How One Fintech Startup Wants to Fight Money Laundering

PRESS RELEASE

Published May 2, 2023

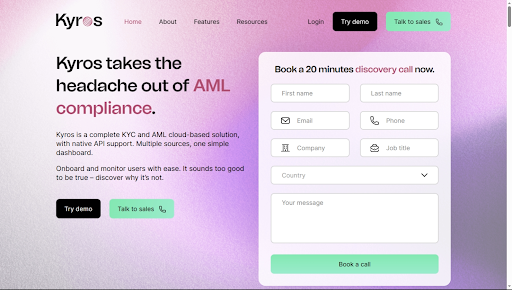

Fintech startup Kyros introduces a complete cloud-based anti-money laundering and financial crime solution with AI analytics and third-party sources, simplifying the process of on-boarding and monitoring clients for regulatory compliance.

Kyros AML Data Suite, a fintech startup, has developed a comprehensive cloud-based solution to combat money laundering, fraud and other financial crimes. By offering a complete Know Your Customer (KYC) and Anti-Money Laundering (AML) dashboard solution, Kyros aims to simplify the complex process of onboarding and monitoring customers while ensuring regulatory compliance.

With support for more than 200 countries, Kyros works seamlessly with one’s existing website, back office or CRM system. Kyros retrieves basic user information and transaction logs via API or manual upload, which is then analyzed and enriched with additional information from premium third-party sources, including international PEP and sanctions lists.

The platform also provides an opportunity to integrate Kyros-hosted self-declaration forms into one’s onboarding flow. This allows businesses to trigger strong customer authentication (SCA) on demand via SMS and email, document users’ identities and answer relevant AML compliance questions.

Kyros’ AI further analyzes the enriched data and automatically risk scores users based on individual risk parameters that are controlled. With live transaction monitoring of all transactions, companies can set up advanced notification rules for user behavior and transaction data, such as triggering EDD based on transaction limits.

All compliance work is performed in the cloud-based Kyros Data Suite, which logs all compliance actions for easy third-party auditing. Businesses can create automatic in-depth reports for easy Suspicious Activity Reporting (SAR) and Suspicious Transaction Report (STR), which can be exported to PDF and uploaded to the relevant financial authority.

Kyros Data Suite can be used alone or as an integrated part of the back office, with seamless data exchange back and forth. API webhooks allow for automated decision making in the back office, making the entire process more efficient and streamlined.

Kyros’ innovative approach to combating money laundering is a game-changer for the financial industry. With a single dashboard, Kyros provides multiple sources of information to make the process of onboarding and monitoring customers simple and straightforward. By integrating artificial intelligence and premium third-party sources, Kyros ensures regulatory compliance while reducing the risk of financial crime.

In conclusion, Kyros’ complete KYC and AML cloud-based solution, with built-in API support, effectively combats money laundering and other financial crimes. Its innovative approach, seamless integration and user-friendly dashboard make it an attractive solution for financial institutions of all sizes.

To learn more, visit www.kyrosaml.com

Media contact

Company name: Kyros AML Data Suite

Contact person: Erik Andersen

Email: Send email

Country: Estonia

Website: