If bulls lose control here, BTC could revisit $21,000

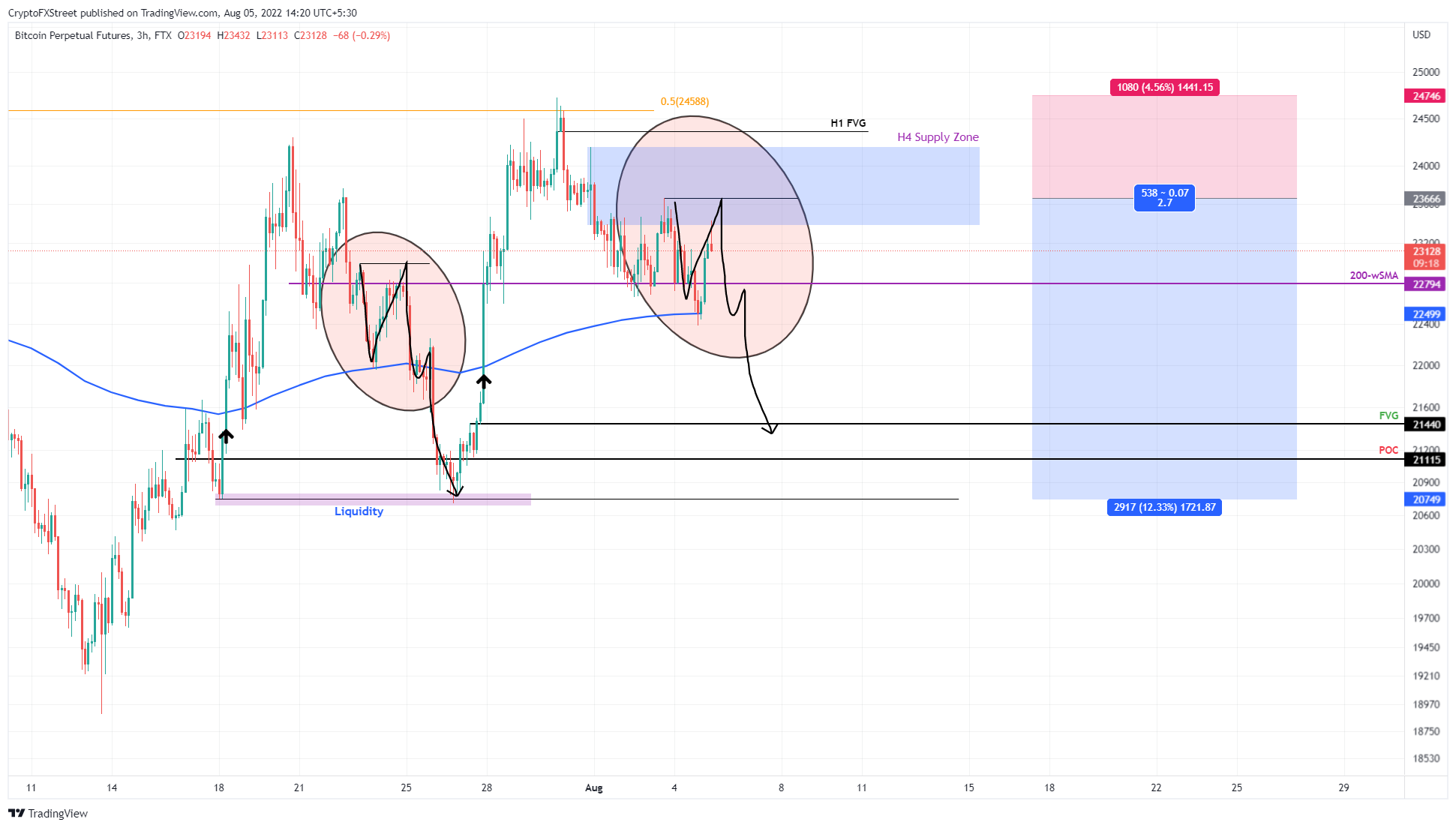

- Bitcoin price is showing a fractal formation on a lower time frame chart, suggesting a potential reversal in the trend.

- This development suggests a re-examination of four-hour price inefficiency at $21,440, which could extend to $21,115.

- A successful reversal of the $24,565 resistance level into a support floor will invalidate the bearish thesis.

The Bitcoin price is showing an interesting setup that could reveal the next move. Upon closer inspection, its technicals support a bearish outlook for the leading crypto.

Crypto’s most important fundamental development

Not everything is negative for the Bitcoin price, however, when investors take into account the fundamental developments that have occurred over the past week. Perhaps the most significant is the entry of BlackRock, the largest asset manager in the world, into the cryptocurrency space via a partnership with a US-based digital asset exchange, Coinbase.

News of this update sent Coinbase stock up more than 10%.

Another notable update is the announcement by the Chicago Mercantile Exchange (CME) of the launch of Bitcoin and Ether Euro futures on August 29.

Despite this fundamental development, the Bitcoin price remained relatively stable for a few hours, but eventually fell below the 200-week Simple Moving Average (SMA) of $22,794 and tested the 30-day Exponential Moving Average (EMA) of $22,499.

Now, however, things look relatively bleak, as this newly developed BTC fractal portends a bearish outlook.

Bitcoin price poised for more pain

Bitcoin price fractal revolves around the 30-day EMA, and the last time BTC pushed above this fractal, it rallied about 13% and set a local high of $24,296. This move was reversed over the next five days as the major crypto tried using the recently reversed 30-day EMA as a support floor.

However, what is interesting is the Bitcoin price action that resulted in a downtrend: it formed a double top pattern as BTC tried to use the 30-day EMA as a crutch to prevent its downtrend.

After a few days of trending below the aforementioned EMA, Bitcoin price has once again broken through the 30-day EMA and rallied 8%, only to be rejected at the 50% retracement level at $24,565. This barrier is the midpoint of the 42% crash between April and June 2022.

Adding credibility to this bearish outlook is the four-hour supply zone, which extends from $23,383 to $24,194. So far, the Bitcoin price has already pierced this level, triggering a potential short setup. However, investors may choose to be patient and wait for a retest of the $23,666 swing high for a double top formation.

BTC/USDT 4-hour chart

Going forward, if BTC formed another double top at $23,666, it would recreate the fractal and herald an incoming crash.

Targets for this setup include the 200-week SMA at $22,749, followed by price inefficiency, also known as the fair value gap at $21,440 and the volume at $21,115.

This barrier is the highest traded level for BTC volume since April 2022. More details can be found in the chart attached below. At POC, market players can expect a massive increase in buying pressure and a battle between buyers and sellers.

This struggle is a common theme across all the rising parallel channel fractals seen since the start of 2022. Therefore, if investors want to short the double top formation at $23.66, they should consider taking profits at $21.115.

BTC/USD 1-Day Chart

Invalidity scenarios for BTC

If investors are on board with the idea of shorting the Bitcoin price, they should also consider scenarios where this task explained above will become invalid.

The first invalidation scenario is for investors with a tight stop-loss, i.e. above the four-hour supply zone upper limit of $23,666. In such cases, if the Bitcoin price decides to test the one-hour FVG of $24,362, the aforementioned stop losses will be hit.

While this may seem bearish, market participants can either set a wider stop-loss or re-enter at $23,666.

The second invalidation scenario is much uglier for bears than it is for bulls, as it involves turning the $24,565 resistance level into a support floor. This development would indicate the resurgence of bullish momentum and invalidate the fractal formation.

In such a case, the market participants must follow the market signals and position themselves accordingly, aka long. This development could see BTC retest the $28,000 to $29,000 levels to form a local top.