How to lend and borrow NFTs

Swell Network is decentralized liquid stake for Ethereum. Enter the ground floor now. 👇

Dear Bankless Nation,

When NFTs took over crypto late last year, almost no one expected it.

Who would have thought that JPEGs of monkeys and pixelated punks would be worth thousands (or millions) of dollars?

Anyway, NFTs are far from being digital memes. There are now billions of dollars in capital in the space.

As a result of this massive influx of capital, people in the NFT sector are not only interested in collecting these NFTs but also in financing them in various ways.

That’s what NFT-Fi (the intersection of NFTs and DeFi) introduces.

William shows us today how to take your first steps into this burgeoning ecosystem, starting with borrowing and lending NFTs.

– Bankless team

Join us for Converge 22Circle’s first annual crypto ecosystem conference, takes place 27-30 September in San Francisco! Featuring extensive demos and developer workshops, plus strong guest speakers including Ethereum’s Vitalik Buterin, Aaves Stani Kulechov, Mary-Catherine Lader of Uniswap Labs, Anatoly Yakovenko of Solana and many more.

Sign up with code Bankless to receive $100 off your ticket!

Bankless Author: William M. PeasterBankless contributor and Metaversal author

One of the hottest areas in DeFi right now is the intersection of DeFi and NFT, also known as NFTfi.

Within this “NFTfi” category, one of the largest sectors is currently the NFT lending and lending arena. This Bankless tactic will show you how to lend and borrow NFTs using the best projects in the field.

There is DeFi, there are NFTs, and then there is NFTfi, where the two fields intersect.

In today’s NFTfi ecosystem, there are already all kinds of categories.

The biggest ones right now are NFT marketplaces and liquidity protocols like OpenSea, LooksRare, Zora, NFTX and Sudoswap. People buy and trade NFT first, right?

Yet there are also NFT derivative projects, NFT infrastructure projects, NFT pricing projects and more. People are exploring the frontiers of NFTs, so each of these sectors is growing rapidly, but the largest NFTfi category outside of marketplaces right now is NFT’s loan and lending protocols.

That said, NFT’s borrowing and lending projects come in different shapes and sizes.

For this tactic, we will walk you through how to use the largest peer-to-peer NFT lending project, NFTfiand the largest peer-to-pool NFT lending project, BendDAO. Let’s dive in!

-

Difficulty: Medium

-

Cost: +💰

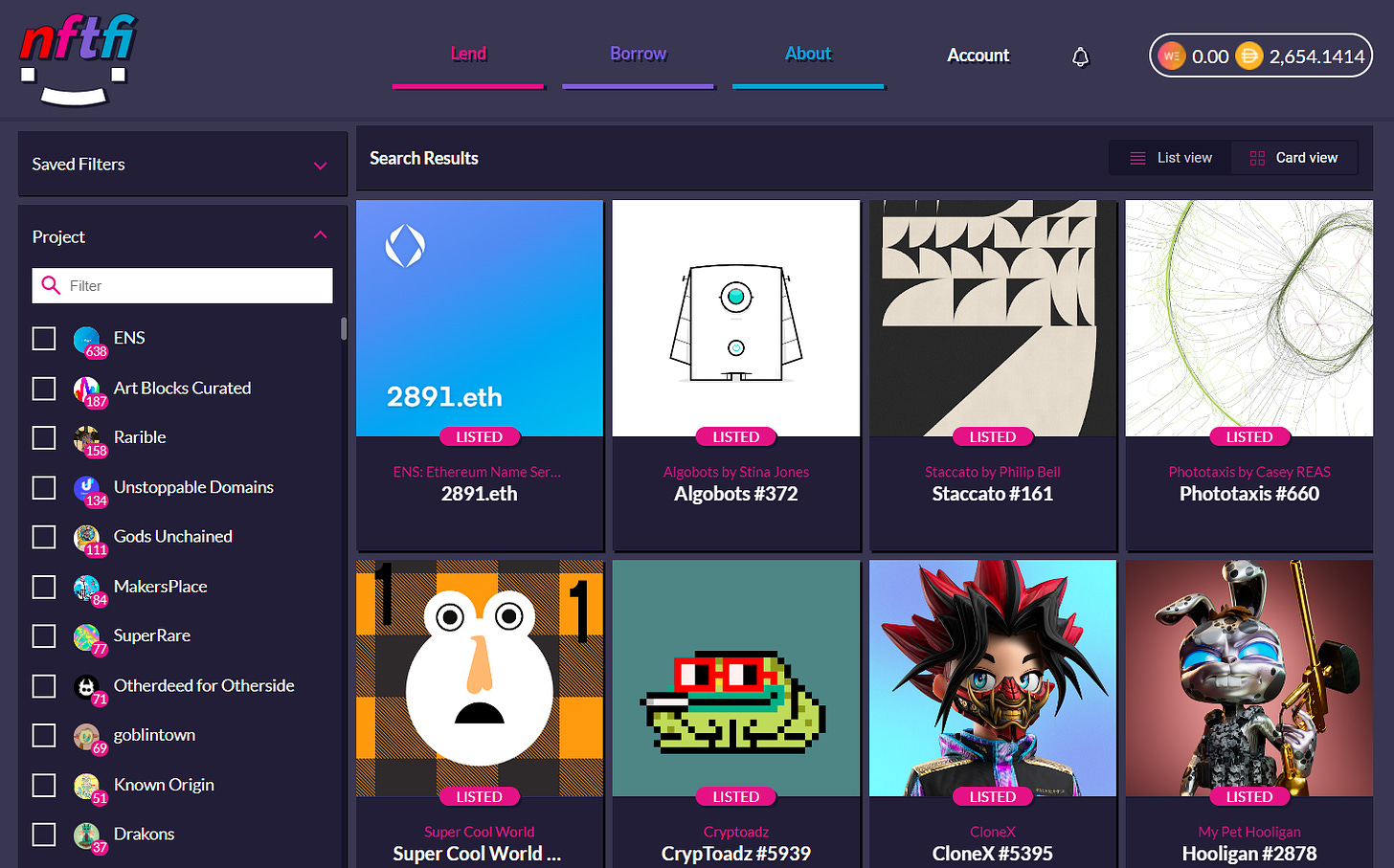

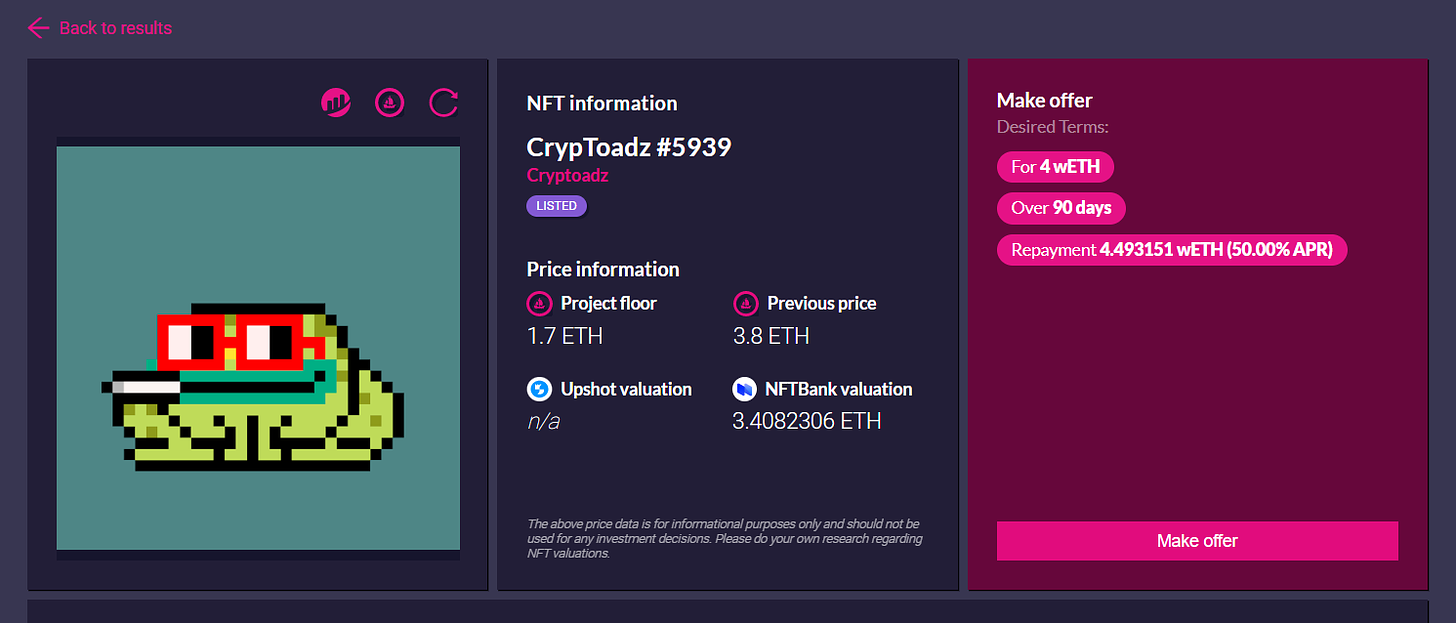

NFTfi is a P2P marketplace for NFT collateral loans.

In other words, this project allows borrowers to submit potential NFT loan parameters, and then crypto borrowers can choose to accept the terms on an individual-to-individual basis.

The advantage of this approach is that it allows you to customize and opt-in to your NFT loan parameters. The downside is that it can take a long time, if ever, to find someone willing to take up the other side of your loan.

-

Go to app.nftfi.com/lend/assets and connect to the wallet

-

Click on an NFT loan proposal that interests you

-

To continue click the “Make Offer” button and choose to accept the borrower’s proposed terms or customize and request your own unique terms (amount, repayment, schedule, etc.)

-

Then click the “Grant” button and use your wallet to authorize NFTfi’s use of your funds (this is a one-time transaction)

-

Then complete the loan offer with the wallet, and voila! Your counterparty has seven days to evaluate your offer before the proposal expires

-

See 3 lending strategies at NFTfi for more information on how to proceed smartly

-

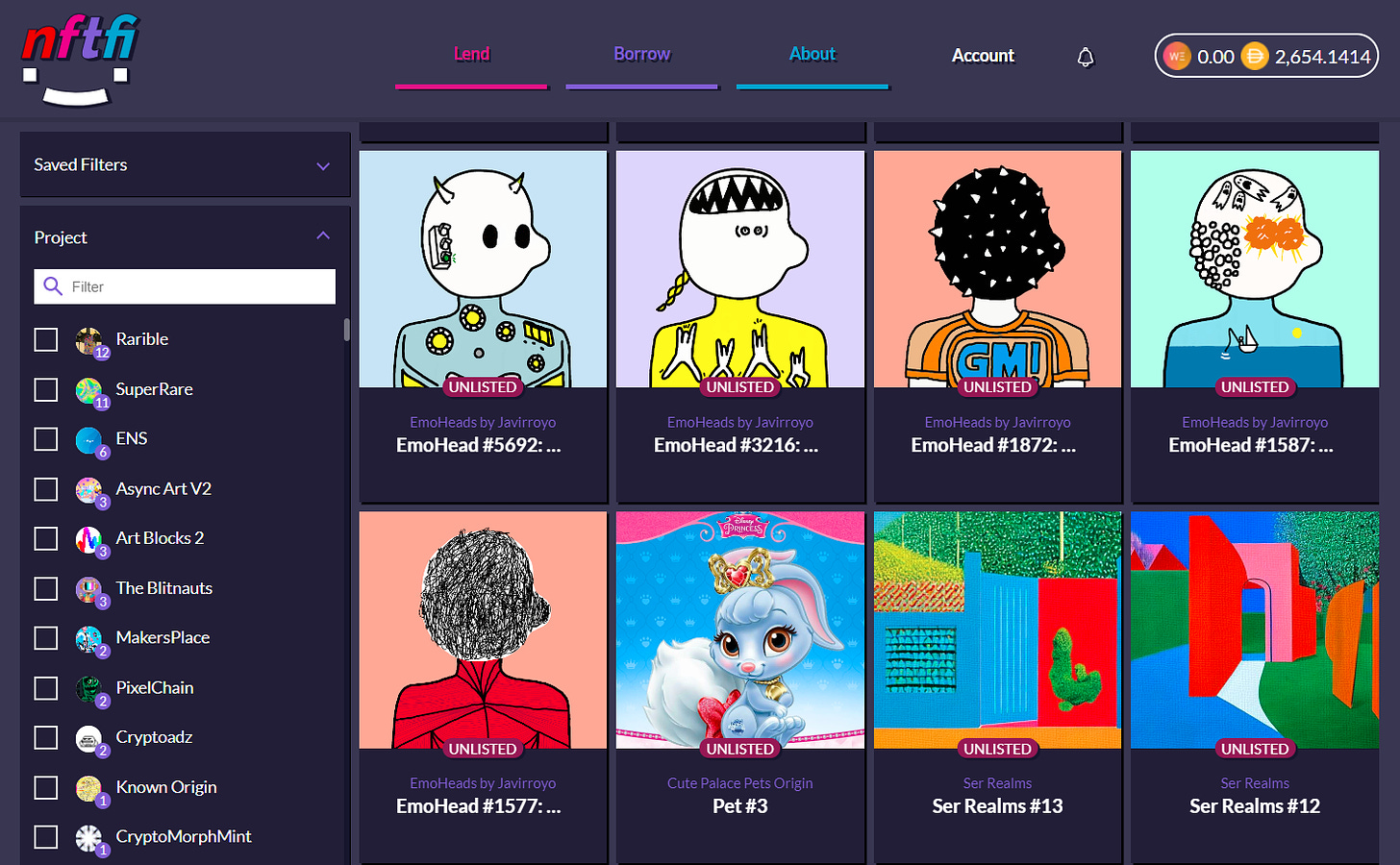

Go to app.nftfi.com/borrow/assets and connect to the wallet

-

Use the provided filters to find the NFT in your wallet that you want to set as collateral

-

Use the subsequent interface to specify the desired loan amount, loan schedule, interest rate, etc.

-

Then use the “List as Security” button to complete the listing

-

Wait to get a bite from a lender who accepts your terms!

-

Difficulty: Medium

-

Cost: 💰💰💰

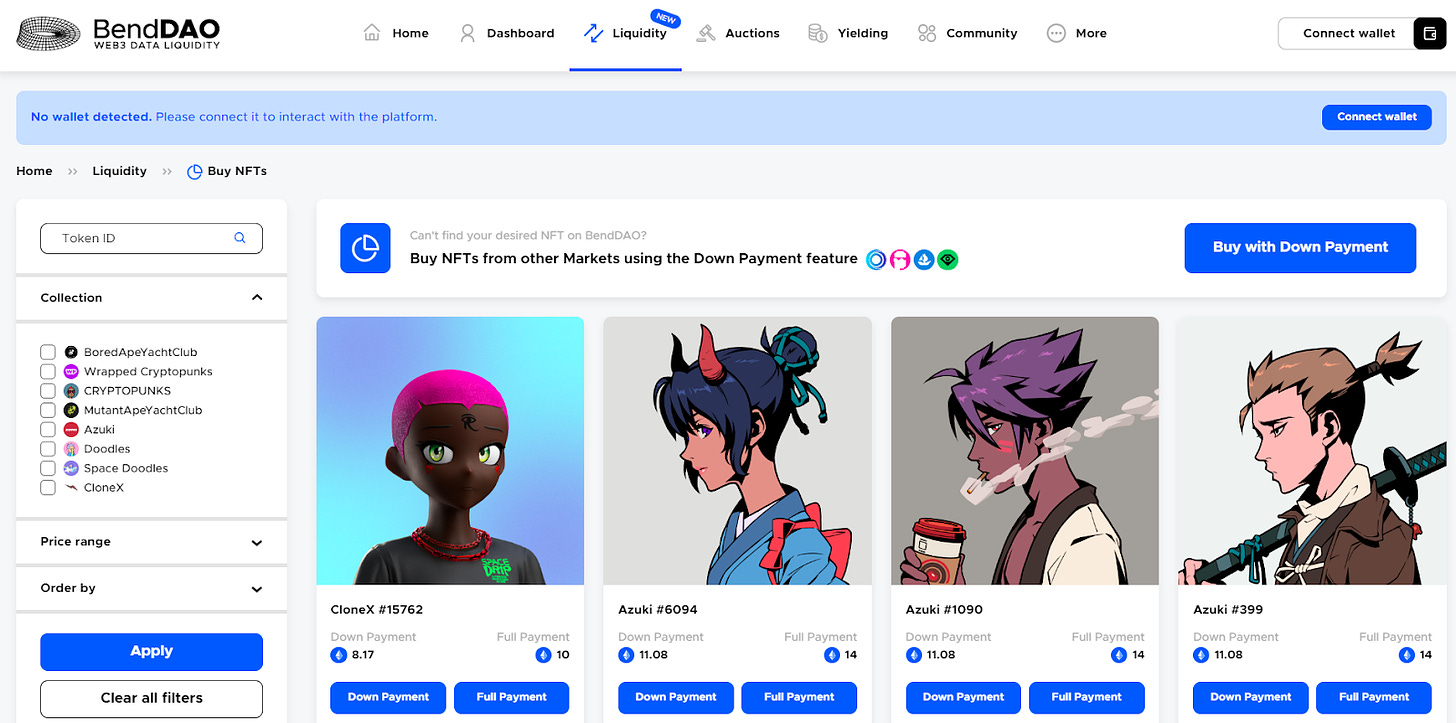

BendDAO is an NFT borrowing and lending protocol that uses a peer-to-pool approach.

In other words, BendDAO depositors give ETH to liquidity pools to earn interest, and then the project’s borrowers can get instant NFT-backed loans through those pools.

-

Go to benddao.xyz and connect to the wallet

-

Sign a transaction to verify your address

-

Click on the “Liquidity” tab and then click on the “Deposit ETH” button

-

Enter the amount of ETH you want to deposit and then press the “Deposit” button

-

Complete the transaction with your wallet and sit back and wait while you earn returns – the current lending rate is 8.5% APR

-

Go to benddao.xyz/liquidity/batch-borrow and connect to the wallet

-

BendDAO currently accepts deposits of Azuki, BAYC, CloneX, CryptoPunks, Doodles and MAYC NFTs – if you have one of these and want to continue, press the “Deposit” NFT button

-

Fire two approval transactions to start, one to approve the debt token and one to approve the NFT

-

Enter the desired loan amount and press “Borrow ETH”

-

You can then pay off the loan as needed through BendDAO’s loan dashboard

When Bitcoin and the first cryptocurrencies appeared, you could send them from address A to address B and so on.

It took the arrival of Ethereum, a smart contract platform, to make digital tokens composable, expressive and able to be used in all sorts of different ways.

We see a similar trajectory from simple to advanced in NFTs. Initially, you could basically only buy and sell NFTs, and while that’s a start, it’s only the beginning of what’s possible.

The emergence of DeFi’s NFTfi sector is starting to pave the way for all kinds of more advanced use cases, such as NFT derivatives, NFT loans, NFT price protocols and more.

Today, NFT lending and lending projects such as NFTfi and BendDAO make it easier for people to get capital against ETH or to earn by delivering ETH against NFT.

These are early pioneers in this field, but in the years to come I expect that we will see many more NFT lending and borrowing protocols coming and that they will become increasingly user-friendly. Familiarizing yourself with this space now can pay dividends going forward.

William M. Peaster is a professional writer and creator of Metaversal– a new Bankless newsletter focused on the rise of NFTs in the crypto-economy. He has also recently contributed content to Bankless, JPG and more!

Subscribe to Bankless. $22 per month. Includes archive access, Inner circle & Divorced.

👉 Join us at Converge22 Circle’s first crypto ecosystem conference. Use code without bank

Want be mentioned on Bankless? Send your article to [email protected]

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Mediation. From time to time I may add links in this newsletter to products I use. I may receive a commission if you purchase through one of these links. In addition, the Bankless writers have crypto assets. See our investment information here.