Institutions are wary of Bitcoin as short BTC products see record entry: Coin shares

Leading digital asset manager CoinShares says that many institutional investors seem to be more cautious about Bitcoin and position themselves as short sellers on BTC.

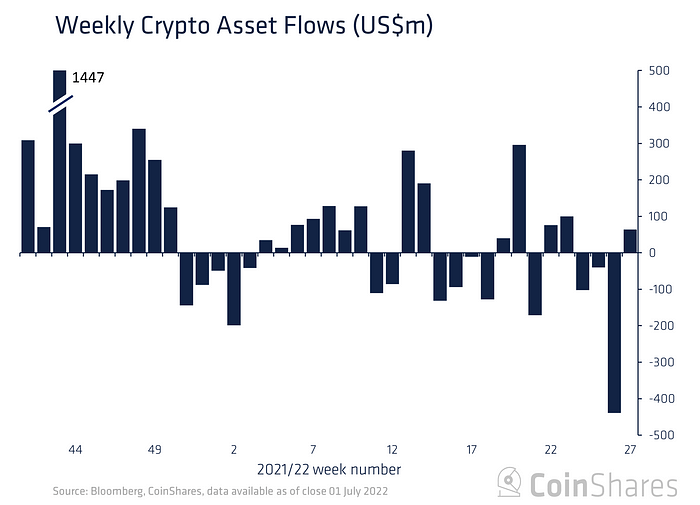

In the latest Digital Asset Fund Flows Weekly report, CoinShares finds that digital asset investment products had a positive week of inflows, mainly due to allocations to short-Bitcoin products.

“Digital asset investment products saw inflows totaling $ 64 million last week, although headline figures obscure the fact that a significant majority were in short-term Bitcoin investment products ($ 51 million).”

As mentioned, 79% of the inflows come from short-Bitcoin (BTC) investment products, or products that want to borrow Bitcoin to sell on the market before buying it back at a lower price.

Small inflows into long-term Bitcoin investment products may support the bearish argument, according to the company.

“Small inflows were seen to long-term investment products in regions other than the United States such as Brazil, Canada, Germany and Switzerland totaling $ 20 million.

This highlights that investors are adding long positions to current prices, with the inflow to short-Bitcoin possibly due to first-time availability in the US instead of renewed negative sentiment.

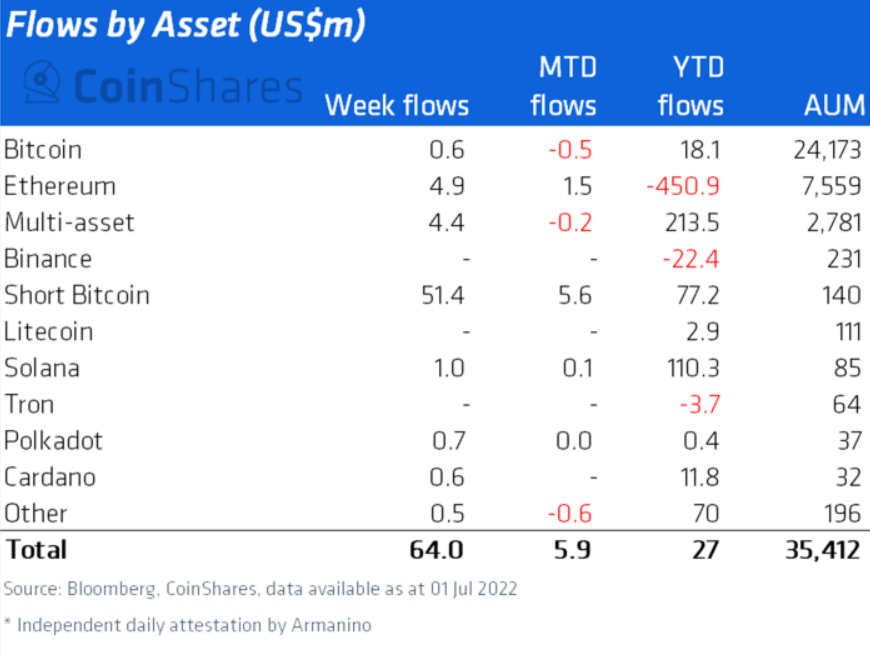

Bitcoin saw little inflow during the week, a total of only 0.6 million dollars. Short-Bitcoin saw a record entry of a total of $ 51 million after the product launch in the United States. “

CoinShares refers to the ProShares launch of the Short Bitcoin Strategy ETF (BITI) on June 21st.

Ethereum (ETH), Solana (SOL), Polkadot (DOT), Cardano (ADA) and multi-asset crypto-investment products all had access during the week, bringing in $ 4.9 million, $ 1 million, $ 0.7 million, $ 0.6 million and $ 4.4 million, respectively.

Check price action

Don’t miss a beat – Subscribe to have crypto email alerts delivered directly to your inbox

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed by The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment adviser. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock / yuhu / maxi iliasin