How Can You Avoid Crypto Ponzi and Pyramid Schemes?

Since the launch of Bitcoin (BTC) in 2009, cryptocurrencies have grown considerably and been adopted by the masses. However, the rise of digital assets has led to various scams, including Ponzi and pyramid schemes.

The simple goal of these scams is to defraud you and other unsuspecting crypto investors. So what are crypto ponzi and pyramid schemes and how can you avoid them?

Understanding Ponzi and Pyramid Schemes in the Crypto Industry

Crypto Ponzi and pyramid schemes involve malicious actors luring and defrauding unsuspecting investors looking to make money. Despite their varying modus operandi, both scams promise massive earnings from supposedly legitimate financial operations, but participating investors usually end up with huge losses.

What is a Crypto Ponzi Scheme?

In crypto-Ponzi schemes, malicious actors seek new investors and promise them massive return on investment (ROI). These scammers present various investment schemes such as staking, automated crypto trading or crypto arbitrage trading, but actually pay early investors using funds from new investors.

An organizer of the crypto-Ponzi scheme may invite investors to buy a new token, say “XYZ”, or to lend their existing tokens, perhaps BTC. These fraudulent promoters are likely to promise a huge rate of interest, claiming that they will generate income when they invest or pledge your assets. They usually take advantage of current trends, so if cryptocurrency betting is on the way, they will promise to stake your assets especially lucratively.

If you invest early, you can get paid and consider the scheme legitimate. This is all a ploy to build hype for the scam. Usually, most participants will join later, invest their assets and hope for massive gains. But after significant asset commitments, the plans would withdraw all crypto assets and disappear.

Ponzi schemes can also collapse if there is a lack of new investors. Because there is no inflow, there will be no way to generate returns for investors. At this point, the planners would take what is available and establish.

Example of Crypto Ponzi Schemes

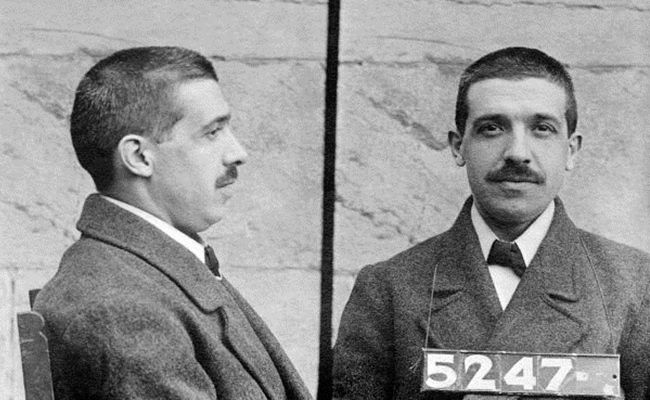

The term “Ponzi schemes” was coined because of Charles Ponzi, who promised investors a 50 percent ROI for a purported international postal coupon investment. Ponzi paid off the earlier investors using funds from newer investors and fled after raising a satisfactory amount.

Similarly, in 2013, Trendon T. Shavers and his firm, Bitcoin Savings and Trust (BTCST), promised investors a weekly interest rate of around 7 percent based on Bitcoin market arbitrage trading. However, BTCST did not sell or buy Bitcoin. After charging Shavers and his firm, the Securities and Exchange Commission (SEC) reported that he had a net profit of over $164,000.

Since then, several crypto Ponzi schemes have been exposed, including Bitconnect, Regalcoin and Mining Max. These schemes have appeared in various forms – fake crypto trading platforms, betting services, lending solutions, cloud mining services and trading bots. Ultimately, they led to the loss of investor funds.

What is a Crypto Pyramid Scheme?

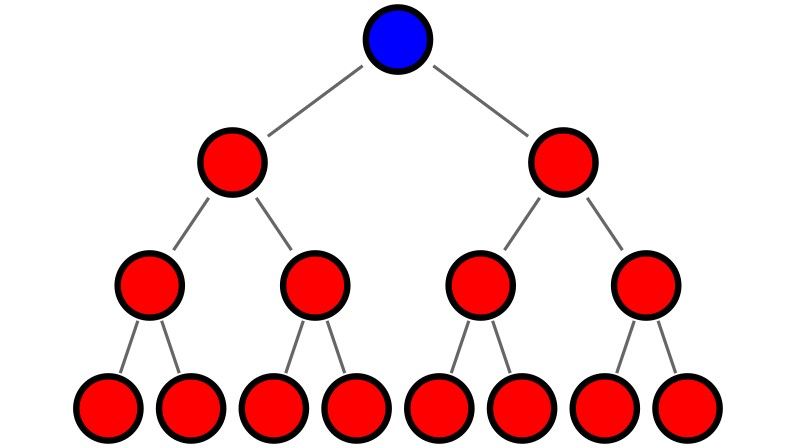

A crypto pyramid scheme involves the first scammer recruiting other investors who will recruit more investors, and so on and so forth. At first glance, this scheme looks like a Multi-Level Marketing (MLM) campaign, where sales are driven through a network of people, groups and companies. However, unlike MLM, crypto pyramid schemes do not offer legitimate products.

Like crypto Ponzi schemes, those at the top of the pyramid make more money and those at the bottom lose money. If crypto investors invite more participants, they can earn more as the money goes from the bottom to the top.

In crypto-Ponzi schemes, fraudsters present an investment opportunity, such as the right to buy a digital asset and sell it at a higher price. And each investor must pay their recruiter for a chance to earn this right. Then the recruiter will pay a certain portion of the fee to those at higher levels of the pyramid.

Examples of Crypocurrency Pyramid Schemes

In December 2022, the Department of Justice announced that Karl Greenwood, one of the founders of OneCoin, had pleaded guilty to fraud and money laundering charges after offering a billion-dollar cryptocurrency pyramid scheme. Greenwood and Ruja Ignatova launched OneCoin in 2014, offering ONECOIN, a fraudulent crypto-asset, through a global MLM network.

The scammers claimed that the fake token would be the next big thing, likely to displace Bitcoin. And this led to many investors recruiting more and more participants until over 4 billion dollars had been invested. Greenwood and Ignatova manipulated the fake token price on the fake crypto exchange from €0.5 to over €29, luring unsuspecting investors until 2017.

10 Common Signs of Crypto Ponzi and Pyramid Schemes

While crypto-Ponzi schemes require investments in digital assets, crypto-pyramid schemes require you to pay a fee, buy digital assets and recruit other investors. Here are other signs of Ponzi and pyramid schemes in the crypto industry:

- Despite the volatile crypto market, these scams usually promise extremely high and consistent returns.

- Sometimes crypto Ponzi and pyramid schemes claim to pose little or no risk to investors.

- If the team members of a crypto project are anonymous, it could be a scam project.

- When crypto firms use massive, elaborate and flashy marketing campaigns, they are likely promoting a scam project.

- Crypto Ponzi and pyramid schemes are largely offered by unlicensed, unregistered and unregulated firms.

- Typically, firms offering these schemes have complex fees, commissions and investment structures.

- These organizations also have limited or no documentation – no white papers or roadmaps.

- Another common sign is that there is no investment requirement; everyone is usually allowed to invest and earn in crypto ponzi and pyramid schemes.

- If you have invested in a scam project, you may notice that you cannot withdraw your investments or that the promoters keep suggesting that you roll over your investments.

- You may also notice errors in bank statements or payment calculations when reviewing investment documents.

How to Avoid Crypto Ponzi and Pyramid Schemes

Despite the increasing prominence of crypto-Ponzi and pyramid schemes, they continue to grow. It is your responsibility to protect yourself from these scams. Here are a few steps you can take to avoid becoming a victim:

- Before investing in any crypto investment, do your own research. Review whitepapers, verified news sources, investor reviews and project affiliation.

- Ensure accountability by verifying the face or team behind each crypto project before you commit. You can also check the public sentiment around the team – if it is favorable.

- Look out for licenses, certifications and affiliations. Check that each crypto organization you trade with complies with the relevant regulatory guidelines. If it is a decentralized finance (DeFi) project, check independent audits and other relevant certifications.

- Don’t be swayed by promises of massive returns. The crypto market is still volatile, and every investment has some risk.

- Be wary if you find out about a crypto project through unsolicited offers and messages. It could mean that the organization has used massive marketing campaigns to lure unsuspecting investors.

- Never invest more than you can afford to lose. Every wise crypto investor has an investment strategy. Don’t invest more because of “sure” promises of returns.

What to Do After Falling Victim to Crypto Ponzi and Pyramid Schemes

If you are lucky, you can withdraw some of your investment before the scheme dissolves. After recovering your assets, or even if you cannot recover them, you should report the fraud to your local enforcement agencies, state securities regulators, the SEC, the Financial Industry Regulatory Authority (FINRA), or the Federal Trade Commission (FTC).

You can also teach other investors about crypto ponzi and pyramid schemes so extraordinary fake returns don’t mislead them.