How decentralized is Bitcoin? (Cryptocurrency: BTC-USD)

Andrii Yalanskyi / iStock via Getty Images

Thesis

Bitcoin (BTC-USD) is decentralized enough that a 51% attack that can come from a lack of decentralization is not a realistic threat outside of major black swan events. Bitcoin, however, is not completely untrustworthy, as investors have to rely on the biggest miners will continue to act collectively in the best interests of the network. Fortunately, this usually means that they act in their own interest.

Background

An academic study was recently published which claimed that “between launch (January 3, 2009), and reaches the award [of Bitcoin] reached $ 1 (February 9, 2011), most bitcoin was mined by only sixty-four agents. “The study claims that at certain times only a single digit number of these agents were active, and that there were points when a single agent had over 50% mining power.

It also commented on these findings, which essentially suggested that Bitcoin was not decentralized enough, at least in the early days: “Although bitcoin was designed to rely on a decentralized, untrustworthy network of anonymous agents, its early success instead of collaboration among a small group of altruistic founders. “

Although the study has not yet been published in a peer-reviewed journal, it received considerable attention, thanks in part to this New York Times article covering it.

The study’s methodology analyzed a modified version of the raw data available on the chain, as it, according to the New York Times, “utilized human loss as insecure user behavior; utilized operational features inherent in Bitcoin software; implemented established techniques to connect the pseudonymous addresses and developed new techniques. “

Given the many data processing techniques used and the lack of peer review at this time, it is possible that the findings are inaccurate. Matching distinct addresses to assume they are the same person certainly leaves room for error. In this article, however, I will assume that the findings are accurate and consider what that will mean for Bitcoin.

51% attacked

The study’s findings are interesting because if a single agent controls over 50% of the mining power, they can launch a 51% attack. The role of miners in the Bitcoin ecosystem is to validate transactions, and each miner is essentially given a vote weighted based on its computing power. Thus, if a single miner has more than half the computing power, their vote on whether a transaction is valid is the only vote that matters.

The power of miners is limited in the Bitcoin ecosystem, so even a successful 51% attack probably could not do things like take control of Bitcoin’s source code, create new coins, reverse very old transactions, or steal coins that are not actively used. in transactions. I have discussed the relationship between Bitcoin miners and the rest of the Bitcoin ecosystem in my previous article on Bitcoin supply.

Miners exist primarily to solve the problem of “double consumption”, where someone uses Bitcoin, then reverses or cancels the transaction and uses it again elsewhere. Thus, an attacker could freely use their Bitcoin over and over again as long as they controlled the network. So even if a 51% attacker would not be omnipotent, they could steal coins and do serious damage to other members of the Bitcoin network and Bitcoin as a whole.

The study claims that Bitcoin survived early 51% attacks because the agents who briefly had control of the network acted altruistically in favor of the overall Bitcoin ecosystem. But I think more is happening here. Apple’s board has seven members, and they may decide to stop producing new iPhones and choose to sell $ 1,000 worth of sheep instead. But no one will say that the board acts altruistically by choosing not to do so. Rather, they act to maximize revenue and profits (and avoid a flurry of shareholder lawsuits).

It’s a similar story for Bitcoin miners. Someone who controls 51% of the mining power would have invested a lot of money in mining equipment and would make a lot of money by simply extracting Bitcoin without attacking the network. If they instead started attacking the network, other Bitcoin users would be reluctant to trade in it because they would lose faith in the integrity of the network. This will almost certainly lead to a collapse in Bitcoin’s price and the attacker will then get in less mining revenue. So, instead of acting altruistically, a theoretical attacker must simply act in his own long-term financial interest to avoid damaging the network.

Admittedly, smaller cryptocurrencies have been exposed to 51% of attacks in the past, so it is not possible that they can not happen. But I am not aware of any 51% attack that made the attackers extremely rich. For example, this article on an attack on Bitcoin Gold in early 2020 indicated that the attacker stole around $ 70,000, but estimated that the attack cost about as much to carry out. Nor was it the first 51% attack on Bitcoin Gold. It is also important to note that the price of Bitcoin Gold is higher today than it was before any of the attacks, so an attack of 51% has not been enough to destroy a coin permanently in the past.

Bitcoin today

My other criticism of the study is that it only focuses on the period 2009-2011. At this time, very few people used Bitcoin. 64 agents who control the network is not much, but if only 64 people use the network, then it is a reasonable number. This means that the more people who use and mine Bitcoin, the more decentralized it can become. Just as I would not sell Apple today because their iPhone sales were low in 2007 when the product was first released, I do not think it makes sense to sell Bitcoin today because it was less decentralized at an earlier time when it was much less popular. .

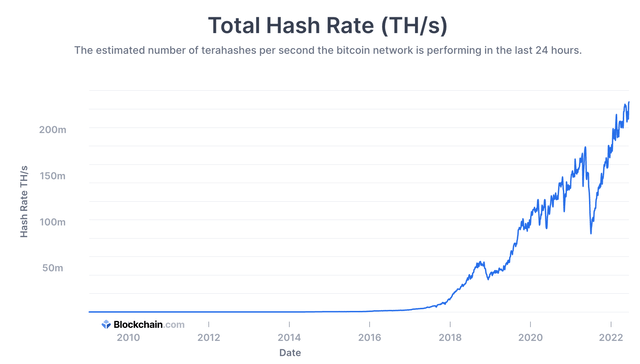

Blockchain.com

Today, Bitcoin’s hash rate is many orders of magnitude higher than it was in 2009-2011. 51% of today’s hash rate will be over 100m terahashes per second, which is a huge number that is difficult to visualize. For a certain perspective, with the current level of energy efficiency, this amounts to over 0.5% of the world’s energy consumption. So for a single unit to launch an attack of 51%, they must start using over 0.25% of the world’s energy. That cost eliminates most potential attackers, especially considering that you also need specialized hardware to utilize energy efficiently.

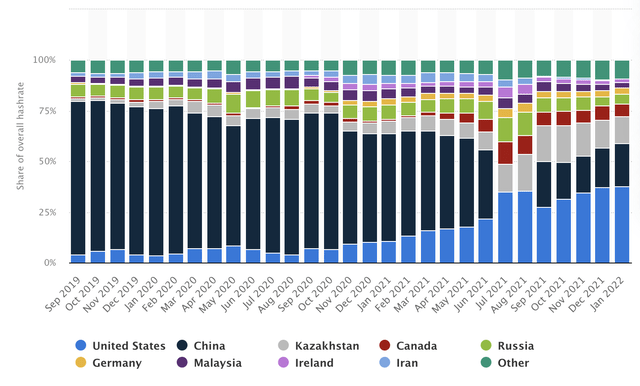

Statistics

Another way to understand the difficulty of launching an attack of 51% is to look at the market share of mining by country. As recently as 2019, Chinese miners had more than half the hash rate. However, the network is much healthier today, and no country accounts for more than 38% of the hash rate. This means that miners in several countries have to work together to launch a 51% attack, which reduces the likelihood of one happening.

And it’s not even considering that each country has several miners, each with their own goals. For example, leading miner Riot makes 4.6 million terahashes per second, less than 2.5% of the total hash rate and not even 10% of the hash rate comes from the United States.

An academic exercise

The previous part shows that it would be difficult to start a 51% attack today. In practice, this is not something that investors need to worry about to prevent a Black Swan event such as massive global power outages or a major regulatory cut.

But is it enough to say that Bitcoin keeps its promise of decentralization? According to a Google search, decentralized simply means “controlled by multiple local offices or authorities instead of a single one.” By that definition, Bitcoin is absolutely decentralized.

But what makes Bitcoin different from, for example, a pizza chain where different franchisees control a few stores? Or the various companies like Atlassian and Netflix that have multiple CEOs? Some may argue that these devices also meet the definition of decentralized.

In my opinion, what makes Bitcoin different is that everyone can become a miner if they have the right equipment and access to enough energy. Even though I have a lot of money, I can not become a franchise owner unless the company executives allow me to. And I can not become a leader without the permission of other leaders and board members. On the other hand, it is not necessary to request permission to participate in the Bitcoin network.

Of course, with today’s mining taking place on a massive scale, there are barriers to entry when it comes to obtaining the equipment and energy needed to participate. As with most businesses, there are size advantages in mining, so the largest miners are now likely to continue to outsource smaller players.

While Bitcoin may be decentralized, it is not entirely untrustworthy; to some extent you have to trust that the biggest miners collectively act in the best interests of the network, which fortunately means acting in their own long-term best interest as well. In my opinion, it is not very different from trusting that the companies ‘managers continue to act in the companies’ long-term best interest when you invest in the S&P 500.

Conclusion

Bitcoin today is very secure. I believe that Bitcoin is decentralized enough now that investors do not have to worry about an attack of 51%, regardless of whether it was possible in the period 2009-2011.

Although this article did not focus on Bitcoin’s main bull task, as I have covered it a lot in previous articles, it is worth noting that in previous cycles Bitcoin did not fall below the previous cycle peak. With Bitcoin close to $ 21,000 today, it is very close to the top of the previous cycle and it looks like it may even break below it. So, based on the trend in previous cycles, I think now is a good time to add Bitcoin and other cryptocurrencies again.