How FinTech Companies Can Grow on Social Media in 2023

Social media apps have become lucrative marketing channels in recent years. If done right, a brand can catapult their business and have a massive return using Instagram, Linkedin and other social media apps. According to GWI’s audience research company, 49% of internet users say they are likely to buy from brands they see advertised on social media.

Here, we’ll take a look at FinTech companies that are thriving on Instagram and other social media apps, and some tips to skyrocket brand awareness and engagement.

How can FinTech companies grow on social media?

Focusing on exposure rather than engagement is a basic rule to follow for social media marketing, but most FinTech companies do not follow this rule. That’s not to demonize the idea of promoting products and announcing business updates through social media, rather than getting the most out of each app.

Most social media apps like Instagram are all about presentation. One mistake companies make is to bombard users with their products. Instead, successful brands take an interactive approach to engaging users rather than becoming a constant sales pitch – which can quickly backfire.

We can see this with Click Through Rate (CTR), an important metric that allows businesses to see how much people are viewing your content. Several FinTech firms on social media have tens of thousands of followers but little or no interaction in their content.

To put this into perspective, the average CTR is between 1% to 2% for an account across social media, and anything above 2% is considered above average. This means that a FinTech company with 10,000 followers can collect between 200 – 500 interactions on their posts, be it likes, reactions, comments, shares, etc.

Don’t be afraid to use humor to deliver a serious message

Social media’s meme culture allows businesses to add some humor to their posts, and users are more likely to interact with this type of content.

Instead of presenting a product, service or promoting an event directly, using memes is a powerful tool to connect with your audience, increase awareness and brand engagement, and also put your brand on people’s minds.

We can take Takeprofit Tech as an example of mixing an important message with humor:

Takeprofit Tech is a FinTech company that provides forex brokers, liquidity providers and exchanges with risk management and liquidity aggregation solutions.

While most finance and FinTech firms prefer to take a more professional tone of voice (TOV) on LinkedIn, Takeprofit Tech and other firms like to spin things up a bit to engage their audience. This strategy allows them to stand out and build more brand awareness.

Use different formats on social media

Companies that play with different types of formats on Instagram and other apps can engage a company’s audience to a great extent.

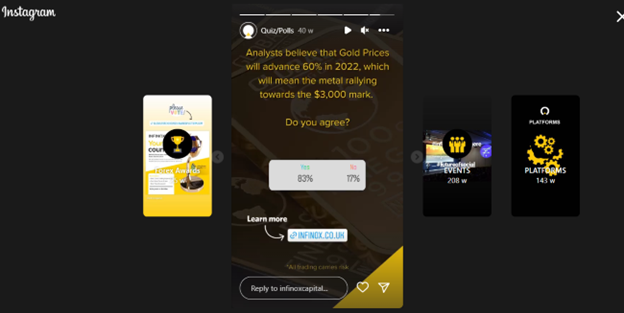

Polls are a fundamental tool that can engage users in social media apps, especially on LinkedIn and Twitter. They’re especially popular on Instagram Stories and Twitter’s News Feed, allowing users to respond with minimal effort. Also, since these apps show the number of users who have voted, other users scrolling down your feed or browsing your featured stories are more likely to respond to your poll.

A good example of this is INFINOX Capital, a London-based broker regulated by the Financial Conduct Authority.

Taking a look at their Instagram feed, we see that they have an established color palette; black, yellow and white, and an organized feed, mixed with different types of formats: jpegs, reels, videos and polls.

This is an important aspect to consider – sticking with a single format can bore an audience in the long run. The problem, it seems, is that FinTech companies are afraid to let their creativity flourish or outsource their product to freelancers who don’t understand it thoroughly. A proper full-time social media manager is the best way to go as they will take the time to download your app and respond to customer inquiries at short notice.

Use short format content

TikTok is another social media platform that can skyrocket a FinTech firm’s popularity. The business model is simple but powerful – engaging users with tons of creative short-format content, and it provides a wide range of features to create this content: filters and effects, duets, video editing, hashtags, analytics and more.

TikTok is also popular due to the amount of influencers and celebrities on the platform. This is a great tool for FinTech firms as they can partner with them to reach hundreds of thousands and even millions of users. Competition with prizes and gifts during live broadcasts is also the way to go.

Don’t be afraid to innovate

That’s not to say that companies should post memes, short-form videos, polls, or post controversial or unrelated content on social media all the time to attract users; it’s about innovating and playing with the cards and rules they’re dealt.

Let’s take Zopa as an example, a money management app in the UK that offers investors an easy way to borrow online and earn an average return of 3.2%.

Topics related to finance and technology are usually complex for most people. But Zopa takes educational content to another level by breaking down topics using cartoon style, where banks, coins and other instruments and devices interact with each other in a fun yet educational way.

Talk about popular trends and provide market insights

Your audience wants to know what’s happening with the latest news in the market. A good way to engage users is to create a weekly or monthly newsletter that summarizes the latest market movements and provides valuable insights from the analysts or top executives.

Another way to go is to post 1- to 2-minute videos on social media accounts, like Match-Prime Liquidity does. Videos are more direct and provide wider engagement, as users can comment and share their thoughts with you.

Final Thoughts: FinTech Firms on Social Media

Not many FinTech companies do well on social media. Only a few have succeeded thanks to their innovative and community-oriented approaches rather than constantly shoving products and services down the public’s throat. Only those who are willing to take risks can make the best of social media. Easier said than done, of course, but many FinTech firms do not allow their creativity and ideas to fully develop.

Image by Pixelkult from Pixabay