How to detect NFT wash trading and not get sucked in

Wash trading is not a new word for people in the financial world. You have probably heard from friends that cryptocurrencies are very “washed” and round and round with the same purchase and systematic sale price. Since you are familiar with this term, let me tell you that the NFT market has similar problems with wash trading.

In a nutshell, wash trading makes it difficult for non-fungible token enthusiasts to gauge true market interest in NFT collections. It also inflates and distorts the amount of trading on marketplaces, misleading analysts about what is happening on trading platforms.

Overall, NFT wash trading is one of the biggest obstacles to accurately evaluating projects and assets in the NFT industry, which includes NFT collections, NFT tertiary tokens (think $X2Y2 and $LOOKS) and the studios and developers that bring products to market .

Using the Footprint Analytics dataset to detect and filter laundromats, let’s take a closer look at how laundromats operate and how chain data can be analyzed to detect suspicious activity.

What is laundromat?

Wash trading is a form of market manipulation where an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity on the market.

In the case of NFTs, laundering occurs when the same user is behind both sides of an NFT transaction. This means that both the seller’s and the buyer’s address are actually owned by the same person. Currently, wash trading is very common in NFT markets, which are not subject to government regulation or oversight, unlike traditional securities.

Why do people wash NFTs?

There are two main motives behind laundry trade in the NFT space.

Type 1: To earn platform rewards

Some NFT marketplaces, such as X2Y2, reward active users by giving them returns (in the form of the protocol’s token) based on their trading volume. Wash traders take advantage of this and maximize their rewards by generating unrealistically large amounts of trading volume. This in turn can easily mislead users who want to analyze NFT collections or marketplaces in terms of liquidity and volume.

Type 2: To create an appearance of value or liquidity

In order to create a false sense of liquidity and an inflated value of a specific NFT collection or asset, some unscrupulous creators turn to wash trades to deceive buyers. They profit when genuine buyers are tricked into buying an NFT from them at a high price. This type of laundromat hides its activities with new wallet addresses that are self-funded from central exchange wallets. This type of laundry trade generates a relatively small volume, which is not as disruptive to the market as type 1 laundry trade.

How is the laundry business done?

Due to Type 1 wash trade transactions’ interference on NFT transaction data, Footprint Analytics aimed to filter them out as much as possible. To understand this type of wash trading, we need to understand the token reward system of X2Y2 and LooksRare. Simply put, X2Y2 and LooksRare distribute tokens daily to both sellers and buyers based on the address’s trading volume as part of the marketplace platform’s daily total volume. Token rewards are determined daily, so wash traders can wash trade and earn reward tokens repeatedly when the daily distribution resets.

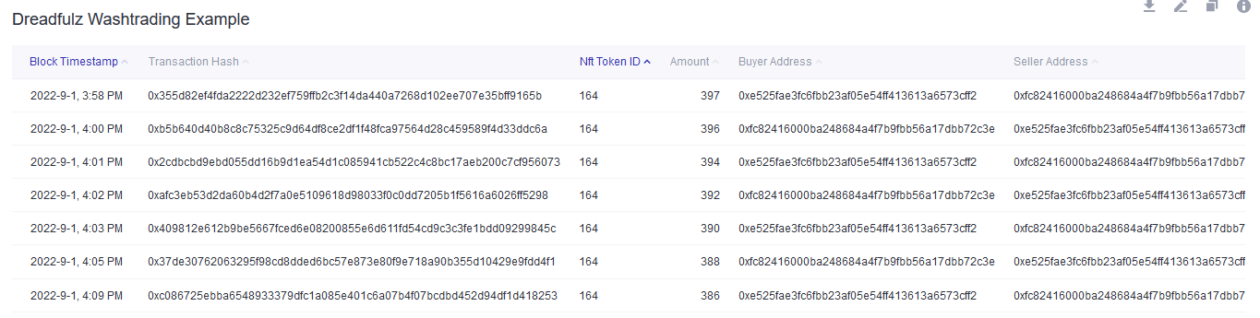

Figure 1 shows an example of laundry trading activities in the X2Y2 market – the NFT collection is Dreadfulz.

As we can see from the figure above, the same NFT (ID 164) was bought back and forth between the same two wallets multiple times in one day with 300+ ETH selling prices per transaction. On September 1, 2022, these two addresses were traded 19 times, generating 7,228 ETH in volume and paying 36.14 ETH in X2Y2 platform fees. Keep in mind that the royalty fee rate for Dreadfulz was not set at X2Y2; therefore, no creator’s fee was paid. Laundry merchants will choose collections with 0% creation fees to minimize their laundry costs.

How to detect laundry trade

I’ve looked at how a few analytics platforms, including Footprint Analytics, do the detection and followed their logic. Their methods are somewhat similar, to be honest. Along with my own knowledge and analysis, here is a checklist of suspicious data and activity that should set off a potential NFT buyer’s alarm bells:

- A particular NFT is traded by the same address more than X times a day while the rest of the collection remains untouched.

- The same address trades with the same NFT in a high-frequency way.

- A collection of NFTs goes into a self-sale in a high-frequency way when there is no marketing or promotion to support the sale.

- The average historical transaction price is X times higher on marketplace A vs. B.

- The sale price of an NFT transaction X times higher than the lowest NFT available for sale.

- The same wallet handles the funding of all suspicious wallets that buy and sell the NFTs.

- An abnormally high trading volume on a constant basis.

The assumptions above are not perfect, and I hope to work with researchers to develop a more comprehensive scorecard to determine NFT trends and behavior more effectively. The ability to track multiple wallets over time to identify different levels of relationships will also be critical.

How washed are the best NFT collections?

In Figure 2, Footprint Analytics applied its detection rules to the collections with the most trading volume on X2Y2 and LooksRare.

Based on their rules, they have discovered that 95% or more of the trading volume of these pools are wash trade transactions. Laundry trade constitutes an extremely high proportion of the trade volume for these collections, which gives a misleading picture of the collections’ historical volume and sales activities. You can review all the transactions they have filtered on the ud_suspicous_txn dataset on their website.

To ensure that their rules are working as intended, Footprint Analytics has applied them to blue chip collections that are not exposed to wash trading activities in Figure 3. You can view the ud_suspicious_txn_bluechip_collections dataset and review the filtered transactions.

Figure 4 indicates that 94.71% and 81.04% of the trading volume on LooksRare and X2Y2 are wash trade transactions, which appears consistent with the marketplace statistics, as shown in Figure 5. We can see from the unfiltered data that the average price per transaction on Looksrare reaches almost USD 85,000, which is around 90 times the average price of OpenSea and unrealistically expensive.

You can view the ud_suspicious_txn_x2_looks dataset and review the filtered transactions for X2Y2 and Looksrare marketplaces, as shown in Figure 4.

Last takeaways

Looking at the monthly trading statistics of the NFT market since January 2022 in Figure 6, we can see that the trading volume of wash accounts for more than 50% of the total volume almost every month. Although the total volume is down significantly from the high in January, the share of wash trading volume in the NFT market remains similar each month. This emphasizes how disruptive wash trading is to having accurate NFT transaction data and the importance of filtering out wash trading for any meaningful NFT data analysis.