Fintech Times has launched its third annual report on the fintech landscape in the Middle East and Africa (MEA) region. It begins with a macro-level overview and then dives into specific aspects of the industry to provide a comprehensive picture of the fintech ecosystem in the area.

The Fintech Times’ The Middle East and Africa Report 2023: Economic Development through Prosperity with Fintech puts the spotlight on the region’s economic development and how market demand and government support have affected the growth and development of the fintech industry.

Since the last edition of this report in 2022, the global world order has changed significantly. The war in Ukraine continues to drag on, bringing ongoing challenges that the world has faced, including inflation, an energy crisis and food shortages, such as wheat from Ukraine and Russia. This is in addition to the challenges of recovering from the Covid-19 pandemic and other destabilizing factors.

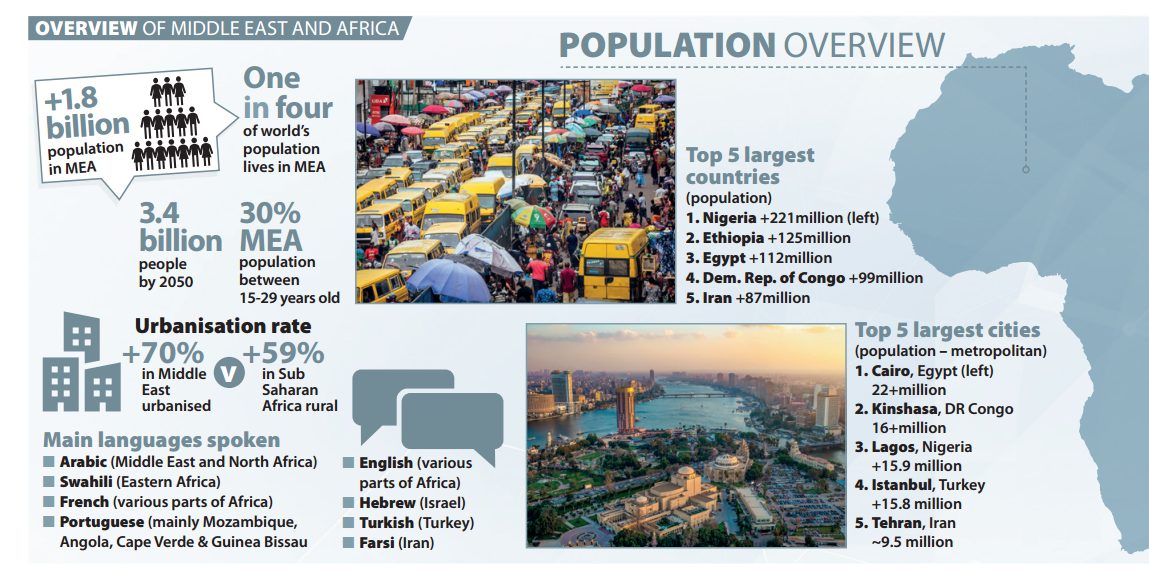

Richie Santosdiazeconomic development advisor for emerging economies on Fintech Timessaid: “The MEA region is an exciting and dynamic area, and I am delighted to share our latest report which spotlights emerging economies. From the prosperous Persian Gulf region to the less prosperous parts of the Middle East and Africa, the region is undergoing some of the greatest transformations the world has ever seen.

“While fintech in MEA is still in its infancy, it has already addressed challenges and opportunities across many demographics in the region. The region is uniquely positioned to drive financial inclusion, including through the involvement of the wealthy sovereign wealth funds of the Gulf in global fintech investments.

Highlights from the report:

- The MEA region comprises over 70 countries, and this report focuses on a selection of key countries

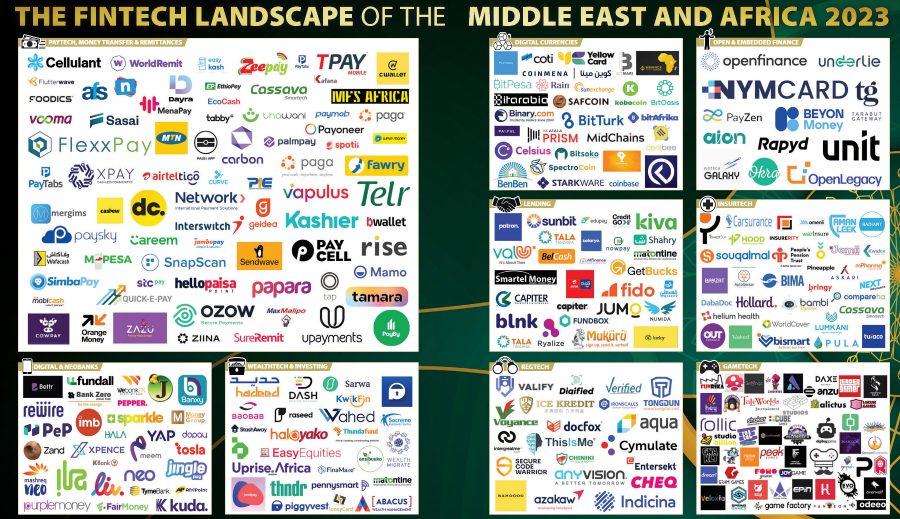

and analyzes their fintech ecosystems. - The fintech landscape in MEA is diverse, with an estimated 3,000 fintech solutions in the region and 26,000 globally

- While fintech has a significant impact on the GDPs of some countries in the region, ongoing global economic challenges pose challenges to further growth

- Fintech activity in MEA is concentrated in certain areas, including Israel, the Big Four African countries (Nigeria, Kenya, Egypt and South Africa), Turkey and the GCC countries, especially the UAE and Saudi Arabia which are increasingly taking a leading role role

- While there are similarities in key components of the fintech ecosystem worldwide, MEA is developing its own unique ecosystem to support fintech growth

- salt edge, a leading global provider of open banking and open finance, is a strategic partner in this year’s report. The company aims to have an active role in the Middle East’s financial ecosystem, and build strong collaborations with regulators and financial institutions to contribute to an organic adoption of the open banking regulations and standards.