How the line between NFTs and GameFi will blur

The NFT ecosystem has become the land of giants, with several large companies and studios dominating the space through consolidation and investment.

The most important forces are undoubtedly Animoca brands and Yuga Labs— Two companies that became prominent in the blockchain industry at the same time, albeit from radically different directions.

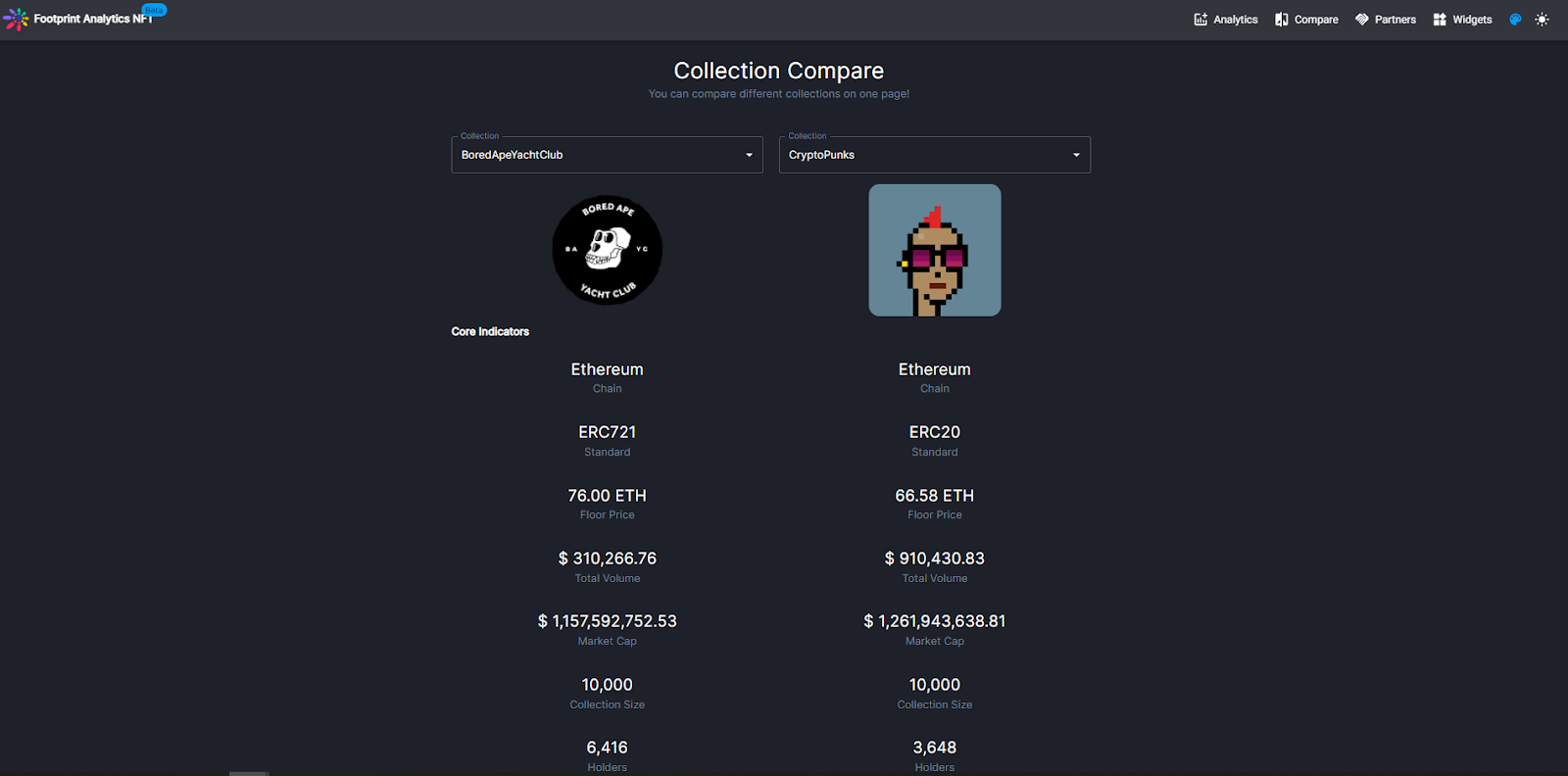

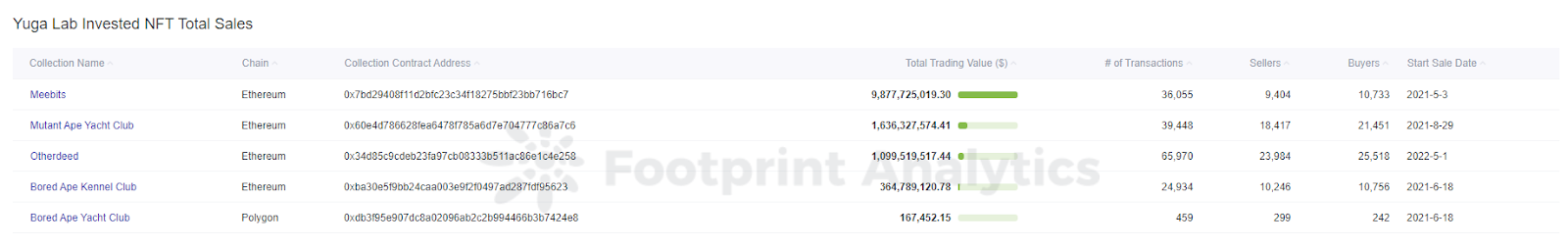

While Animoca Brands and its subsidiaries own several of the most prominent blockchain gaming titles and have investments across the board, Yuga Labs stepped into the spotlight by launching Bored Ape Yacht Club NFT collection. The studio has since acquired the largest NFT collection by Market Cap—CryptoPunks—and founded several other NFT projects.

NFT Collection comparison (Data source: Footprint Analytics)

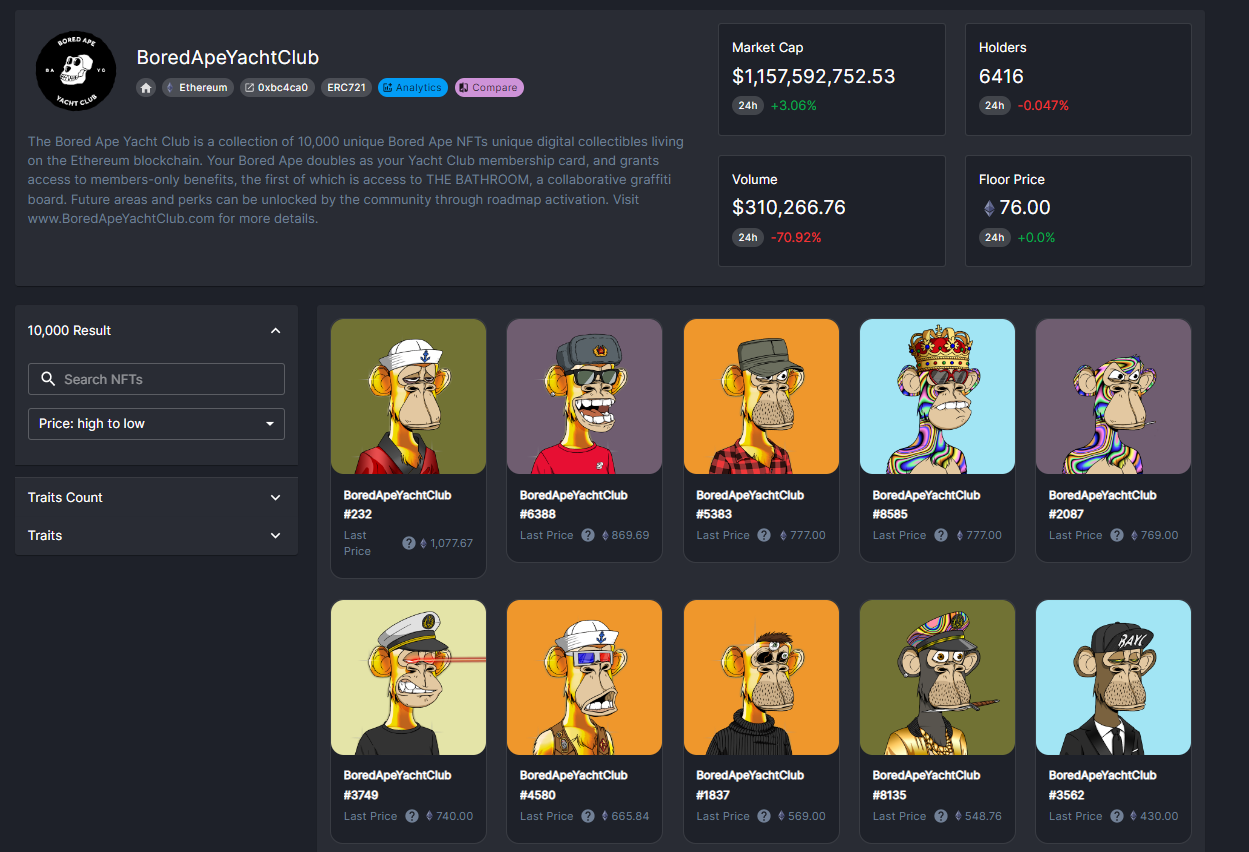

BAYC collection (Data source: Footprint Analytics)

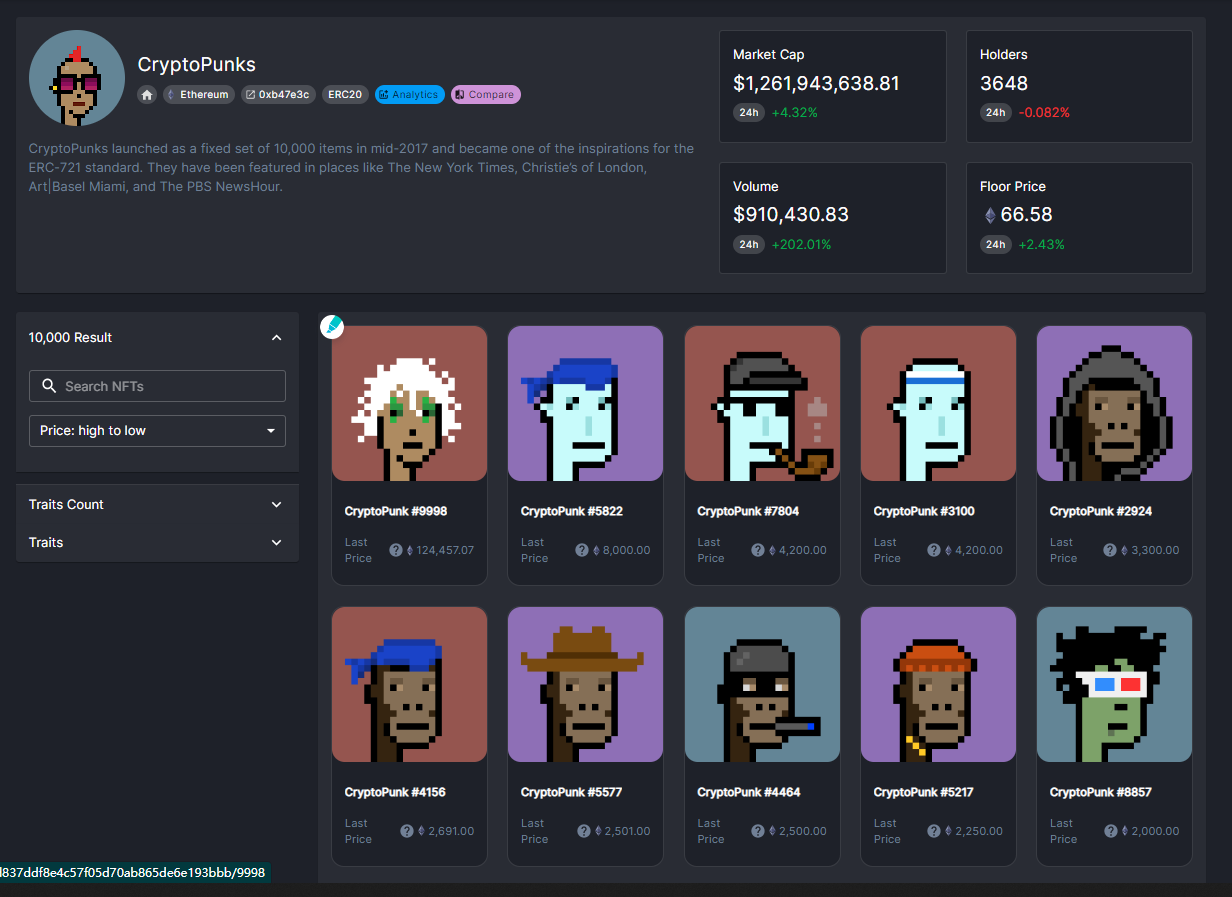

The CryptoPunks Collection (Data source: Footprint Analytics)

These two worlds are now colliding as NFTs are gamified, with huge implications for investors and ordinary crypto-enthusiasts alike.

Using chain data, we can assess the true extent of these giants’ holdings, understand their impact on the industry, and analyze how to make better decisions in anticipation of further collaboration and consolidation from these players.

Who is Animoca Brands?

Animoca Brands used to be a relatively small mobile game developer until 2021, when its flagship product, The sandboxmade waves in the crypto industry during the bull market.

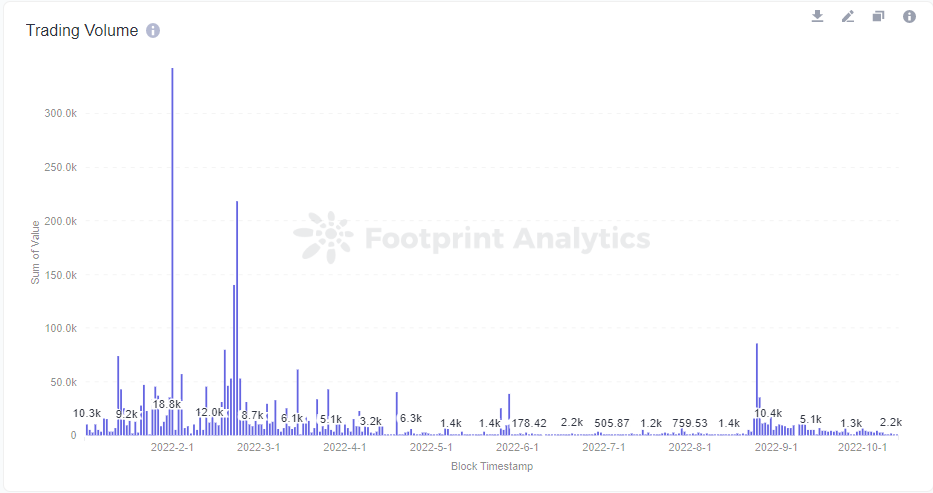

SandBox NFT Trading Volume (Data source: Footprint Analytics)

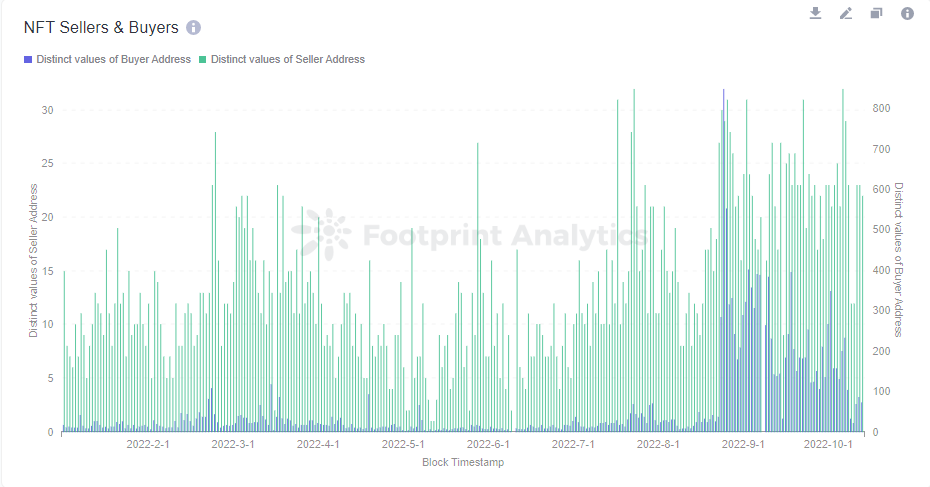

SandBox NFT sellers and buyers (Data source: Footprint Analytics)

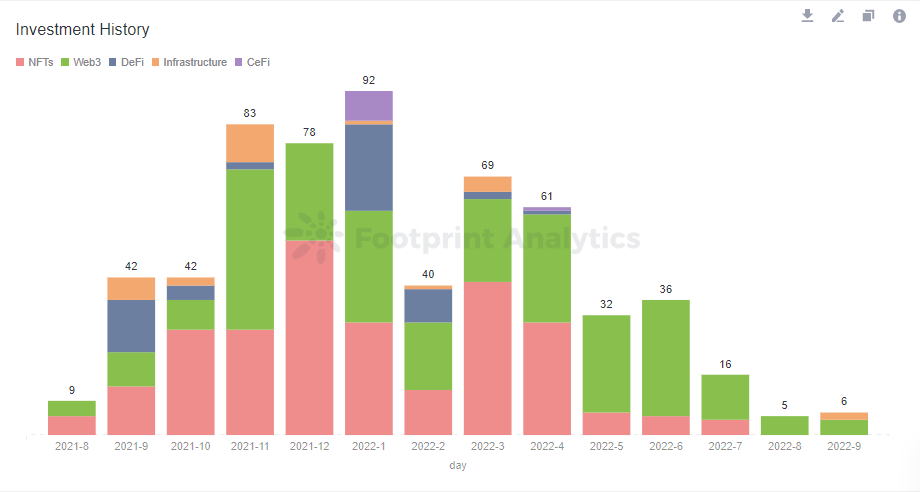

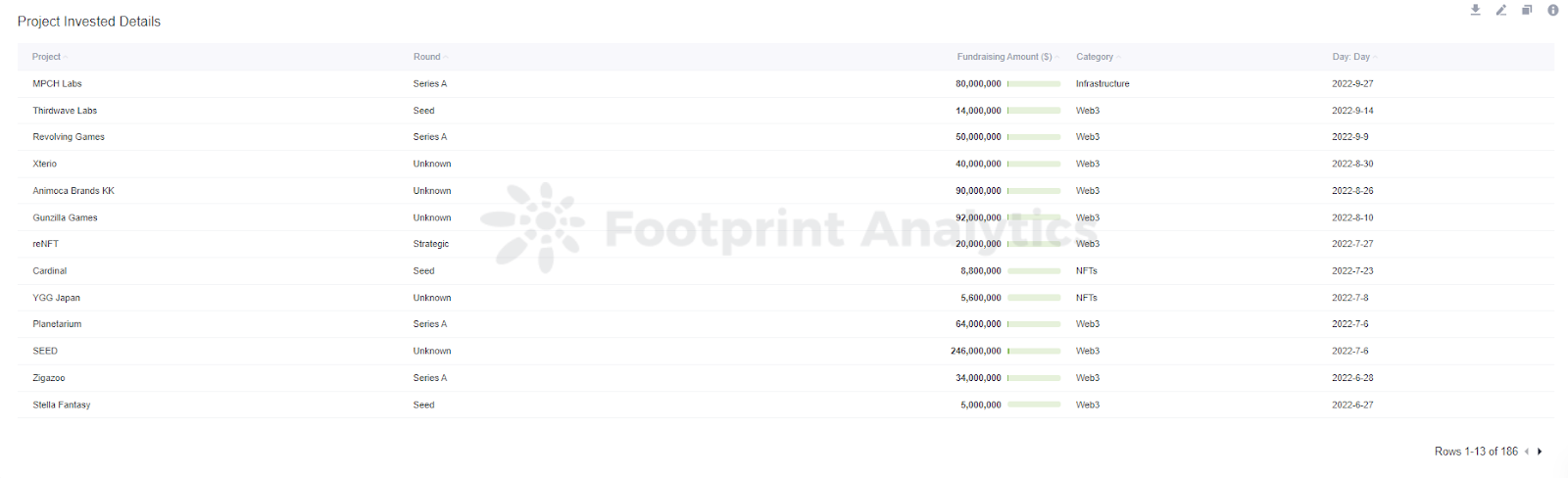

While Animoca has several other notable games in its portfolio, it has become known for its extensive investment in GameFi and NFTs. Since 2021, it has financed almost a hundred projects.

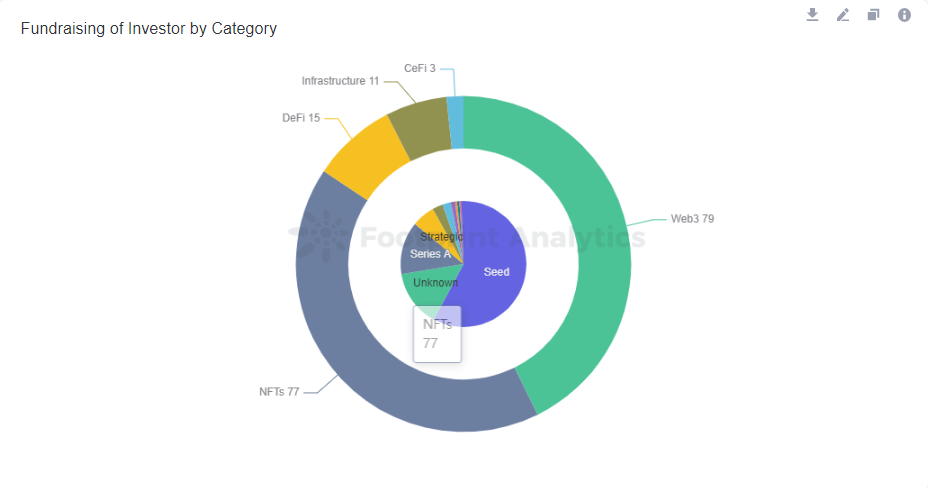

Animoca Brands’ investment by category (data source: Footprint Analytics)

Number of Animoca brands’ investment by category (data source: Footprint Analytics)

Investment history of Animoca Brands (Data source: Footprint Analytics)

Projects they’ve invested in include guilds like YGG and Avocado Games, blockchain games like Mines of Dalarnia and Upland, and broader infrastructure projects like ImmutableX and Atmos.

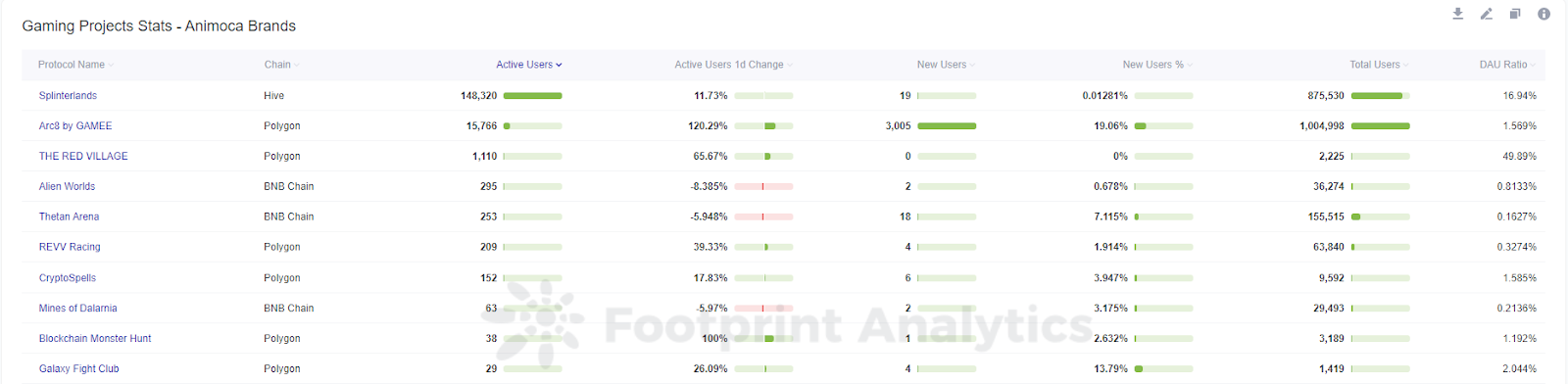

Game Project Statistics – Animoca Brands (Data source: Footprint Analytics)

Animoca Brands’ investments are truly extensive. But in the current bear market, it has become clear that even support from Animoca is a smooth sailing path to growth.

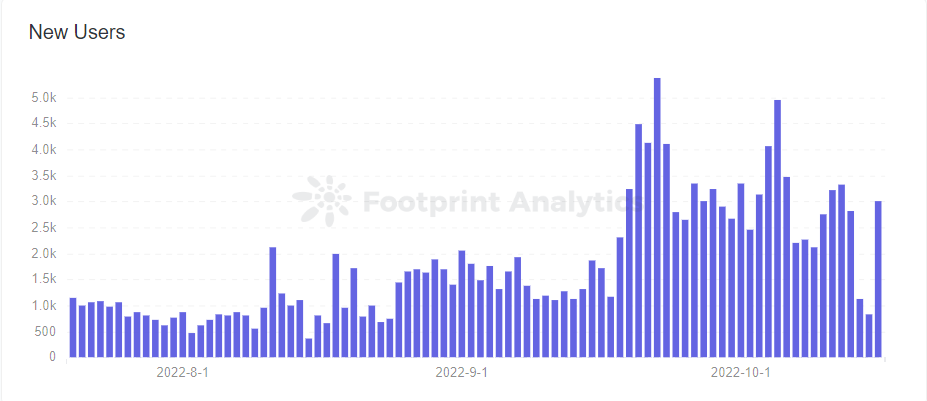

Only 7 of Animoca’s GameFi investment projects have more than 100 daily active users. On the other hand, the company is a significant investor in both of the two most consistently active games in the industry at the moment, Alien Worlds and Splinterlandsas well as one of the fastest growing projects and the largest at Polygon, Arc8.

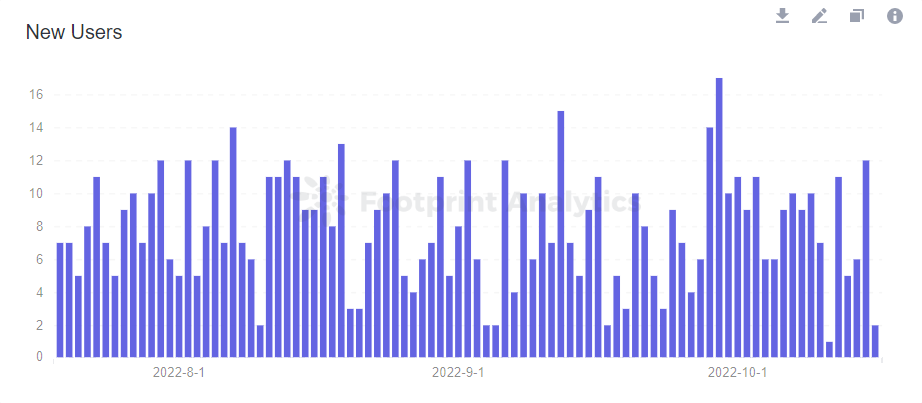

New Users – Alien Worlds

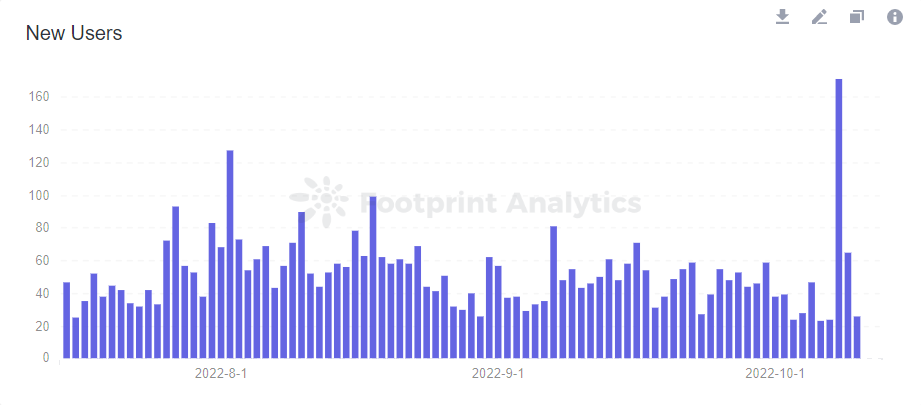

New Users-Splinterlands

New Users-Arc8

The vast majority of games struggling to attract new users as of October 2022.

Top games ranking by new users (Data source: Footprint Analytics)

The data above shows that while Animoca Brands dominates the GameFi industry, GameFi itself risks being trapped in the bubble of existing users – no new blood – without an influx of outside interest.

Until recently, the GameFi and NFT industries have been relatively separate. That’s starting to change, however, and the partnership between Animoca Brands and Yuga Labs could be the catalyst for the next wave of GameFi adoption.

Who is Yuga Labs?

Around the same time Animoca Brands’ The Sandbox gained mainstream attention, Yuga Labs Bored Ape Yacht Club launched the NFT collection.

Launched on April 30, 2021, the price of their first BAYC NFT was 0.08 ETH (then worth about $190). Within 12 hours, the collection was sold out, and celebrities such as Stephen Curry, Gwenyth Paltrow and Post Malone started buying Bored Apes.

Yuga Labs has grown to become one of the biggest names in Web 3.0 by launching a series of spin-off projects—Bored Monkey Kennel Club and Mutant Ape Yacht Club— and acquired the #2 blue-chip collection, CryptoPunks, in March 2022. The company has also launched its token, ApeCoin, and is building its metaverse project, The other sidewhich will integrate its various NFT collections and more.

Yuga Labs portfolio (Data source: Footprint Analytics)

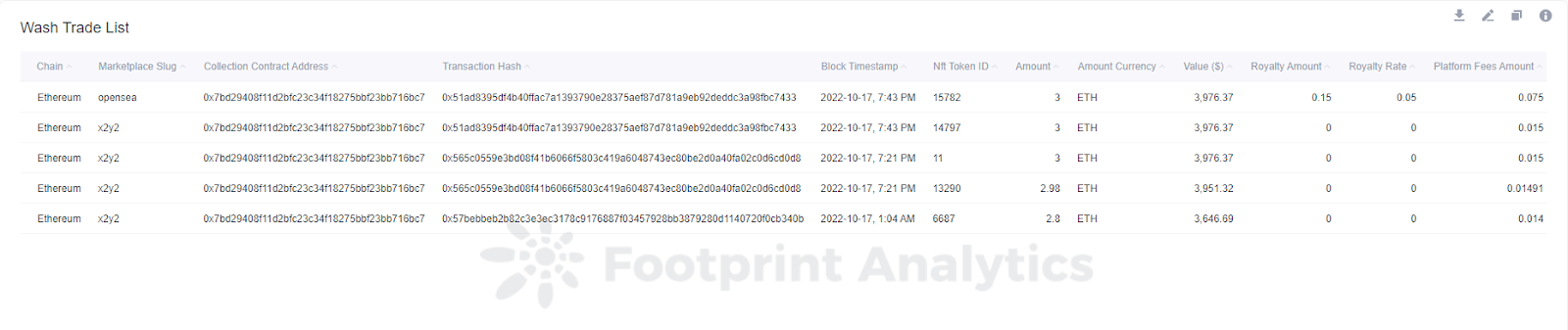

Even the company’s lesser-known projects, Meebitsis performing relatively well, although it is currently full of wash trade.

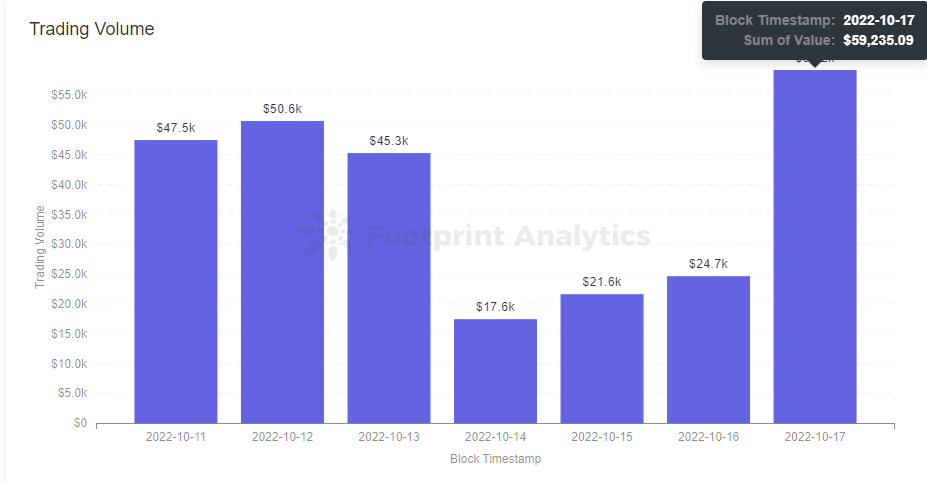

Meebit’s NFT trading volume (Data source: Footprint Analytics)

Meebit’s NFT Wash Trade List (Data source: Footprint Analytics)

Yuga Labs’ many offshoot projects highlight the difficulty of preventing even the best blue chip collections from becoming obsolete. The expansion to the metaverse (with Otherside) is the perfect case study for how NFT studios gamify. Gamification can keep their communities hopeful for the next thing and add value.

NFTs meets GameFi

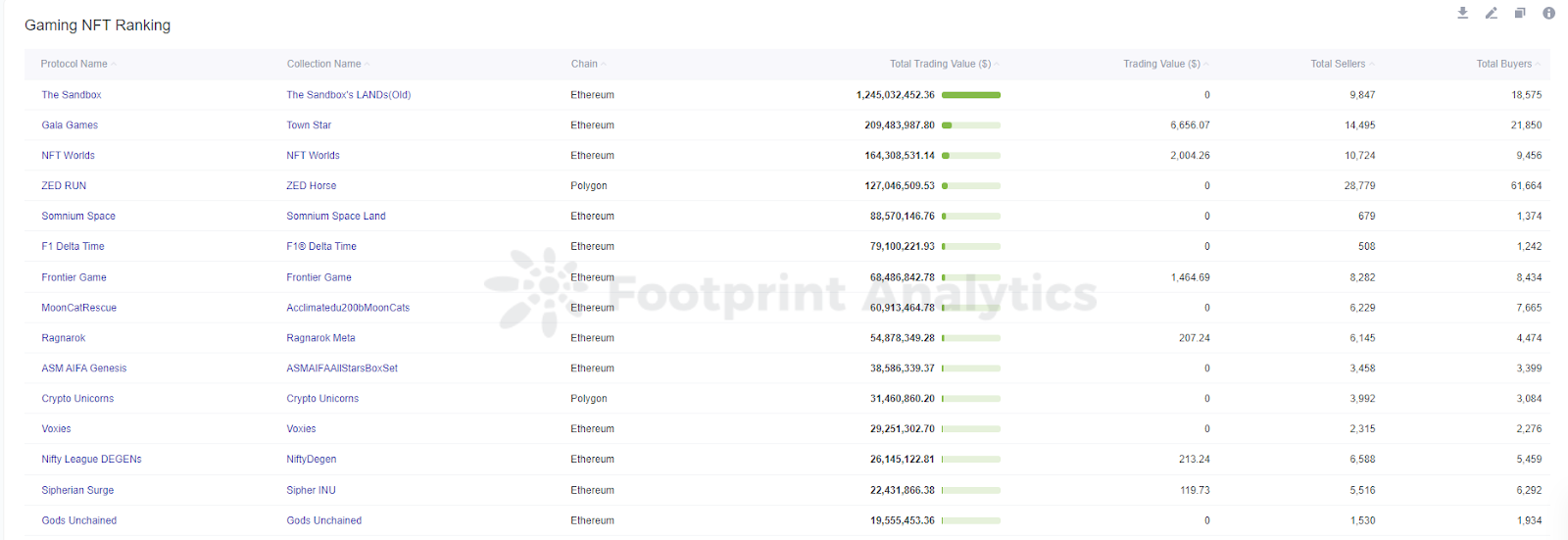

As outlined above, GameFi projects need new users and waves of interest, while NFT studios need to benefit collections. Considering these two factors gamification of NFTs seems inevitable.

Gaming NFT Ranking (Data source: Footprint Analytics)

Will Otherside be the project that turns gamification on its head?

In December 2021, Animoca Brands partnered with Yuga Labs on an undisclosed blockchain game. However, many speculate that this game is actually the Otherside, which would reinforce NFT ownership by creating a world where Apes and other NFT projects – e.g. Women’s world, Cool catsetc. – will interact.

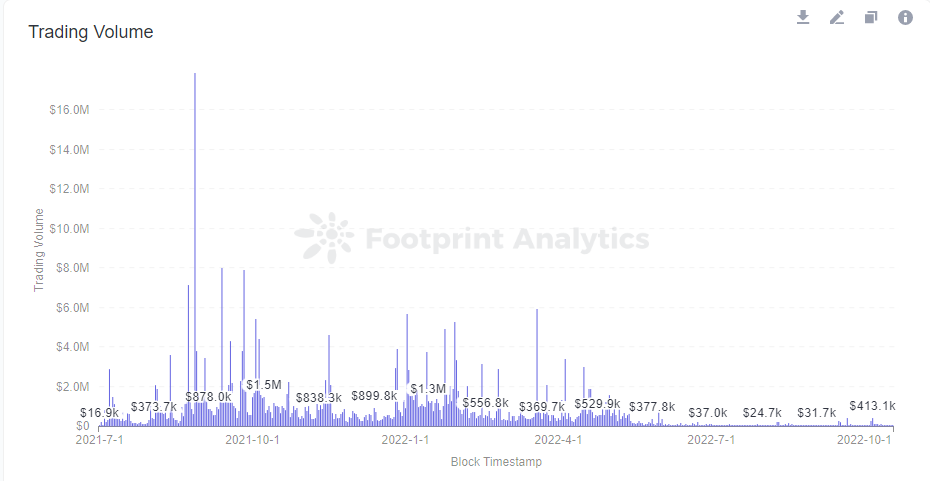

Actually, according to Yuga Labs has released a teaser trailer for Otherside with Cool Cats and Noun NFT last March, the Cool Cats collection saw an increase in trade volume.

Cool cat collection (Data source: Footprint Analytics)

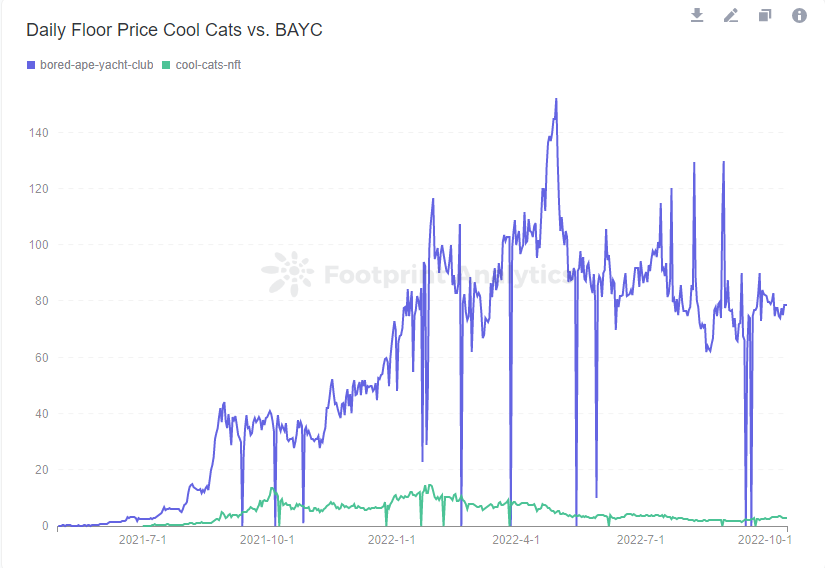

Animoca Brands is a strategic investor in Cool Cats Group, highlighting how NFT ecosystem giants are now sharing crossover value between their products.

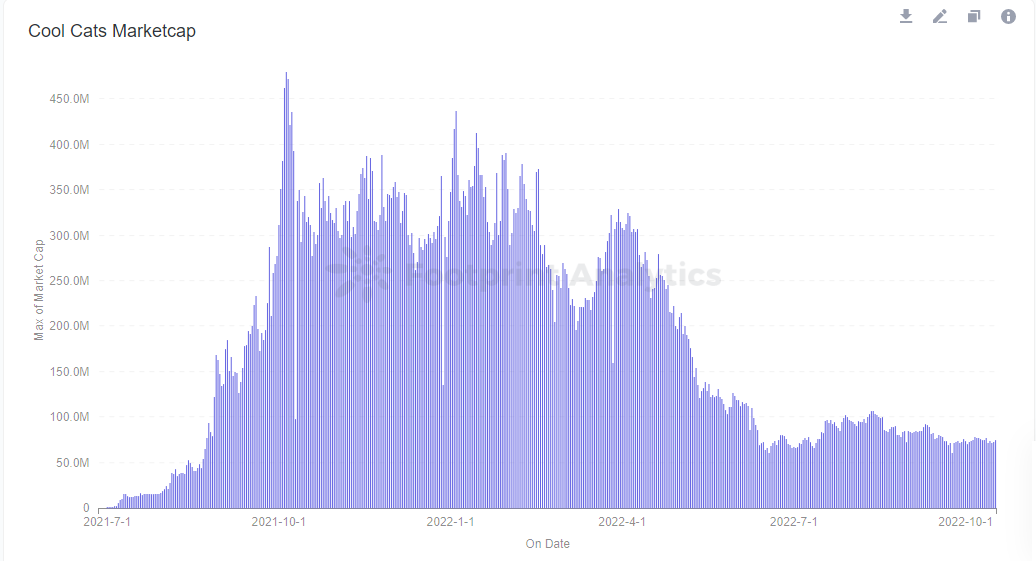

Since March, however, the Cool Cats collection has lost 72 percent of its value. Nevertheless, they are still sitting at a respectable floor price of 2.9 ETH.

Marketcap – Cool Cats Collection (Data source: Footprint Analytics)

Daily floor price – Cool Cats vs. BAYC (Data source: Footprint Analytics)

Summary

By providing utility to popular NFT collections, GameFi developers increase their user base. On the other hand, games can solve the utility problem for studios – a mutually beneficial relationship.

The first to reap the benefits of this trend will be participants in the best blue chip ecosystems, namely the Yugaverse. However, as the number of collections and blockchain games expands, we can expect collaborations between medium and small developers and studios creating metaverse NFT gamification.

This seismic shift is one of the reasons why Footprint Analytics is building out analytics capabilities that combine the GameFi and NFT domains. For example, as it will become impossible to assess GameFi projects or NFTs in their own bubbles, Footprint Analytics is building a wallet tracker that gives analysts the full picture of an NFT game holder. Which NFT resources are most useful to players in the context of a particular game? What percentage of NFT Collection X also plays Blockchain Game Y? This type of question will become more relevant.

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

October 2022

Author: [email protected]

Source: Animoca Brands & Yuga Labs

Footprint website:

Disagreement:

Disclaimer: Views and opinions expressed by the author should not be considered financial advice. We do not provide advice on financial products.