Investors continue to buy Bitcoin Dip as price falls below $19,000

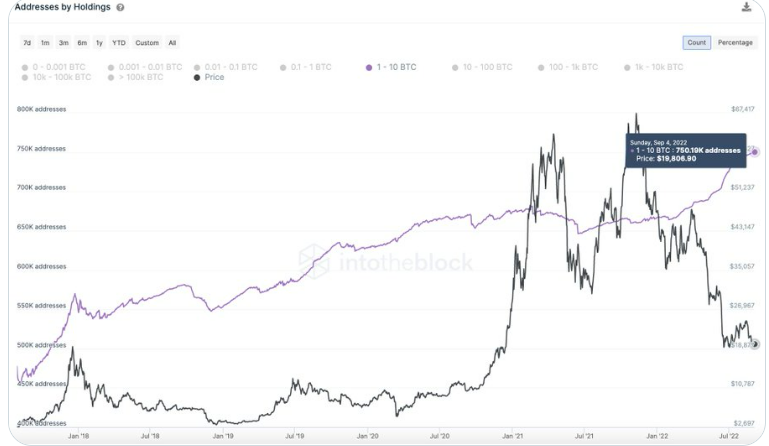

The number of BTC wallets holding between one and ten BTC has risen to an all-time high as bitcoin falls below $19K.

Bitcoin briefly fell to a nine-week low of $18,917 on September 6, 2022, sparking a buying spree that saw the number of wallets with 1-10 BTC rise to over 750K. The previous low was on July 3, 2022, when the price reached $18,780.

The number of addresses with between one and ten bitcoins has been on a steady increase since the BTC price fell below $50,000 in late December 2021 and early January 2022.

Massive liquidations as bitcoin hits 9-week low

The latest price drop also saw $77 million worth of bitcoin positions liquidated, with over $40 million liquidated in the last hour and a half. The majority of BTC liquidations occurred when BTC fell to around $18,964. Crypto exchanges OKX and Binance lead liquidations across multiple cryptocurrencies today, with Binance liquidating $39.03 million and OKX $70.37 million.

Liquidation occurs when a trader posts a minimum amount (margin) which is then multiplied to create a leveraged position. For example, a trader can set up a margin of $500 with 50x leverage to create a $25,000 position. The trader then buys a certain amount of bitcoin with his borrowed amount. If the price of BTC decreases by more than 2%, the trader will lose his first $500 through forced liquidation. It is a high-risk, high-reward strategy, and regulations govern the amount of leverage that can be used.

Coinbase Pro had to shut down the leveraged trading product offered to Coinbase Pro customers following a regulatory downgrade.

Forced liquidations are unlike traditional markets, where traders are given a margin to deliver additional funds to cover their position.

Institutional adoption key to driving wallet growth

While the number of wallets holding between one and ten bitcoins has increased, hedge fund billionaire Anthony Scaramucci believes that institutional adoption will be a crucial driver in the growth of bitcoin wallets and its use as an inflation hedge. Institutions such as BlackRock say institutional interest in bitcoin is strong, despite its price falling nearly two-thirds from its November 2021 high.

British investment conglomerate Abrdn and Charles Schwab have dipped their toes into the bitcoin pool, with Abrdn buying a stake in crypto exchange Archax and Schwab launching a crypto exchange-traded product.

For Be[In]Crypto’s Latest Bitcoin (BTC) Analysis, click here.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.