How many investors suffer mid-2022?

Bitcoin traded at $35,000 early this year and experienced multiple crashes almost every month. BTC’s price halved in June after it plunged to $18,000, dragging the entire crypto market down with it. Leading cryptos are down more than 65% from their all-time highs and lost all the profits they generated last year. However, despite the markets rumbling, a majority of investors appear to be unaffected by the crash.

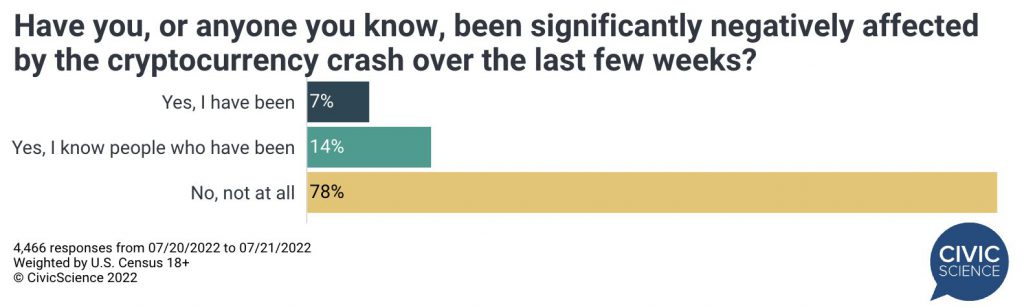

A recent survey published by Civic Science indicates that the majority of investors are unaffected by the market crash despite top cryptocurrencies losing most of their value.

Also Read: Bitcoin Reaching $100,000 Is A Matter Of Time: Bloomberg Analyst

The survey highlights that 78% of holders had no negative impact during the market crash and continued with life as usual. Only 7% of investors said the market crash had an impact on their lives and finances. Also, 14% of investors revealed that they know people whose lives were affected due to the market plunging.

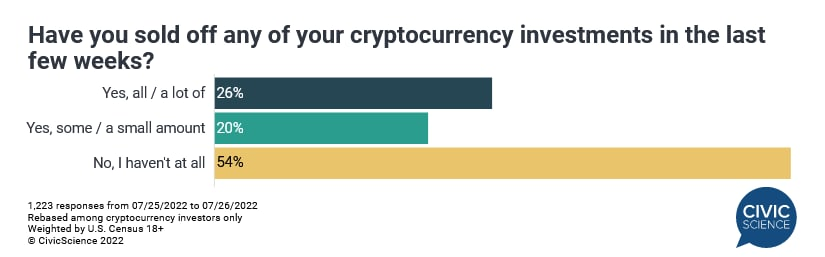

The survey also highlighted that the majority of investors held on to their cryptos during the crash and did not exit. 54% of respondents said they did not sell their cryptos despite heavy losses and are holding them for the long term.

20% of respondents revealed that they sold some of their cryptos during the market turmoil and held onto the rest. However, 26% of investors stated that they sold all their cryptos and jumped ship after they were unable to sail through the crash.

Also read: Shiba Inu’s bones double in price: break $1 from $0.50 in 30 days

When Will Bitcoin and Crypto Markets Rise?

Bitcoin and the rest of the crypto markets rallied last month after trading on the backside early this year. Still, the markets seem to be losing their grip this month and started trading in the red yesterday. Bitcoin and Ethereum have lost almost 5%, causing the rest of the altcoins to fall.

A rally may not be on the cards, as the economy has yet to emerge from the inflation crisis. Although gas prices have seen a reduction this month, they are still $2 higher than in January of this year. A recent survey revealed that 58% of Americans are living paycheck to paycheck after inflation rises. Even 30% of Americans earning $250,000 per year or more live paycheck to paycheck, the report revealed.

Also Read: Ethereum Prediction: Here’s the Downside Target for ETH

All these developments are hampering the market’s growth, and a bull run does not seem to be anywhere on the horizon. At press time, Bitcoin was trading at $22,934 and is down 4.4% in 24-hour trading. The leading crypto is also down 66.8% from its all-time high of $69,044, which it reached last November.