If MicroStrategy invested in Ethereum over Bitcoin, what would its valuation be?

It is a known fact that MicroStrategy’s founder, Michael Saylor, is a Bitcoin supporter. With over 130k BTC, the Business Intelligence firm is currently the largest Bitcoin institutional investor. Interestingly, the company has bought BTC during – both – the bullish and bearish phases of the market.

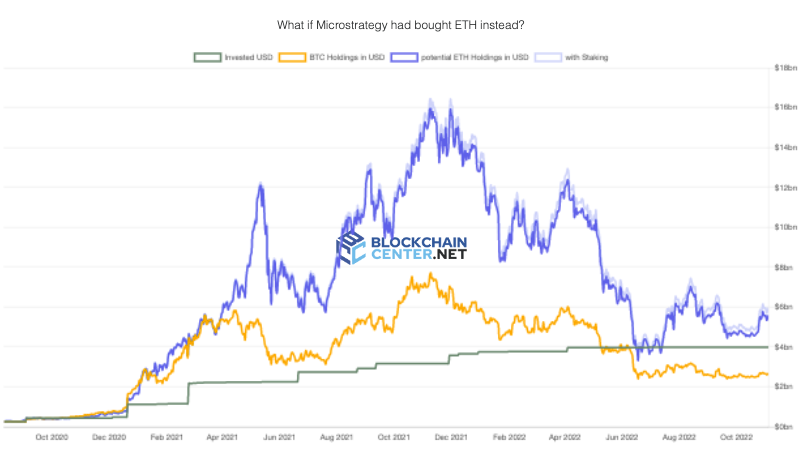

What if MicroStrategy invested in Ethereum instead of Bitcoin?

The Blockchain Center has a dashboard that compares MicroStrategy’s “actual” and “what if” crypto investments. Per data from the same, its current 130k BTC HODLings are currently worth $2.679 billion. However, if it had invested in Ethereum, the firm would own around 3.5 million tokens worth $5.596 billion. The result is that instead of going down by $1.304 billion, MSTR will increase by $1.614 billion with ETH.

On the side, the company could have staked ETH to earn another 240,000 tokens now worth $370 million. In fact, if Saylor traded his BTC holdings for ETH now and bet, he could still have 1.7 million ETH and make $134 million a year betting. Per Blockchain Centre, MicroStrategy has never had so much operating income.

Conventionally, investors avoid putting all their eggs in one basket and choose to diversify their assets to better manage risk. However, Saylor has never been a fan of said theory. Commenting on his school of thought in relation to diversification, the MicroStrategy executive said last November,

“When you build a building and you stand out on a steel beam, you’re not diversifying the steel beam. Steel is metallic energy, it’s a higher form of metallic energy than iron, which is a higher form of metallic energy than bronze…If someone came along and said, ‘Let’s diversify the skyscraper with some balsa wood and some clay and some bronze so we’ll be safe’, you’d scream at them.”

In fact, he has also stated several times in the past that there is no second best cryptocurrency. Well, according to the previously highlighted data, MicroStrategy would be in a better position if it chose to divert funds towards Ethereum.

That said, that doesn’t mean MicroStrategy’s decision to invest in Bitcoin was unreasonable. Despite the choppy past 12 months, the biggest crypto asset has delivered on the macro front. In the words of the creator of the dashboard,

“Of course, hindsight is 20/20, and his decision to convert his company’s cash (and more) into Bitcoin could have been (and may still be) the greatest decision ever. But saying “there is no second best crypto asset” is a bit of a stretch if you ask me and the data currently available.“