Intuit: Fintech leader with huge cross-selling opportunities (INTU)

-Oxford-

Intuit (NASDAQ: INTU) is a global software company on a mission to “drive prosperity around the world”. To achieve this, the company has created/acquired a number of market-leading financial products such as Quickbooks for SME accounting and CreditKarma. Intuit has a strong leadership position and in Q1,FY23 the company beat both top and bottom line estimates for growth. In this post I’ll break down the business model, economics and valuation, let’s dive in.

Business model and strategy

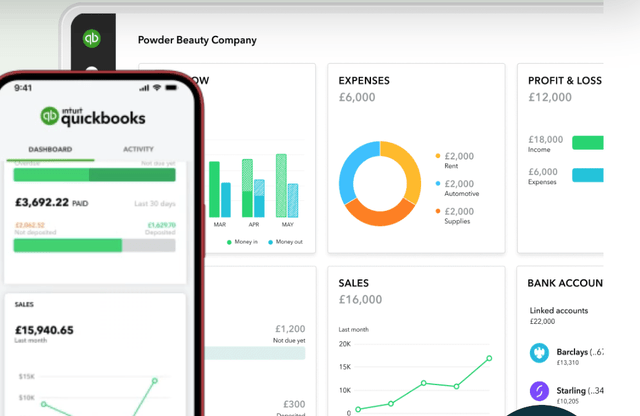

Intuit is a financial software company focused on helping small and medium-sized businesses [SMBs] streamlining finances and accounting. Traditionally, keeping track of SMB finances is a messy and time-consuming process involving multiple spreadsheets, folders of receipts, etc. Intuit solves this problem with its iconic “QuickBooks” platform. This product streamlines the entire accounting process and offers intuitive dashboards to help users run their businesses more efficiently.

Quickbooks (Intuit/Quickbooks website)

The easy-to-use nature of the solution means it’s no surprise that the QuickBooks product is the leading digital accounting platform for small and medium-sized businesses and has ~82% market share in the US. The product is distributed via several versions, the most popular being “QuickBooks Online”, followed by a desktop distribution and a self-employed version. Over time, management’s strategy is to convert all of its legacy desktop users to its more scalable cloud-based platform. In general, larger organizations that have used the platform for a long time are slow to switch.

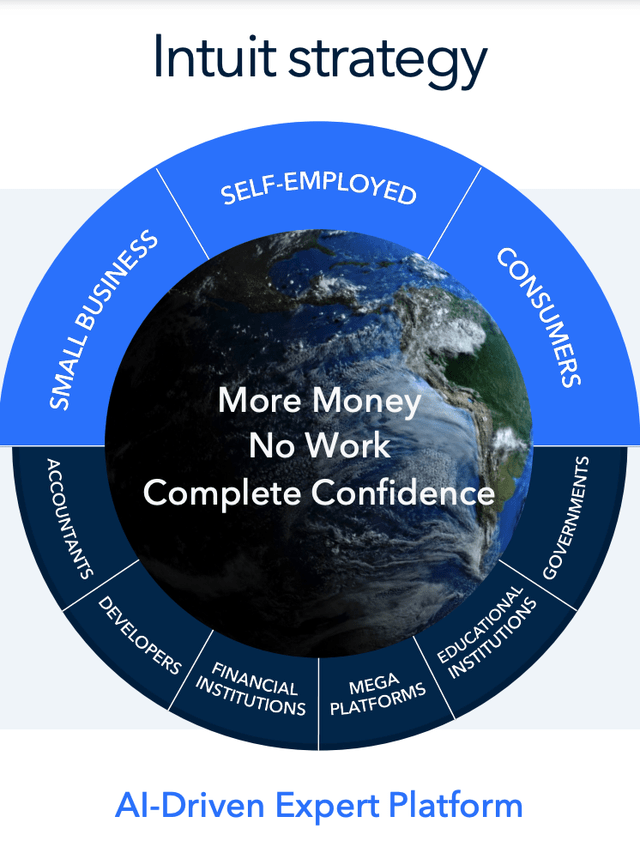

Intuit’s leadership realized a long time ago that a great way to scale the business is to help small businesses and individuals with other financial solutions from getting loans to managing taxes and even marketing. This strategy led Intuit to acquire Turbotax in 1993 and develop it into the user-friendly tax solution it is today. In 2009, Intuit also bought Mint.com for $171 million. This product offers an intuitive personal financial app and access to credit cards etc.

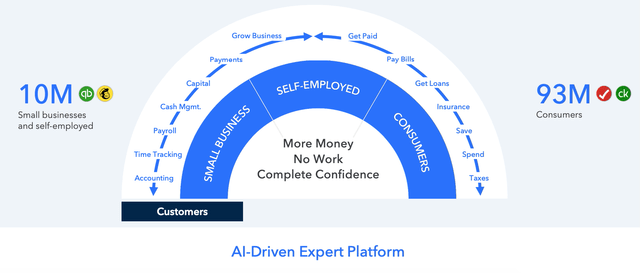

Intuit strategy (Investor presentation)

More recently (2020), Intuit acquired CreditKarma for $3.3 billion in cash and $4.4 billion worth of stock. CreditKarma is a “personal financial assistant” that helps customers access credit reports, improve credit scores and access loans and credit through its partners. In 2021, the company acquired Mailchimp for $5.7 billion in cash and 10.1 million shares. Mailchimp is an email automation platform, and it’s arguably the most diverse acquisition the company has made outside of its core financial products. However, there is a method to the perceived madness. 75% of small businesses surveyed rate finding new customers as their biggest obstacle, according to a study cited by Intuit.

As Intuit aims to solve problems for its SMB customers, there are synergies and huge cross-selling opportunities. So it’s no surprise that QuickBooks and Mailchimp have roughly 10 million SMB and self-employed customers. In addition, Intuit’s Credit Karma and Turbo Tax platforms serve over 93 million consumers. Part of Intuit’s strategy is to also focus on being “expert-driven” with the power of artificial intelligence [AI]. AI is a growing industry and has recently exploded in popularity, thanks to viral platforms like ChatGPT created by the Open AI Institute. The power of an AI model is dictated by the amount and accuracy of the training data. In this case, Intuit has access to over 400,000 customer/financial attributes per SMB. Thus, it can train its AI models with this huge data set. The company generates ~58 billion machine learning predictions per day, helping to power over 730 million customer interactions.

Intuit solutions (Investor presentation)

Growing economy

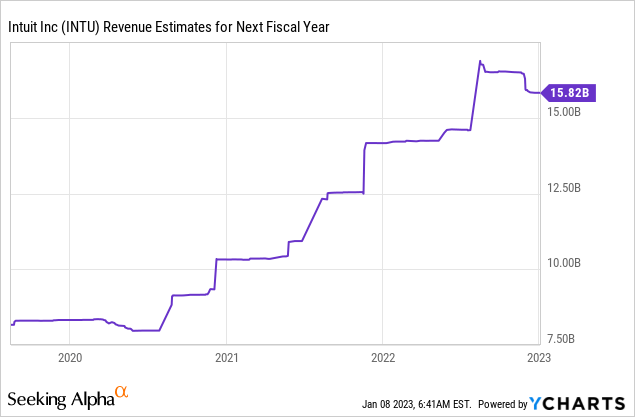

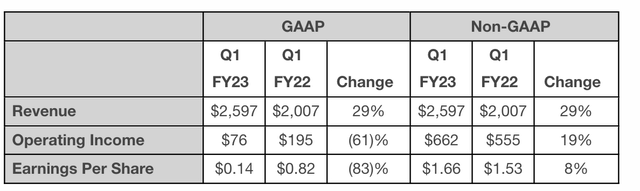

Intuit reported strong financial results for the first quarter of fiscal 2023. Revenue was $2.6 billion, which was up a brisk 29.4% year-over-year and beat analyst estimates of $97.15 million.

Breaking down revenue by segment, small business and self-employed revenue increased 38% to ~$2 billion. $264 million of this revenue is attributable to Mailchimp and thus excluding this revenue increased by a steady 19% year over year. Credit Karma grew at a slow rate of 2% year over year to $425 million. This platform appears to have been affected by macroeconomic headwinds, as high interest rates affected lending. Consumer group revenue increased 25% year over year to $150 million. This was followed by “ProTax” group revenue which rose 30.7% year over year to $34 million.

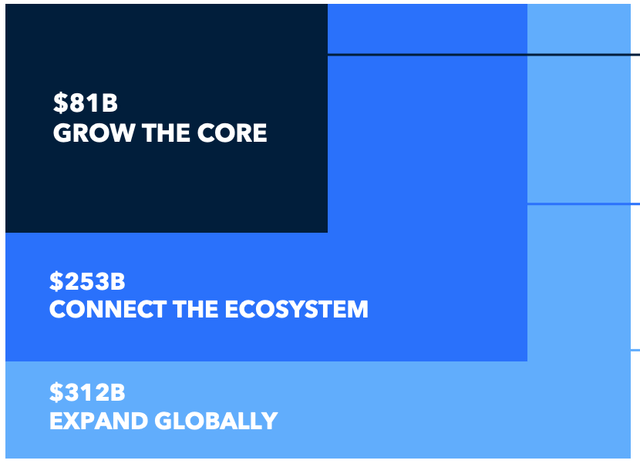

Intuit’s growth strategy focuses on three core elements; growing the core, connecting the ecosystem and expanding globally. The estimated total addressable market for growing core alone is ~$81 billion. Additionally, the company estimates a global expansion market size of $312 billion. So far, the company has executed its strategy to a tee. Its “core” QuickBooks platform reported solid online growth of 29% year over year. SaaS accounting platforms are quite “sticky” with customers because when a user starts uploading all their finances, there are quite high “switching costs” in terms of admin. Therefore, it was no surprise to discover that Intuit has raised the price of its QuickBooks solution. Customers are unlikely to abandon it provided the price increase is not drastic, this is good news in a high inflation environment.

Intuit TAM (Investor presentation)

Intuit has also carried out the second pillar of its growth strategy well which is to “connect the ecosystem”. As I discussed in the business model section, Intuit has made a series of acquisitions with a related customer base. This means there are plenty of cross-selling opportunities. Intuit’s total revenue from “online services” increased by a whopping 109%. This includes a $264 million contribution from Mailchimp. The payroll product also contributed to growth, as SMBs look for an easier way to pay employees.

Intuit’s third growth pillar, growing internationally, has also been implemented well. Online ecosystem revenue increased a whopping 172% year-over-year, or 19% year-over-year excluding Mailchimp.

In terms of profitability, Intuit reported $662 million in Non-GAAP operating income, which was up 19% year over year. Total earnings per share [EPS] was $0.14 which beat analyst estimates by $0.54.

Economy (Q1, FY23)

Intuit has a solid balance sheet with $2.7 billion in cash and marketable securities. The company is quite heavily leveraged at ~$7 billion in debt, but the majority of this debt at $6.48 billion is long-term debt and thus manageable.

Intuit bought back shares worth $519 million in Q1, FY23, which is a positive sign and shows that management has faith in its business strategy. The company also pays a forward dividend of 0.81%, which isn’t very high, but it was up 15% year-over-year.

For the full fiscal year 2023, management has forecast revenue growth of between 10% to 12%, which is slower than previous growth. This appears to be mainly impacted by an expected (10% to 15%) decline in Credit Karma revenue, which is expected to be driven by the high interest rate environment and expected recession.

Advanced valuation

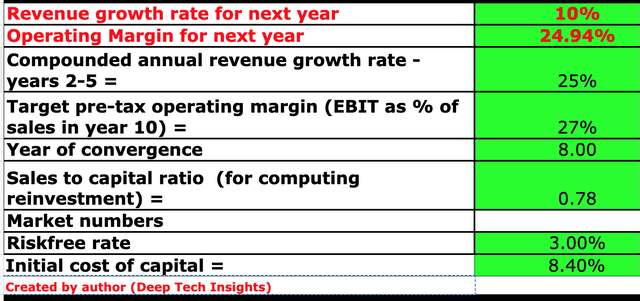

To value Intuit, I’ve plugged the latest financials into my discounted cash flow model. I have forecast 10% earnings growth for “next year”, which includes the next three quarters in my model and is in line with management’s tepid expectations, due to the macroeconomic environment. In years 2 to 5, I have forecast a larger revenue growth of 25% per year, as economic conditions are projected to improve and Intuit benefits from growth in more products.

Intuit stock valuation 1 (created by author (Deep Tech Insights))

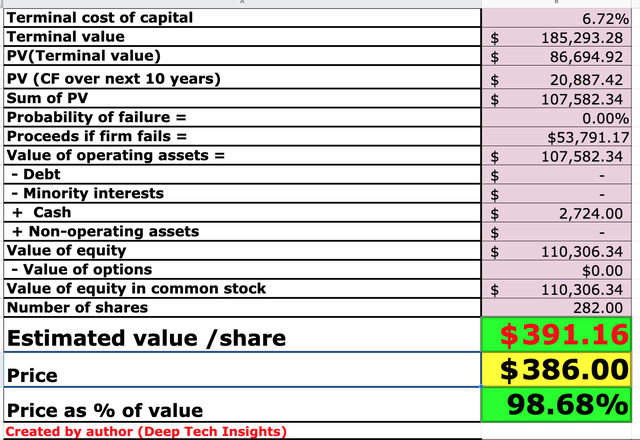

In order to increase the accuracy of the valuation model, I have entered R&D expenses on the balance sheet which have raised the net income. Additionally, I have forecast a 2% increase in operating margin over the next 8 years as the business benefits from increased scale and cross-selling.

Intuit stock valuation 2 (Created by author Deep Tech Insights)

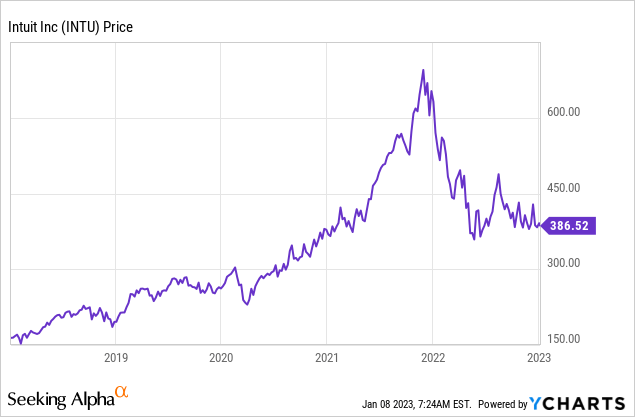

Given these factors, I get a fair value of $391.16 per share, the stock trades at ~$386 per share at the time of writing and is therefore “fairly valued”. This valuation is expected as the company has a strong leadership position, with growth opportunities and a high-quality business model.

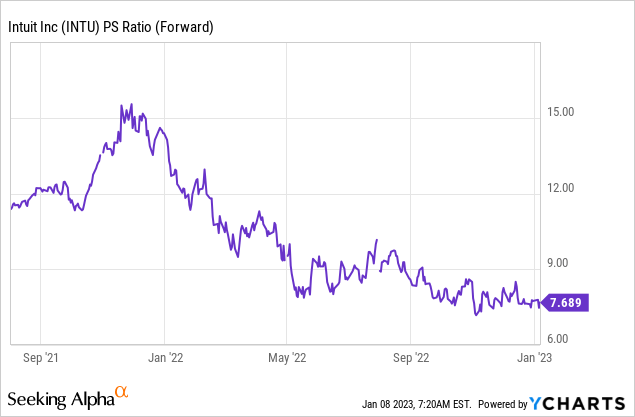

One positive is that Intuit is trading at a price-to-sales ratio = 8.19, which is 24% cheaper than its 5-year average.

Risks

Recession/slowing growth

Many analysts have predicted a recession, so I expect longer sales cycles, and slowing growth for Intuit. One positive is that I don’t think the company’s market position will be affected and I don’t expect them to lose SMB customers.

Final thoughts

Intuit is a market-leading fintech company and offers a number of iconic products with high “stickiness” among its customer base. Its three-pillar strategy has been executed well so far as the company continues to grow its core. In addition to cross-selling the products to the related consumer base. The share is reasonably valued in itself and undervalued in relation to historical multiples at the time of writing, and thus it can be a great long-term investment.