If Bitcoin Bulls wants to stick, the cryptocurrency must pass a key level

The stock market enjoys a solid session on Friday as the bulls hope to take a five-day losing streak in the S&P 500.

Help show the way? A risk rally in cryptocurrencies.

When I look at the market, I see it in sections. The S&P 500 is a broad market index, but there are clues elsewhere. Small capital stocks, growth stocks, technology and bitcoin are all sections to be seen in the market to get a sense of where investors are taking risks.

When investors take risks, they can signal a broader rally. Since this applies to bitcoin, the top cryptocurrency is working on its third daily rally in a row.

Bitcoin prices are now up more than 11% from Wednesday’s lowest to today’s highest. But the bulls should take care: the king of crypto is not yet out of the woods.

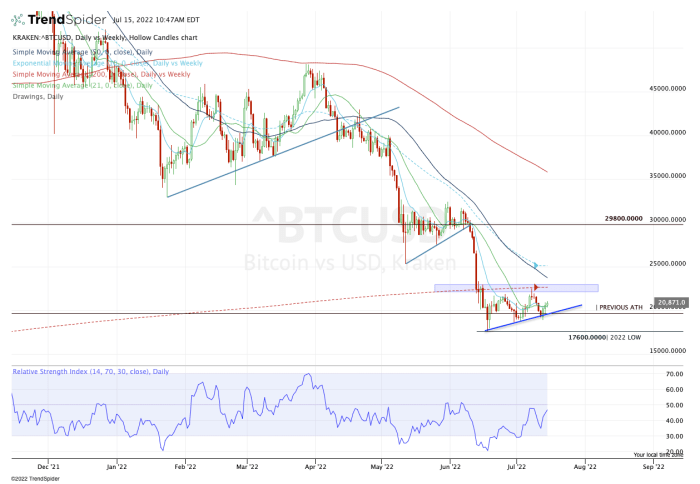

After plunging under key support last month, bitcoin has been strangely quiet when it goes in the $ 3,000 range between $ 18,750 and $ 21,750.

Traders who move in and out of bitcoin must respect areas of support and resistance. If anything is obvious in 2022 – across all assets – it is that the technicalities can help keep investors out of trouble if they back down when the support is gone.

So what does bitcoin need to do to get the bullish party going?

Bitcoin Trading

Scroll to Continue

The previous “blow-off peak” comes into play around $ 19,500, but it has not been much of a factor as bitcoin blew just below this level.

After doing so, it found a low of $ 17,600 and has posted higher lows since. That said, resistance around $ 22,500 has come in. For the bulls to enjoy an expanded rally, bitcoin must regain this level.

And a number of key measures come into play at or just above this level. Between $ 22,500 and $ 25,000, there are 200-week, 10-week and 50-day moving averages.

On the plus side, bitcoin sets a number of higher lows and trades above the 10-day and 21-day moving averages.

From here, it has to push into the $ 22,500 range. If it can handle $ 25,000, it could clear the way up to the $ 29,800 to $ 30,000 plus zone.

A word of warning: See trend support (blue line). If this level is lost, it puts $ 18,750 back into play. A breach of this level opens the door back to the low point in 2022.

If you need a reminder of what happens when uptrend support breaks in the middle of a major general downtrend, just look at the previous examples in the charts.

The $ 40,000 break opened the door down to $ 26,000 and the $ 30,000 break put $ 18,000 at stake.

Remember that.