Investors dumped a record number of Bitcoins last week, only to miss out on a Face Ripping Rally

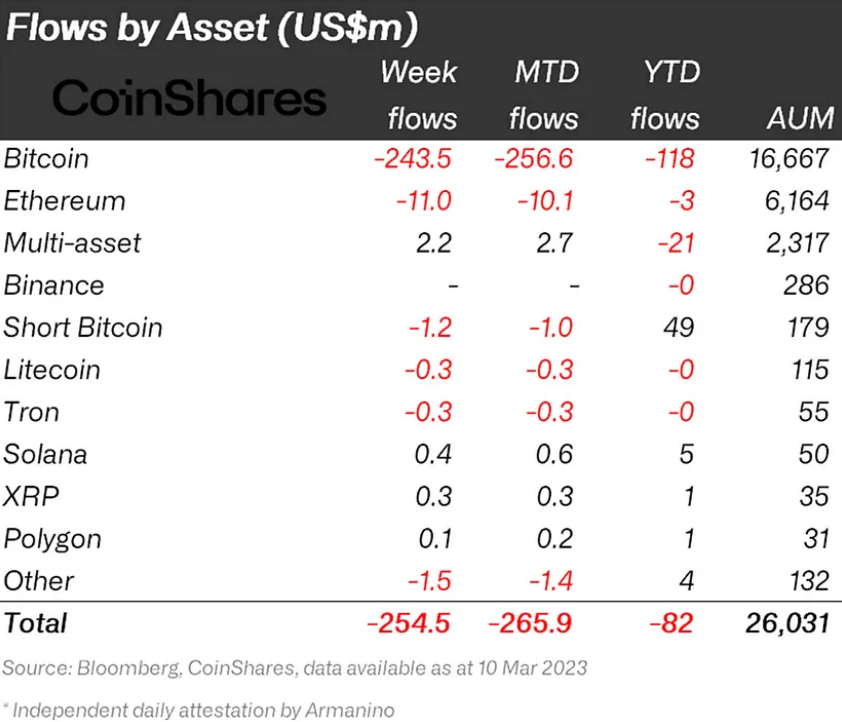

Digital asset investment products saw their highest ever weekly outflows last week, according to the latest Digital Asset Fund Flows Weekly Report released by CoinShares. The $255 million in net payouts represented 1.0% of total assets under management (AuM) that fled the space.

Expressed as a percentage of assets under management, last week’s outflow represented the second largest outflow of capital from crypto after assets under management fell by 1.9% in one week back in May 2019. However, at the time, this represented only $52 million in outflows from investments in digital assets Products.

Bitcoin dominated outflows, with $243.5 million exiting long Bitcoin investment products, while $1.2 million exited short products. Ethereum saw weekly outflows of $11 million. Altcoin net flows were close to neutral – Litecoin and Tron lost $0.3 million in capital, while Solana, XRP and Polygon gained $0.4, $0.3 and $0.1 million respectively. Other altcoins lost another $1.5 million.

Last week’s outflows from crypto products wiped out net inflows for the year. Net flows are now -$82 million since the beginning of January.

Investors dumped crypto due to banking problems

Investors likely dumped their digital asset investments at such a rate last week amid concerns about a series of high-profile crypto-related US bank failures, including Silvergate and SVB Financial. The failures of these banks sparked fears among investors about weakening fiat-to-crypto on-ramps and also about the safety of Circle’s USDC stablecoin, which had some reserves parked at these institutions.

Bitcoin at one point last Friday had fallen all the way back to test its 200-day moving average and realized price in the upper $19,000s. Investors were also likely concerned by the ongoing hawkish message from the Fed about the need for further rate hikes, as included in a speech by Fed Chairman Jerome Powell earlier this week.

And missed a Face Ripping Rally

However, the investors who dumped their crypto holdings missed out on a face-smashing rally over the past two days. Bitcoin last traded in the low-$24,000s, up a whopping 24% from last Friday’s low.

The rally comes as 1) US authorities stepped in to save Silvergate and SVB depositors from potential losses and introduced a new $25 billion liquidity program to prevent further bank runs and 2) markets are aggressively pulling back on Fed tightening bets. The Fed cannot continue to tighten with the US banking system on the brink of collapse, the thinking goes, especially given that its aggressive hiking campaign has been the main driver of the vulnerabilities.

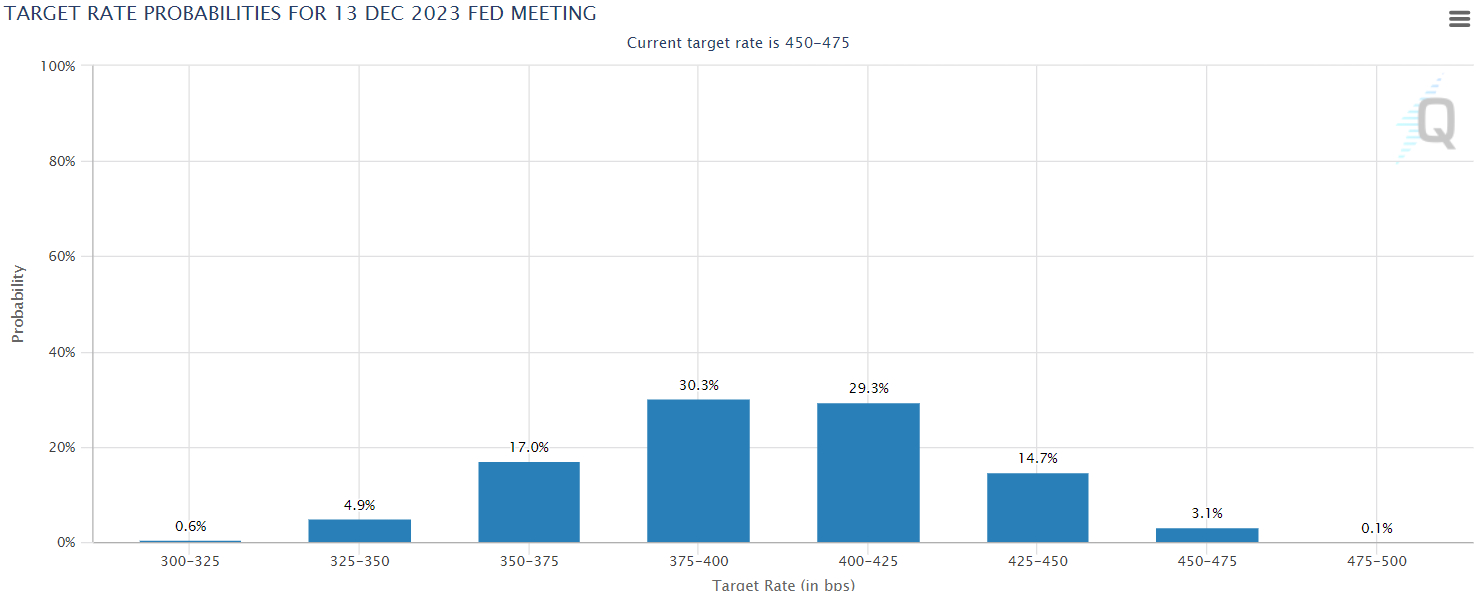

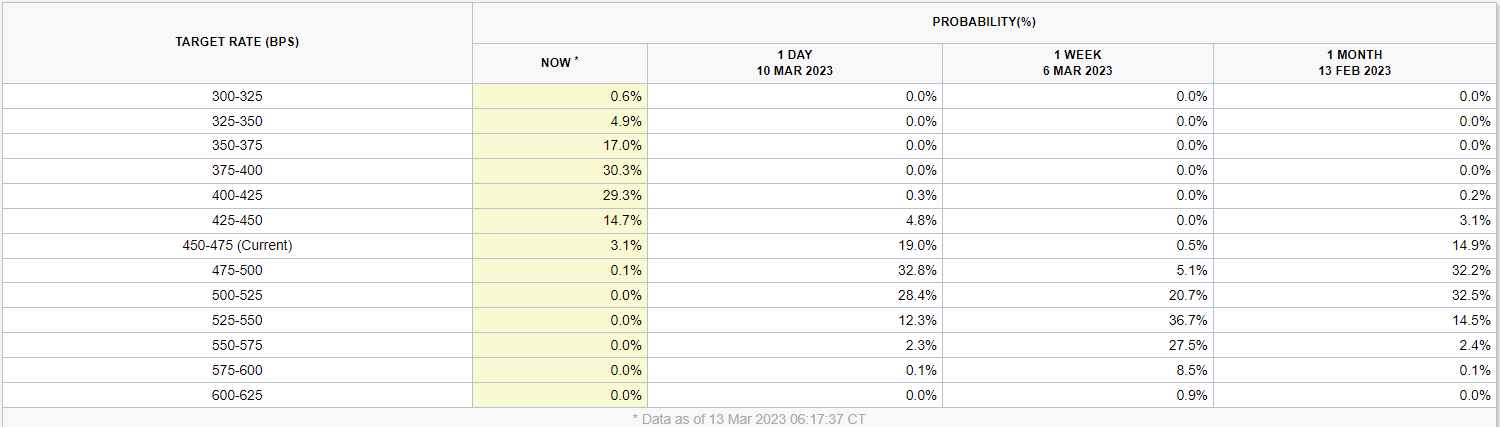

According to CME’s Fed Watch Tool, markets are only now assigning a 65% chance that the Fed will raise interest rates by another 25 bps later this month. A week ago, markets assigned a roughly 30% chance of a 50bps rate hike later this month, and an increase of at least 25bps as an absolute certainty.

The money markets then assign only a slim chance of 32% for a further 25 bps rate hike (to take rates to 5.0-5.25%) in May. By the end of 2023, money markets are now priced so that US interest rates have fallen back to around or just below 4.0%. This time last week, rates were more skewed toward rates that ended the year in the mid-5.0% range.

The huge repricing in the Fed’s tightening of expectations has triggered a collapse in US Treasury yields, with the 2-year back to around 4.0% again, after hovering around 5.0% just days ago. The US dollar is understandably coming under pressure. This massive easing of economic conditions by the US government to prevent a financial crisis is hugely bullish for crypto, as seen in the price action over the past two days.