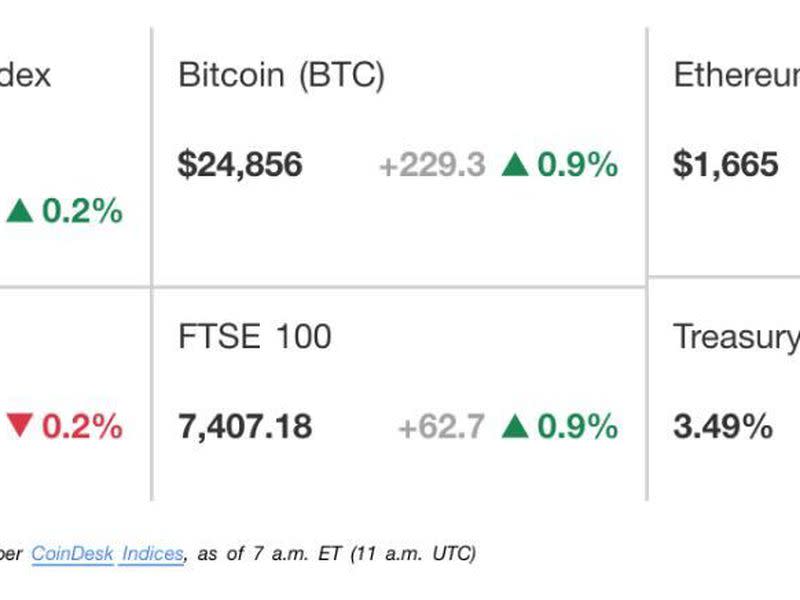

Latest prices

The main things

Bitcoin funds are bleeding coins even as US bank failures fuel expectations of an early Federal Reserve central bank in favor of eases in liquidity. Usually, if the Fed doesn’t raise interest rates aggressively as it has, risky assets like bitcoin will benefit, but the opposite happens with bitcoin funds. Data tracked by ByteTree Asset Management shows the number of coins held by closed-end, spot and futures-focused exchange-traded funds in Europe, the US and Canada has fallen by 16,560 BTC ($409 million) this month, hitting a 17-month low of 826,113 BTC. ETFs and other investment vehicles that allow exposure to bitcoin without having to own the cryptocurrency are considered a proxy for institutional activity.

Bankrupt cryptocurrency exchange FTX transferred $2.2 billion to founder Sam Bankman-Fried through various entities, said the firm’s new management. A total of $3.2 billion was paid to Bankman-Fried and other key employees, according to a financial report filed Wednesday. The second biggest recipient after Bankman-Fried was Nishad Singh, FTX’s former director of engineering, who received about $587 million. In February, Singh pleaded guilty to charges including fraud and conspiracy for his role in FTX’s collapse. The payments were made mainly from the Bankman-Fried-owned trading firm Alameda Research, whose precarious finances set the wheels in motion for FTX’s collapse in November.

US Securities and Exchange Commission Chairman Gary Gensler doubles down on his opinion that proof-of-stake tokens can meet the definition of securities under the Howey test, thereby bringing them under the agency’s regulatory authority. Speaking to reporters after a commission vote on Wednesday, Gensler said securities laws could be triggered because investors expect a return when they buy tokens underpinned by a proof-of-stake consensus mechanism. The Block first reported the news.

Today’s chart

-

CryptoCompare’s chart shows that bitcoin’s 1% market depth for BTC/USD pair or collection of bids and offers is within 1% of the mid-price or average of the bid and ask/offer prices.

-

Market depth fell to fresh multi-month lows over the weekend after the USDC lost its dollar peg, making it harder for traders to execute large orders at stable prices.

-

“Coinbase’s BTC-USD liquidity (which is a unified market for USD and USDC on Coinbase) saw a sharp decline in its 1% market depth that was more severe than when FTX collapsed. 1% market depth fell from 846 BTC on the 10th to 417 BTC on the 11th, down 50.7%,” CryptoCompare said in a report on Tuesday.

-

Deterioration in liquidity, as measured by market depth, means that a few large orders can trigger large price movements in either direction.