Intel Cancels Bitcoin Mining Chip Series After Less Than a Year

Intel is canceling its Bitcoin mining chip series, the Blockscale 1000 ASIC, for its smartphones. It has barely been a year since the series was launched. Is artificial intelligence (AI) driving a strategic shift?

The technology industry is constantly evolving, and it’s no surprise that the current landscape is significantly different from a few years ago. The arrival of blockchain technology sparked a lot of excitement in the tech industry. Many believe in its revolutionary potential. However, the crypto winter has shaken faith in blockchain technology. This has a significant impact on the industry.

The crypto winter refers to a significant decrease in the value of cryptocurrencies. Especially Bitcoin, which suffered in late 2017 and continued into 2018. This decline went hand in hand with a loss of faith in blockchain technology, which many had hoped would drive the next wave of innovation.

New sherriff in town

One reason for the decline in belief in blockchain was a series of high-profile frauds and scams. Many investors lost fortunes in these scams, leading to a loss of confidence in the technology. In addition, the hype around blockchain technology led many companies to launch projects without understanding the technology, leading to mistakes.

Another factor contributing to the crisis of faith was the need for real-world use cases. While a few successful projects use blockchain technology, such as Bitcoin and Ethereum, there are relatively few examples of blockchain technology being used to solve real-world problems.

In contrast, AI has become a hot new investment in the technology industry. AI has been around for a while, but recent advances have led to renewed interest and investment. AI has the potential to revolutionize various sectors, from healthcare to finance to transportation, making it a popular investment area for many companies.

One of the factors behind the renewed interest in AI is the success of companies such as Google and Amazon, which have used AI to improve their products and services. For example, Google uses artificial intelligence to fine-tune search results and develop new products such as Google Assistant. Amazon uses AI to make its recommendations and develop new products such as Alexa.

The shift in innovation

In addition, many real-world use cases for AI lead to increased technology investments. For example, AI can detect fraud in financial transactions, diagnose diseases in healthcare and optimize supply chain management in logistics.

The shift in focus from blockchain technology to AI has also led to many technology companies tightening their belts and shaking off less than core businesses. This is because AI is seen as a core area for many companies, and they are investing heavily in technology to gain a competitive edge. This has led to several companies selling non-core businesses to focus on AI.

One example is IBM, which sold its managed infrastructure services business to focus on cloud computing and AI. Another example is Intel, which sold its NAND memory business to SK Hynix to focus on AI and other core areas.

The shift towards AI has also brought a focus on talent acquisition as companies look to hire the best AI talent to drive innovation in the field. This has led to increased competition for AI talent, with many companies offering attractive packages to attract top talent.

Killing the crypto chip

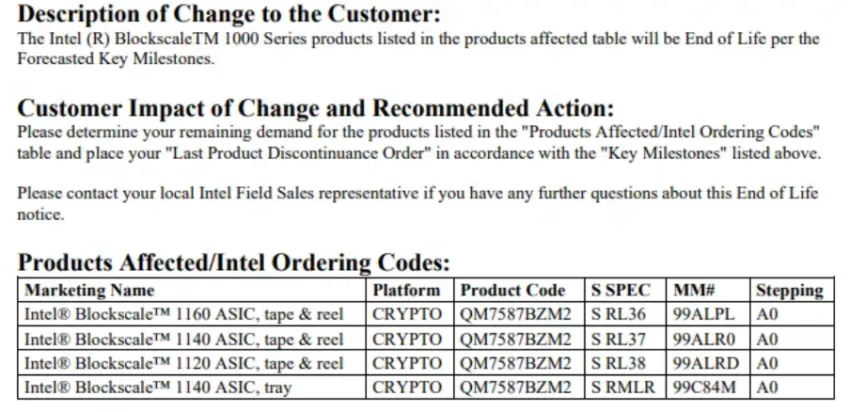

Intel announced that it is discontinuing development of the Blockscale 1000 ASIC mining chip series for Bitcoin. The decision was made because the company has decided not to pursue any future generations of the chips. This marks the end of Intel’s brief foray into the Bitcoin mining market.

The Blockscale chips were supposed to be high-performance mining chips for Bitcoin. The goal is to make mining more accessible to individual miners. And work together with mining software to perform the complex calculations required to mine new bitcoins.

However, the development of the Blockscale chips has been characterized by delays and setbacks. For example, a chip manufacturer dropping the project completely without announcing a new chip that will succeed it. Intel dodged a question from Tom’s hardware on whether it would exit the Bitcoin ASIC business, saying:

“We continue to monitor market opportunities.”

The company has cited several reasons for the decision, including the high cost of developing the chips and the low demand for them.

Crypto out, AI in?

Intel’s decision to discontinue the Blockscale chips is not surprising, given the challenges the Bitcoin mining market has faced in recent years. The high cost of mining equipment and the increasing difficulty of mining new bitcoins have made it difficult for individual miners to compete with large mining operations.

In addition, the Bitcoin mining market has become increasingly centralized, with a few large mining operations controlling a significant portion of the network’s computing power. This has led to concerns about the security and decentralization of the network. In fact, Intel is feeling the heat from the escalating regulatory attack on crypto. For that reason, as well as factors mentioned above, some companies may choose to distance themselves.

At the same time, Bitcoin has performed unexpectedly well, hitting the $30,000 threshold. Still, an April 19 report in The Verge noted that Intel may be looking at AI.

Integration of the latest technology

The chipmaking giant is well positioned to take advantage of the growing demand for AI. After some digging, BeInCrypto found some interesting things. The company has a strong track record in the development and production of high-performance chips, and AI is a natural extension of its core business.

AI applications require powerful chips that can process large amounts of data quickly and efficiently. Intel has invested heavily in developing chips specifically designed for AI applications, such as the Nervana Neural Network Processor (NNP).

Nervana NNP is designed to accelerate the training and inference of deep neural networks, a key technology in AI applications such as computer vision and natural language processing. The chip is optimized for high-performance computing and can process large amounts of data in parallel, making it ideal for AI applications.

In addition to developing specialized AI chips, Intel has also been working on integrating AI into its existing products. The company’s processors are increasingly designed with AI in mind, with features such as vector processing and integrated neural network accelerators.

AI Flying High

Intel has also invested in software tools and libraries, making it easier for developers to merge AI into their applications. For example, the company has developed the OpenVINO toolkit, which allows developers to optimize their AI applications for Intel hardware.

Intel’s focus on AI is already paying off. The company has reported strong growth in its data-centric businesses, which include AI and other high-performance computing applications. In the fourth quarter of 2021, Intel’s data-centric businesses generated $9.90 billion in revenue, an 11% year-over-year jump.

Looking ahead, the demand for AI technology is only expected to increase. AI applications are being developed across various industries, from healthcare and finance to retail and transportation. The market for AI hardware and software could reach $500 billion by 2025, according to a report by McKinsey & Company.

As a leader in the chip manufacturing industry, Intel is well positioned to take advantage of this growth. The company has a strong track record in developing and manufacturing high-performance chips, and its focus on AI helps position it for success in the growing AI market. Other actors within the industry have supported the innovation by incorporating it into their businesses.

Nvidia Corporation’s chief technology officer, Michael Kagan, has criticized the cryptocurrency industry. Namely to establish that it does not provide anything valuable for society. Although Nvidia’s processors sell to the crypto industry, Kagan believes that processing power use in artificial intelligence chatbots like ChatGPT is more beneficial than mining crypto.

Meanwhile, famous people like Elon Musk censured the use of artificial intelligence.

The coming backlash?

Intel’s sudden shift and scrapping of Bitcoin plans may raise concerns as a company that provides value to its consumers and clients. Did the company choose the route due to regulatory pressure? The US government has been taking steps to sideline the Bitcoin mining industry for years now. Coincidentally, Intel’s decision may align with the regulators’ goals.

There are a few cases where Intel’s (secret) actions backfired. One of the most significant examples was the “Meltdown” and “Spectre” security vulnerabilities discovered in Intel’s processors in 2018. These vulnerabilities allowed attackers to gain access to sensitive information, such as passwords and encryption keys, from the memory of affected devices.

The discovery of these vulnerabilities led to widespread concern among consumers and clients. Furthermore, it raised questions about Intel’s security protocols and testing procedures.

Another example is the delay in the launch of Intel’s 10nm processors. Originally expected to launch in 2016, but delayed several times until the final release in 2019. The delay led to frustration among consumers and clients, who were eagerly awaiting the release of the more powerful and more energy efficient processors. The delay also allowed Intel’s competitors, such as AMD, to gain market share and increase their market value.

Additionally, there are concerns about Intel’s pricing strategies. Some consumers and customers accuse the company of charging high prices for its processors compared to its competitors. This has led some customers and consumers to look to alternative chip suppliers for their computing needs.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.