Institutional investors are making moves as crypto markets see the biggest outflow of capital since last year: CoinShares

Digital asset manager CoinShares says digital asset products for large institutional investments saw the biggest outflows of the year last week.

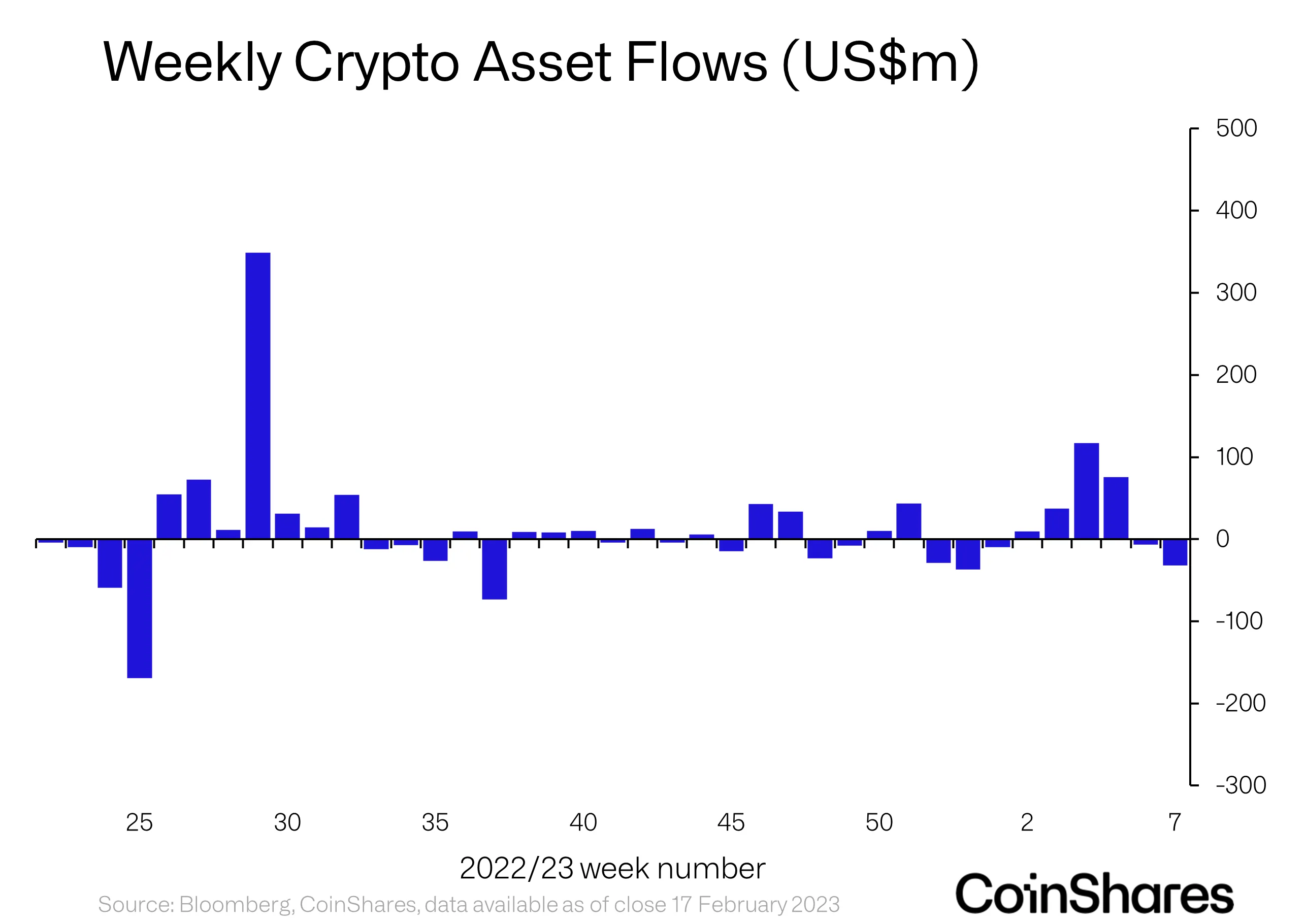

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional digital asset investment products suffered massive outflows in the middle of last week, but that sentiment had improved by the end of the period.

“Digital asset investment products saw outflows totaling USD 32 million last week, the largest since the end of December 2022. Midway through last week, outflows were much higher at USD 62 million, but sentiment improved on Friday with inflows of USD 30 million. “

As usual, Bitcoin (BTC) products took the brunt of outflows. Meanwhile, short-Bitcoin products had access. Short-BTC products have had the second largest inflows so far this year, behind only long-BTC products.

“Bitcoin bore the brunt of the negative sentiment, seeing nearly $25 million in outflows, while short-bitcoin investment products saw inflows of $3.7 million and have seen some of the biggest inflows at $38 million at $38 million, second only to Bitcoin with the US. $158 million.”

Altcoins were a mixed bag of inflows and outflows. While XRP, BNB, Fantom (FTM), Aave (AAVE) and Decentraland (MANA) institutional investment products all had smaller inflows of less than $0.36 million, Ethereum (ETH), Polygon (MATIC), Cosmos (ATOM) and Avalanche ( AVAX) investment instruments led all outflows.

“The negative sentiment was very mixed, with Ethereum, Cosmos, Polygon and Avalanche seeing outflows of USD 7.2 million, USD 1.6 million, USD 0.8 million and USD 0.5 million respectively. While Aave, Fantom, XRP, Binance and Decentraland all saw inflows between USD 0.36 million – USD 0.26 million.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/petrov-k