How Lightning Could Enable Decentralization – Bitcoin Magazine

This is an opinion editorial by Kishin Kato, the founder of Trustless Services KK, a Japanese company that mainly focuses on the research and development of the Lightning Network.

This is the third article based on the contents of the “Understanding Lightning” report produced by the Diamond Hands community, the largest Lightning Network community in Japan. The report aims to provide an overview of Lightning’s technology and ecosystem for a non-technical audience. The first article can be found here, the second can be found here.

Previous articles in this series have covered how the Lightning Network excels in terms of payment usage and the opportunities it currently enables. While retail payments and international transfers are extremely powerful use cases for Lightning on its own, much more is possible.

In this article, we’ll explore some advanced use cases that Lightning may enable in the near future, with a particular focus on enabling various application use cases.

Enabling Peer-To-Peer Finance

Compared to other payment technologies, one of the defining characteristics of the Lightning Network is its peer-to-peer architecture. While it’s important to recognize that not everyone will realistically want to run their own Lightning node, setting up and running one for personal use is already relatively easy and straightforward, and we can expect that best practices for businesses running Lightning nodes will become more established in the coming years. Ultimately, these factors will enable the delivery of simple and complex financial services on a peer-to-peer basis over the Lightning Network.

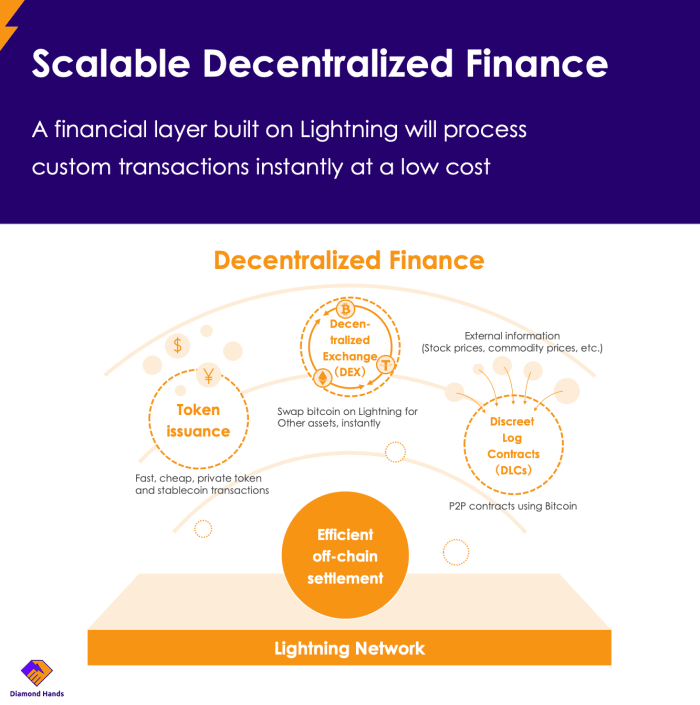

While the limitations of Bitcoin Script prevent the enforcement of on-chain contracts using global consensus rules, the Lightning channel state is managed locally between the relevant peers, allowing the exploration of various custom state management protocols. Solutions such as DLCs aim to achieve privacy and on-chain settlement of contracts for differences that rely on ignorant oracles, and similar contracts can be recreated on Lightning channels, enabling trust-minimized peer-to-peer trades, at least between peers sharing a channel.

The trade-off space that can be explored is even greater if the relationship between these peers is such that compromises can be made regarding enforcement in the chain, for example if distrust is overkill and being able to prove fraud is sufficient. Such channels can handle concepts such as credit, settlements on other blockchains or databases, and more.

Credit-based channels already exist in a limited capacity, commonly known as host channels, and are already being used to provide banking services such as fiat-denominated Lightning channels (a delicate topic for another day). In theory, even exchange accounts can be represented as a hosted channel! Such constructs give us the flexibility to explore economic use cases and user experiences Todayespecially where the service provided in any case requires custody and trust.

In addition to the opportunities that customized government management of individual channels can provide, this peer-to-peer financing limits systemic risk for the network. If a credit-based channel provider is insolvent, the credit-based channels with users may be affected, but other channels in the network will not be (provided they are not dependent on this provider behind the scenes). In particular, regular Lightning channels are completely immune, as they are completely secured and permissionless.

Finally, we also see projects experimenting with token issuance schemes that enable transfers over Lightning. In my opinion, the advantages of this approach over others are unclear at best, as most tokens are based on the provision of services by a centralized party, and therefore may be better served by a centralized database or hub-and-spoke model. Nevertheless, there seems to be interest in developing tokens on Lightning, which could result in some useful innovations.

Payments on a more decentralized web

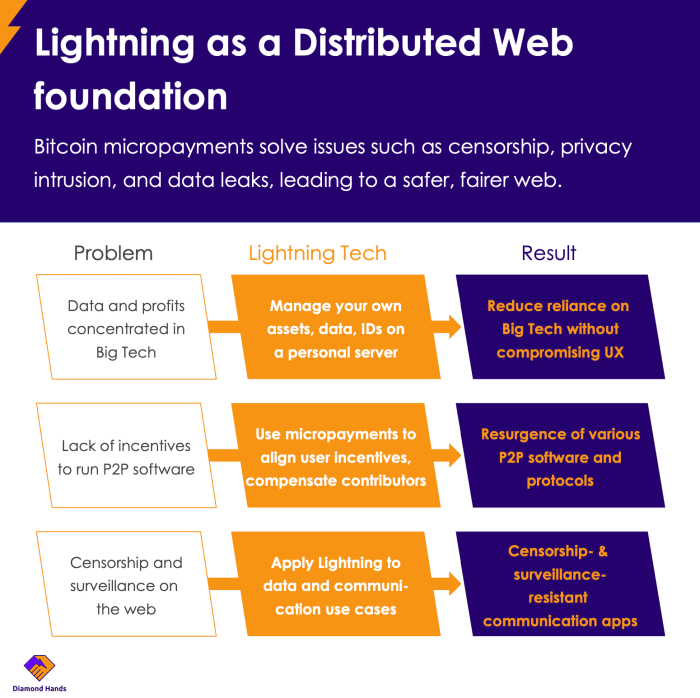

As a payment technology, it is important to consider which pain points the Lightning Network is well positioned to solve. Given recent events, one answer is becoming clearer and clearer: Lightning enables payments that resist censorship and deplatforming.

In fact, the Web5 concept announced by Jack Dorsey’s Project TBD is focused on building a decentralized application platform that aims to free users and developers from the stranglehold of large technology platforms and payment processors by separating the concerns of identity, data storage, authentication and app distribution.

While Web5 itself does not require the use of Lightning or bitcoin, it is obvious that a web where users run servers to selectively deliver data to applications has a strong synergy with Lightning (even if most choose not to run their own servers/nodes !) . While not representative of the general public by any means, Lightning enthusiasts run thousands of nodes, thanks in part to the efforts of projects like Umbrel, RaspiBlitz, and many more node leaders.

In fact, since Lightning Payments is technologically an atomic trade between a pre-allocated information (preimage) and bitcoin, it is particularly suitable for payments for information, whether it is paid content, data acquisition or key material. There are already lapps (Lightning-powered apps) that explore some of these use cases.

Of course, even if efforts to decentralize the web application environment including Web5 never take off – perhaps the majority of users and developers will eventually prefer the walled gardens offered by Big Tech even with their drawbacks – the value of a politically neutral, censorship-resistant and easily verifiable money cannot underestimated, as the trend of politicizing money continues. Even traditional full-custodial apps can benefit from interoperability with other apps that integrate Lightning deposits and withdrawals, as covered in previous articles in this series.

Summary

The Lightning Network has enormous potential beyond just being a scalability solution for Bitcoin payments. Since anyone can participate in the network without permission, a diverse ecosystem of peer-to-peer financial service providers operating over vanilla and custom Lightning channels can exist. Furthermore, if the market really sees value in application platforms that resist capture by Big Tech and large payment processors, the Lightning Network has features that make it well suited for regular and contingent payments in such a context.

The road to mass adoption is long and not guaranteed, with countless obstacles to overcome. Still, with the network constantly growing and developer interest increasing, the Lightning Network is poised to become an interesting testing ground for peer-to-peer applications and finance.

This is a guest post by Kishin Kato. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC, Inc. or Bitcoin Magazine.