How To Profit From Bitcoin Price Drops: Exclusive Insider Tips

Bitcoins its decentralized nature and the potential for significant returns have attracted countless enthusiasts. Still, as with any investment, risks are associated with the notorious price volatility of Bitcoin. With the right knowledge, strategies and timing, savvy investors can take advantage of this volatility, turning Bitcoin price drops into profitable opportunities.

Various techniques and insider tips can be explored to profit from Bitcoin price drops and improve investment portfolios.

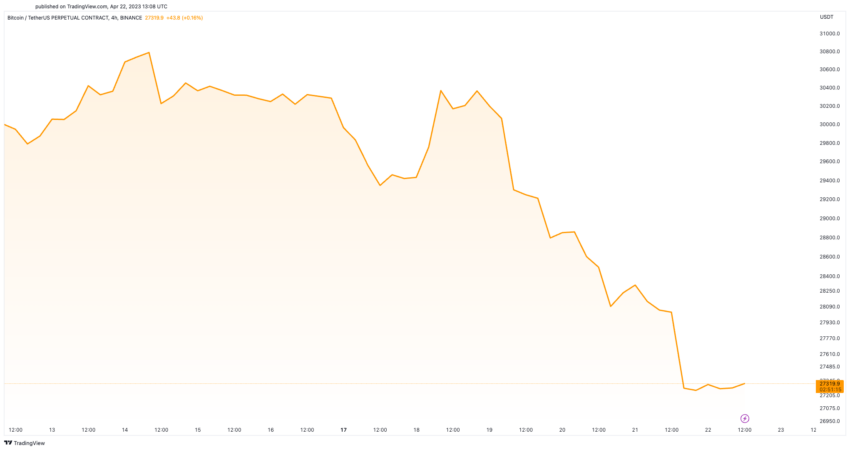

Why Bitcoin Price is Falling

The volatility of Bitcoin prices can be attributed to several factors, each of which plays a crucial role in shaping the market landscape. By understanding these drivers, investors can better anticipate price fluctuations and maximize profits.

- Market sentiment: The collective sentiment of investors and traders can significantly affect Bitcoin’s price. Fear, uncertainty and doubt (FUD) can lead to rapid selling, while optimism and positive news can drive the price up.

- Regulatory changes: Government policies and regulations surrounding crypto can affect Bitcoin’s price. Tighter regulations or negative policy changes can dampen investor confidence, causing Bitcoin prices to fall, while favorable regulations can boost market enthusiasm.

- Technological advances: Innovations and improvements in Bitcoin’s underlying technology and the broader blockchain ecosystem can affect its price. For example, advances that improve transaction speed, security or scalability can bolster investor confidence and drive price. Conversely, vulnerabilities or technological setbacks can cause the price of Bitcoin to fall.

- Macroeconomic trends: Global economic events, such as recessions, financial crises or geopolitical tensions, can affect the price of Bitcoin. In times of economic uncertainty, investors may flock to alternative assets such as Bitcoin, while a stable economic climate may see a decrease in demand, leading to a fall in the price of Bitcoin.

By carefully examining these factors, investors can gain insight into the potential causes of Bitcoin price declines and develop strategies to profit from these fluctuations.

How to Profit from Bitcoin Price Drops

There are several strategies to profit from Bitcoin price drops. Here are some of the most effective:

Buy low and sell high

The simplest strategy is to buy Bitcoin when the price is low and sell it when the price increases. This can be challenging, as it is difficult to predict the exact moment when the price will fall or rise.

Nevertheless, with careful observation and analysis, this strategy can be profitable.

Short Seller

Short selling involves borrowing Bitcoin from a third party, selling it at the current price and buying it back at a lower price to return it to the lender. The difference between the sale and repurchase price is the profit.

This strategy is risky, as the potential for loss is unlimited if the Bitcoin price goes up instead of down.

Trade on margin

Margin trading allows investors to borrow funds from a trading platform to increase their trading position. This leverage can amplify gains when the Bitcoin price falls.

But it also magnifies losses, which makes it important to manage risk carefully.

Trading in derivatives

Derivatives are financial instruments that derive their value from an underlying asset, in this case Bitcoin. Two popular types of derivatives are:

- Futures contracts: These agreements commit the buyer to purchase an asset at a predetermined price and date in the future. Investors can profit by selling a futures contract when they expect the Bitcoin price to fall and buy it back at a lower price.

- Option contracts: Options give the buyer the right, but not the obligation, to buy or sell an asset at a specified price before a specified date. Investors can profit from a price drop by buying put options, which give them the right to sell Bitcoin at a predetermined price.

Cryptocurrency Mining

Cryptocurrency mining is the process of validating transactions and adding them to the blockchain in exchange for a reward in the form of a new Bitcoin.

As the price of Bitcoin falls, mining may become more profitable as the competition and mining difficulty decrease. This strategy requires a significant investment in hardware and ongoing operating costs, but it can provide a steady stream of income.

Lending

Lending involves lending Bitcoin or other cryptocurrencies to borrowers through a lending platform and earning interest on the lent assets. By borrowing Bitcoin during a price drop, investors can earn interest, which can help offset the drop in value.

It is important to carry out thorough research and choose reputable lending platforms to minimize the risk of default or loss.

Arbitrage trading

Arbitrage trading involves exploiting price differences between different exchanges.

When the price of Bitcoin falls, these price deviations can become more pronounced, allowing traders to buy low on one exchange and sell high on another, profiting from the difference.

Investment in ICOs and IEOs

Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) are fundraising methods for new crypto projects. As Bitcoin’s price falls, investors may be more interested in these offerings as they may provide better returns.

However, this strategy comes with high risk as many ICOs and IEOs may not succeed.

Tips for successful Bitcoin trading

To maximize your profits from Bitcoin price drops, follow these tips:

- Keep an eye on the market: Monitor news, social media and market data to predict price movements and make informed decisions.

- Maintain a diverse portfolio: Diversify investments across different cryptos and other asset classes to reduce risk.

- Develop a trading strategy: Create a plan outlining various objectives, risk tolerance and preferred trading techniques.

- Stay informed and up to date: Stay up to date with developments in the crypto industry and continuously improve your knowledge and skills.

- Manage risks and emotions: Set stop-loss orders, avoid over-leveraging and maintain a fair approach to trading.

Sums it all up

Profiting from Bitcoin price drops requires a deep understanding of the market and a disciplined approach to trading.

By using a combination of strategies and continuously learning and adapting, investors can take advantage of the opportunities presented by price fluctuations.

Common questions

Yes, anyone with an understanding of the market and the right strategies can potentially profit from Bitcoin price drops. However, it requires research, skill and discipline.

Yes, short selling is risky, as the potential for loss is unlimited if the price goes up instead of down. It is crucial to manage risk and use stop-loss orders to limit potential losses.

There is no “safest” strategy, as each one comes with its own risks and rewards. However, maintaining a diverse portfolio and managing risk effectively can help reduce losses.

Not necessarily. Some strategies, such as arbitrage trading or buying low and selling high, can be executed with a relatively small amount of capital. However, others, such as mining or margin trading, may require more substantial investment.

Yes, you can profit from price declines by trading derivatives such as futures and options contracts, which do not require owning the underlying asset.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.