Hut 8 Stock: Even More Questions Now (NASDAQ:HUT)

bernardbodo/iStock via Getty Images

It’s been a little over a month since my first public coverage of Hut 8 Mining (NASDAQ:HUT). Since then, we have learned of a very large fundamental catalyst following the recently announced merger agreement with the US Bitcoin Corp. I’m not convinced that this is actually a good deal for HUT shareholders. There are a number of reasons for that perception, and I will highlight my main issues shortly.

Merger details

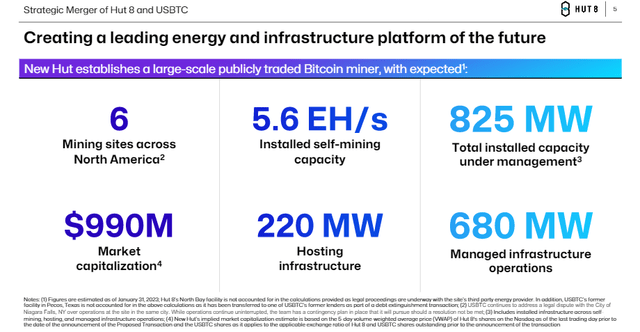

However, assuming the merger is completed, this deal will increase Hut’s mining EH/s to 5.6. That would more than double the 2.7 EH/s the company revealed in late January — and this apparently doesn’t include the currently offline North Bay facility in that capacity estimate:

Cabin 8

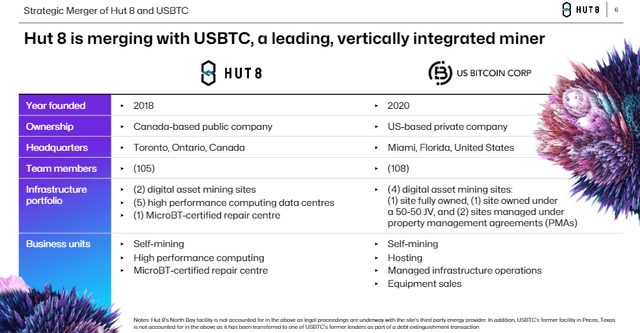

According to the announcement deck, US Bitcoin Corp brings in 4 new mining sites, hosting revenue, equipment revenue and “managed infrastructure.”

cottage 8

On paper, it’s an interesting combination, but there’s quite a bit of key information that we simply don’t know. And when such big things happen and we don’t know key information, I tend to be cautious rather than euphoric.

What we know

The Treasury HODL days are over for now as the company has stated that it will use Bitcoin (BTC-USD) to fund its operations before this merger closes:

In the interim period, we plan to cover our operating costs through a combination of selling the Bitcoin we mine, selling from our stack and/or exploring various debt options, as agreed in accordance with the terms of the business combination agreement. Upon successful completion of the transaction, we will take the opportunity to carefully review and determine our secondary financial strategy

Upon completion of mergers, “New Hut” shareholders will split equity 50/50 between current HUT shareholders and US Bitcoin Corp shareholders. Hut 8’s management estimated a market value of $990 million after the merger, but I think that makes a lot of assumptions that are potentially difficult to justify from the outside. As part of the deal, there will be a reverse split of the current HUT. shares on a 5 to 1 basis.

From where I sit, this means that unless US Bitcoin Corp can truly be valued at the same level as HUT 8 is today, current HUT shareholders appear to be getting diluted in a roundabout way. I take that view because I don’t think we can assume that the market will value new HUT shares at the individual unit price necessary to keep current HUT investors whole post-merger and post-split. That brings us to what we don’t know.

What we don’t know

We honestly have no idea what the correct valuation for “New Hut” should be after the merger because we have no idea what US Bitcoin Corp’s balance sheet looks like. The answers weren’t really given by Hut 8 CEO Jamie Leverton to questions about post-merger balance during the company’s merger announcement webinar. But I think we can reasonably infer that US Bitcoin Corp is financially distressed just by looking at the important details of the announcement’s press release. For example, US Bitcoin Corp has essentially lost a facility in Texas to a lender according to a notation in the announcement:

Hytte 8’s North Bay facility is not included in the calculations provided as legal proceedings are ongoing with the site’s third-party energy supplier. Additionally, USBTC’s former facility in Pecos, Texas is not included in the above calculations as it has been transferred to one of USBTC’s former lenders as part of a debt settlement transaction.

And later in the release:

Pursuant to the Business Combination Agreement, Hut 8 has also agreed to provide USBTC with secured bridge financing in the interim period, with the expected amount of such financing varying from USD 6.0 – USD 6.5 million, subject to completion of final loan documentation.

In addition to US Bitcoin Corp giving up property to satisfy debt obligations, the deal isn’t even done yet, and US Bitcoin Corp is getting money from Hut 8 up front through a bridging loan. I think we can safely assume that US Bitcoin Corp is bringing some financial baggage with that EH/s capacity and probably not much BTC.

More questions now

It was clear that Hut 8 had to do some kind of cash raising to fund its operations going forward. Financing conditions in this credit environment are probably not that good, especially for crypto-related businesses. And it probably made the most sense to sell the stack. However, in order to be able to sell BTC to fund operations, it’s pretty crucial that Hut 8 can top up that treasury HODL before the halving. From the outside, it looks like this is the deal Hut 8 is making because it’s probably the best deal the company can get at the moment.

US Bitcoin Corp apparently needs cash and Hut 8 needs machines if it is to meaningfully scale a Bitcoin mining operation before the halving. What’s a bit disturbing from where I sit is just a month ago it looked like Hut 8 was transitioning to an HPC business. Now we see a doubling of EH/s capacity that will only provide block rewards on par with current levels for an extra year or so after the merger – possibly less.

Investor Takeaway

It feels like management is not sure about the company’s long-term vision, and that’s disturbing. Leverton declined to give a picture of what the business might look like in three years:

we keep trying to make sure we’re skating where the puck is going. So I can’t predict how things will look in three years. But what I can say is that we will continue to do exactly what we have been doing for the last two years, but now with even more strength and scale as a combined company under New Hut.

If you had asked me to explain where Hut 8 would be in 3 years just a few weeks ago I would have told you that Hut will likely be a cloud computing and HPC services business that also mines some Bitcoin. But here we are a little over a month later scaling up EH/s at the expense of the HODL approach. Not knowing how much debt New Hut is about to carry, I sold off about half of “HUT HODL”.

I could certainly get more excited about HUT again if US Bitcoin Corp’s balance is actually not as bad as I expect it probably is. Until then, HUT is still a good trade when BTC goes up and probably a big sell when BTC goes down. Currently, we don’t have enough information to make a big fundamental case for Hut anyway.