Indian fintech OneCard tops $ 1.4 billion valuation in new financing – TechCrunch

FPL Technologies, an Indian startup offering credit cards to customers under the OneCard brand, is the latest in the South Asian market to join the Unicorn Club following a new round of funding.

Singapore’s Temasek, one of the world’s largest investors, led Pune’s startup’s Series D round of over $ 100 million, OneCard revealed in a submission to the local regulator. The new round values OneCard at over $ 1.4 billion (post-cash), up from around $ 750 million in January this year, a source familiar with the matter told TechCrunch.

Existing supporters QED, Sequoia Capital India and Hummingbird Ventures were among those who took part in the new round, which brings OneCard’s hitherto increase to over $ 225 million.

OneCard declined to comment Wednesday night. TechCrunch reported in February that Temasek was in talks to lead a round of over $ 100 million in OneCard worth around $ 1.5 billion. The Indian news media Entrackr first reported on the submission.

Fewer than 30 million Indians have a credit card today, which has created a large room for startups in the country to innovate on technology and reach more consumers. Banks across the country, and beyond, are increasingly trying to expand their own credit card customer bases, but their strict and archaic eligibility criteria make most Indians unworthy of credit cards.

And that’s a factor OneCard founders understand very well.

OneCard was founded by banking veterans in 2019, and operates a mobile-first credit card. The cards come without membership or annual fee and give customers more control and flexibility over how and where they shop. It also offers a variety of personal rewards and loans to customers.

The startup also runs an app called OneScore, which helps users understand and find credit scores. The app is one of the largest customer acquisition drivers for OneCard, it has previously said.

OneCard said earlier this year that it had gathered over 250,000 customers who spent around $ 60 million with their cards each month. Anurag Sinha, the co-founder and CEO of the startup, said in January that he estimated that around 80 million to 90 million Indians were eligible to have a credit card.

This is not to say that credit card companies do not face any of their own challenges. UPI, a five-year-old payment line developed by retail banks, has been rapidly adopted and is the most popular way Indians shop today. UPI’s rapid entry has eroded some use of debit cards, although it seems that credit cards so far are largely immune to it.

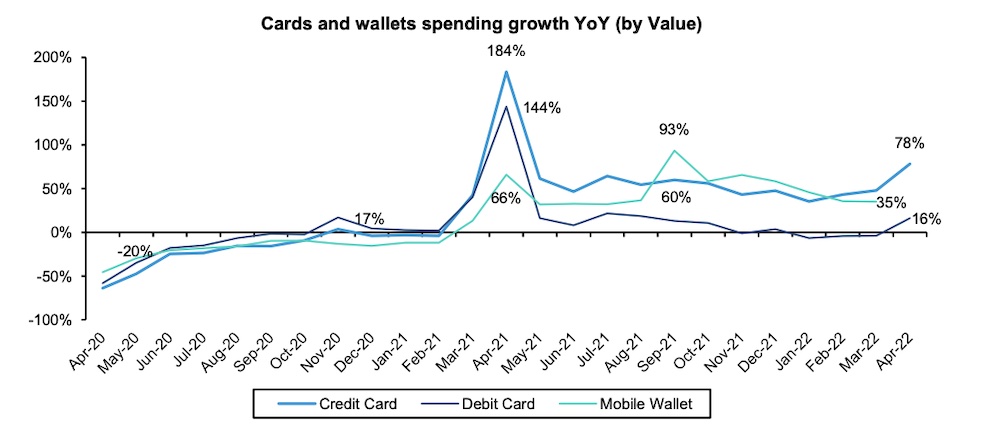

Data: NPCI, RBI, Bernstein analysis. Photo: Bernstein.

“The UPI P2M transaction value exceeded the total credit and debit card usage for the fourth month in a row. The share of P2M transactions increased from 16.6% to 18% in value. Wallets are recovering well (+35% on an annual basis, by value) “We believe the return comes from Paylater fintechs that pay out credit through the wallet / PPI route,” a Bernstein analyst wrote in a note to customers last month.

“We believe this will continue to affect debit cards and credit cards (albeit to a lesser extent). The growth in credit card consumption was +78% per year, with a growth in debit cards of + 16% per year. We believe the topic mobile over cards and credit over debit poses a major threat to debit cards (consumption growth) and credit cards (albeit to a lesser extent – consumption growth, price pressure) », it added.

In addition, the local central bank’s recent move – blocking the practice of loading non-bank prepaid payment instruments (PPIs), such as prepaid cards using credit lines, is likely to hurt many startups offering credit card-like offers. The central bank’s other recent move to integrate credit cards with UPI is expected to lead to higher spending on credit cards “but there is limited clarity about the merchant discount rate (MDR) for such payments,” the analyst wrote.