Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

A new survey shows that the majority of nearly 1,000 investors who responded expect bitcoin’s price to fall to $10K. In addition, 28% of respondents expressed strong confidence that cryptocurrencies are the future of finance, while 20% said they are worthless.

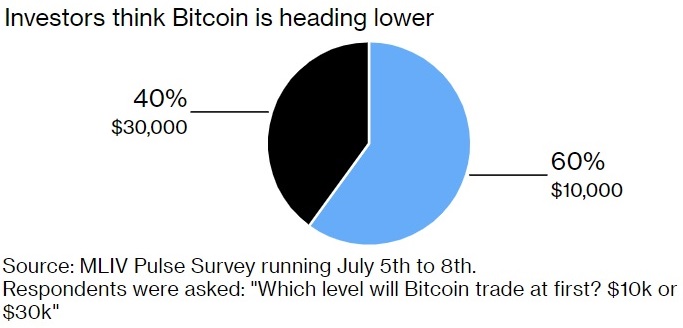

The latest Bloomberg MLIV Pulse survey, conducted from July 5 to 8, asked 950 investors who responded where they see the exchange rate of bitcoin.

Respondents were asked, “Which level will bitcoin trade at first? $10K or $30K.” According to the results published on Monday, 60% of them said that BTC will fall to the $10K level first.

Furthermore, 28% of respondents expressed strong confidence that cryptocurrencies are the future of finance, while 20% said they are worthless, Bloomberg reported, adding that most respondents were at least a little skeptical about cryptocurrencies.

When asked about non-fungible tokens (NFTs), only 9% of respondents said they were an investment opportunity. The majority see them as art projects or status symbols.

At the time of writing, bitcoin is trading at $20,553, down 3.3% over the past 24 hours and 40% over a one-year period.

There has been a lot of discussion about where the bottom is for bitcoin. Shark Tank star Kevin O’Leary said last week that he doesn’t think we’ve seen the bottom yet. He warned that there will be a major panic event in crypto.

A Fidelity Investments analyst recently said that at current levels, bitcoin is cheap. Deutsche Bank predicted in June that BTC will rise to $28K by the end of the year, but warned that the crypto-free fall could continue.

Do you think the price of bitcoin will fall to $10K? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.