How to short Bitcoin with options

(~ BTCUSD) has been in a massive downward spiral after the record in November 2021. The leading cryptocurrency has currently fallen more than 70% since then.

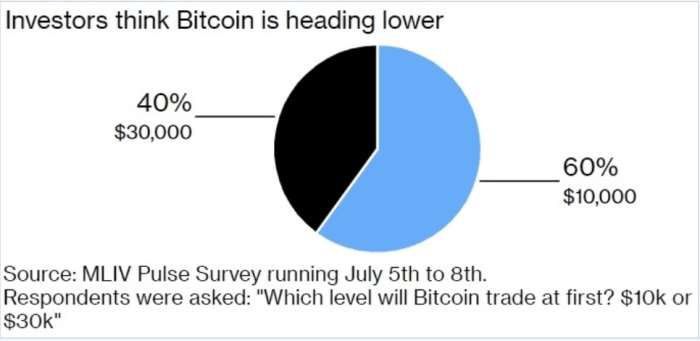

According to a recent survey, the majority of investors believe that there are several disadvantages for BTC in the future.

Investors believe that Bitcoin will probably reach $ 10,000 before it reaches $ 30,000 – an ominous prediction. Survey taken from MLIV.

The last time Bitcoin traded for $ 10,000 was almost two years ago in September 2020.

With the success of Bitcoin Bears throughout 2022, you may be wondering how to join the bearish game.

Three ways to shorten Bitcoin

There are a few different ways to bet against Bitcoin, each with its own pros and cons. Some Bitcoin bears use exchanges such as FTXLedger to buy direct put options on the cryptocurrency itself. However, this direct exposure comes with a price: these types of exchanges suffer from extremely low liquidity, which makes order execution difficult and often expensive.

Another strategy for shorting crypto is to use marginal exchanges like KuCoin to take out short positions with high leverage on Bitcoin – this is a valid alternative, but a very risky one. An increase in an asset class known for its high volatility can lead to the liquidation of your entire portfolio – a fate that even institutional investors are not immune to.

While these short Bitcoin strategies can Be efficient, there is a better way. In our search for bearish Bitcoin strategies, we need look no further than institutional options trading.

How institutions and hedge funds use options to short Bitcoin

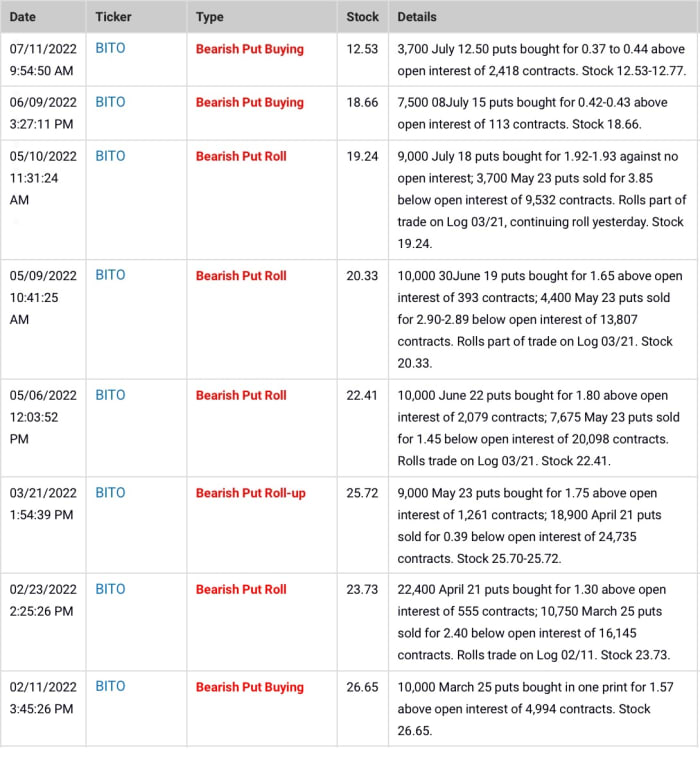

Institutional traders have a clear weapon of choice that they use when they want to be bearish on Bitcoin: Put options on the relatively new ProShares Bitcoin Strategy ETF, BITO.

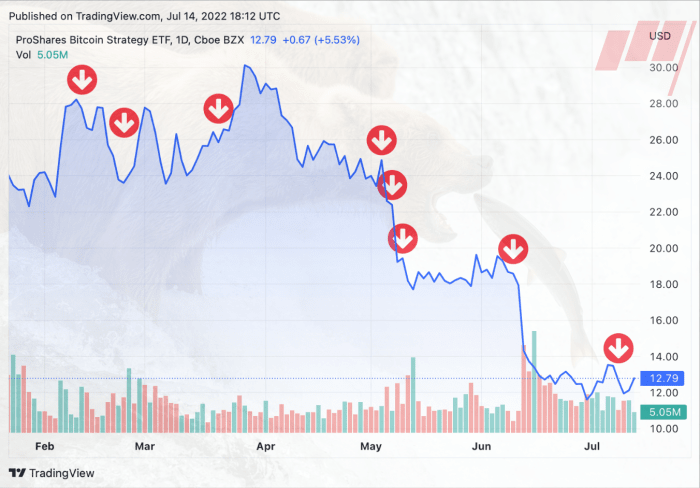

ProShares’ Bitcoin Futures ETF BITO began trading just one month before Bitcoin’s record high in November. Since debuting at $ 41.23, it has fallen 69.2% – to the bears’ satisfaction.

Scroll to Continue

Let’s take a look at how a Bitcoin bear actively managed its BITO put options to make big gains on the ETF when it fell more than 50%.

Starts in February, with (BITO) – Get ProShares Bitcoin Strategy ETF report traded at $ 26.65, this trader spent $ 1.57 million dollars betting that BITO would fall below $ 25. It did. Within two weeks, self-employed rolled These March $ 25 puts to April $ 21 puts, collects a more than 50% gain on the original putts and increases his / her bet to a total cost of $ 2,912M.

Vocab Check

Roll: Sell an option and at the same time buy another option in the same stock with the same skewed direction. May be at a lower strike (rolling down), at a higher strike (rolling up), at a further outlet (rolling out) or at a closer outlet (rolling in).

A month later, the recently rolled trade did not go his / her way – BITO had risen to $ 25.72 from $ 23.73. But instead of cutting the trade, this trader rolled up. They used the sale of thousands of putters, which expire in April, to finance the purchase of 9,000 strike kits with an expiration of $ 23 in May, and called the register on a trade that was now worth $ 1.575 million.

This bold move would set the course for a number of gains.

Ready to start shopping? Try Unusual alternative Activity important. Learn how to follow “smart money” with a fresh UOA trading site every week – including technical levels so you know where to go in and out!

The bearish Bitcoin trader would continue to roll these options three more times in May as the price of BITO fell by more than 20% – collecting profits while maintaining bearish exposure for trading through the early summer months.

Were they finished? Absolutely not. In June, they acquired a new batch of BITO plaster for more than $ 318K, worth $ 0.42- $ 0.43 apiece. Today (one day before expiration) these pillows were traded as high as $ 2.89 – almost 7X the trading amount, and valued the initial bet of $ 318K at a high of $ 2.1675M. This value does not even account for any of the previous bearish Bitcoin option trades. Despite all the profits they have now earned and the ITM expiration of June, they set still are not done – re-engage in new BITO setups again as late as July 11th.

So if you’re wondering if it’s too late to get into the bearish Bitcoin frenzy, it seems that “smart money” doesn’t believe it.

Bottom line: How can you make bearish bets on Bitcoin?

Although there are several methods to get short exposure on Bitcoin, the smartest and most popular method is to use long put options on BITO. And if you want to add an extra advantage to your trade, consider following institutional trades using the Market Rebellion service for unusual options. By watching the flow of institutional option orders, you can emulate the trades and risk management style of major traders like the Bitcoin bear above.