Individual investors among UP Fintech Holding Limited’s (NASDAQ:TIGR) largest shareholders and were hit after last week’s 9.8% price drop

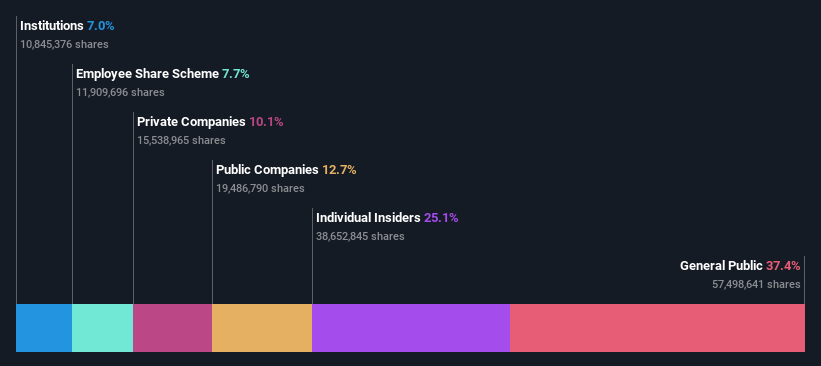

If you want to know who really controls UP Fintech Holding Limited (NASDAQ:TIGR), you need to look at the composition of the share register. We can see that individual investors own the lion’s share of the company with a 37% stake. This means that the group will gain the most if the stock rises (or lose the most if there is a decline).

While insiders who own 25% came under pressure after their market capitalization fell to $496 million last week, individual investors took the biggest losses.

In the diagram below, we zoom in on the various ownership groups of UP Fintech Holding.

Before we look at the ownership distribution, you may want to know that our analysis indicates that TIGR is potentially overrated!

What does the institutional ownership tell us about UP Fintech Holding?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indexes.

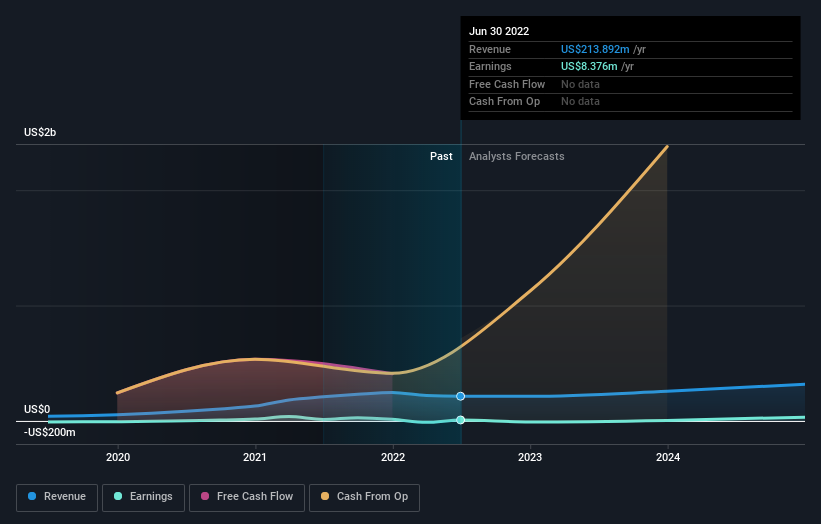

UP Fintech Holding already has institutions in the share register. They actually own a respectable stake in the company. This may indicate that the company has a certain degree of credibility in the investment environment. However, it is best to be cautious about relying on the supposed validation that comes with institutional investors. They are also wrong sometimes. When multiple institutions own a stock, there is always a risk that they are in a “crowded trade”. When such a trade goes wrong, multiple parties can compete to sell shares quickly. This risk is higher in a company without a history of growth. You can view UP Fintech Holding’s historical revenue and earnings below, but remember there’s always more to the story.

UP Fintech Holding is not owned by hedge funds. The company’s CEO Tianhua Wu is the largest shareholder with 15% of outstanding shares. Meanwhile, the second and third largest shareholders hold 11% and 9.5% of outstanding shares respectively.

Upon closer inspection, we found that more than half of the company’s shares are owned by the top 7 shareholders, which suggests that the interests of the larger shareholders are to some extent balanced out by the smaller ones.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiment to know which way the wind is blowing. There are a fair number of analysts covering the stock, so it can be helpful to find out their overall view on the future.

Insider ownership of UP Fintech Holding

The definition of company insiders can be subjective and varies between jurisdictions. Our data reflects individual insiders, capturing at least board members. The company’s management answers to the board and the latter must represent the shareholders’ interests. In particular, sometimes top-level managers themselves sit on the board.

I generally consider insider ownership a good thing. But in some cases it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders have a significant stake in UP Fintech Holding Limited. It has a market capitalization of just $496 million, and insiders hold shares worth $124 million in their own names. We would say that this shows compliance with the shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if these insiders have bought or sold.

General public ownership

With an ownership of 37%, the general public, mainly consisting of individual investors, has a certain degree of influence over UP Fintech Holding. Although this size of ownership may not be enough to influence a political decision in their favor, they can still have a collective impact on the company’s policies.

Private company ownership

Our data indicates that private companies own 10% of the company’s shares. It may be worth looking into this. If related parties, for example insiders, have an interest in one of these private companies, this should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Public ownership

We can see that public companies own 13% of the shares in UP Fintech Holding. This may be a strategic interest and the two companies may have related business interests. It could be that they have merged. This holding is probably worth investigating further.

Next step:

It is always worth thinking about the different groups that own shares in a company. But to understand UP Fintech Holding better, we need to consider many other factors. Take risk for example – UP Fintech Holding has 2 warning signs we think you should be aware of.

If you prefer to find out what analysts are predicting in terms of future growth, don’t miss this free report on analysts’ forecasts.

NB: Figures in this article have been calculated with data from the last twelve months, which refers to the 12-month period ending on the last date of the month in which the accounts are dated. This may not be consistent with the annual report for the entire year.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Valuation is complex, but we help make it simple.

Find out about UP Fintech Holding is potentially over- or under-rated by checking out our extensive analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis