How Bitcoin is saving lives around the world

Cryptocurrencies have evolved beyond their original purpose as digital currencies, showing that Bitcoin is saving lives and supporting communities in challenging situations globally.

Real-world applications of cryptocurrencies show how they contribute to financial inclusion as well as economic stability and empower marginalized communities in the face of adversity.

Bitcoin offers refuge from financial crises

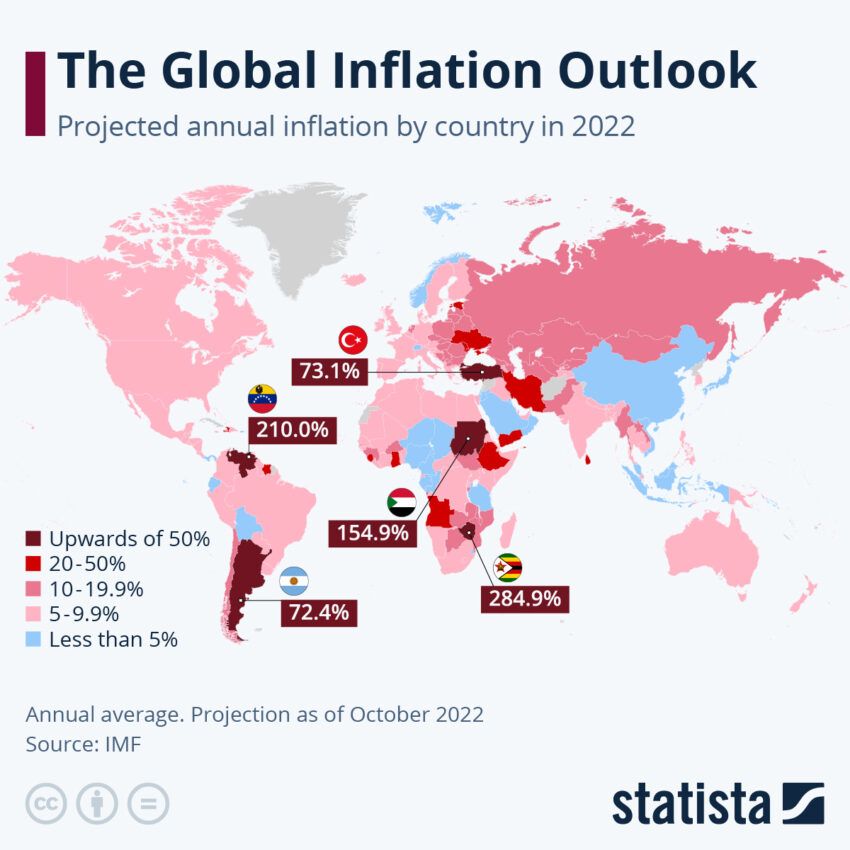

As the Turkish lira experiences a sharp decline in value, Turkish citizens are piling into Bitcoin and Tether. They are desperately looking for ways to protect their savings and maintain their purchasing power.

The growing interest in cryptocurrencies in Turkey has led to an increase in crypto-related businesses and trading platforms, catering to the growing demand for alternative financial instruments.

Similarly, Venezuela’s economic crisis and hyperinflation have forced its citizens to seek alternative means to preserve their wealth. Many Venezuelans have turned to Bitcoin to secure their savings as the national currency, the bolivar, continues to lose value.

In a country where even basic necessities are scarce, Bitcoin is saving lives, giving Venezuelans a lifeline to purchase essential items and medical treatments.

The economic crisis in Lebanon has also meant that many residents are struggling to make ends meet. With the local currency falling in value, some Lebanese have turned to Bitcoin mining as a source of income. Furthermore, Lebanese citizens use stablecoins like Tether to buy groceries and essentials, offering financial stability amid the chaos.

Argentina is another country where economic problems have led citizens to seek alternative economic solutions. Cryptocurrency has emerged as a popular choice to preserve wealth and protect against the country’s rampant inflation. With restrictions on foreign currency purchases and high inflation, Argentines increasingly rely on digital currencies to maintain their purchasing power.

Strengthening marginalized communities

In the aftermath of the Taliban’s takeover of Afghanistan, many women lost their jobs and the ability to support their families.

Cryptocurrencies have enabled Afghan women to receive donations worldwide, providing much-needed financial support. This influx of funds has enabled these women to continue to support their families in the face of adversity.

On the other hand, sex workers often face discrimination from traditional banks, leading to economic exclusion. Crypto has offered an alternative that enables sex workers to receive payments and manage their finances without relying on traditional banking systems.

By turning to cryptocurrencies, these individuals can maintain financial autonomy and protect their earnings from potential seizure or censorship.

Lifelines during political unrest

During the EndSARS protests in Nigeria, the government froze the bank accounts of key organizers. Protesters turned to Bitcoin to fund their cause, circumvent government interference and continue their fight for justice.

This use of cryptos highlights the power of decentralized financial systems to enable activists to maintain control over their funds and movements.

Across the world, political dissidents are increasingly turning to cryptocurrencies to finance their activities and avoid government interference. In authoritarian countries where financial repression is common, cryptos have emerged as a powerful tool for dissidents to receive funding and continue their fight for freedom.

Helping refugees and immigrants

In the midst of the Russia-Ukraine crisis, many Ukrainians have fled their homes and sought refuge in neighboring countries. Some refugees have relied on Bitcoin to secure their finances in this uncertain time.

A Ukrainian refugee, for example, fled to Poland with $2,000 worth of Bitcoin on a USB drive. Bitcoin provided a lifeline and financial stability in a time of upheaval.

Cryptocurrencies like Bitcoin have become a valuable tool for human rights activists operating in authoritarian countries. These digital currencies provide a secure and private way for activists to receive funding. Also, to support their work without fear of government intervention or censorship.

The decentralized nature of crypto allows greater financial freedom and autonomy for those fighting for human rights.

Cuba is laying the groundwork to legalize crypto

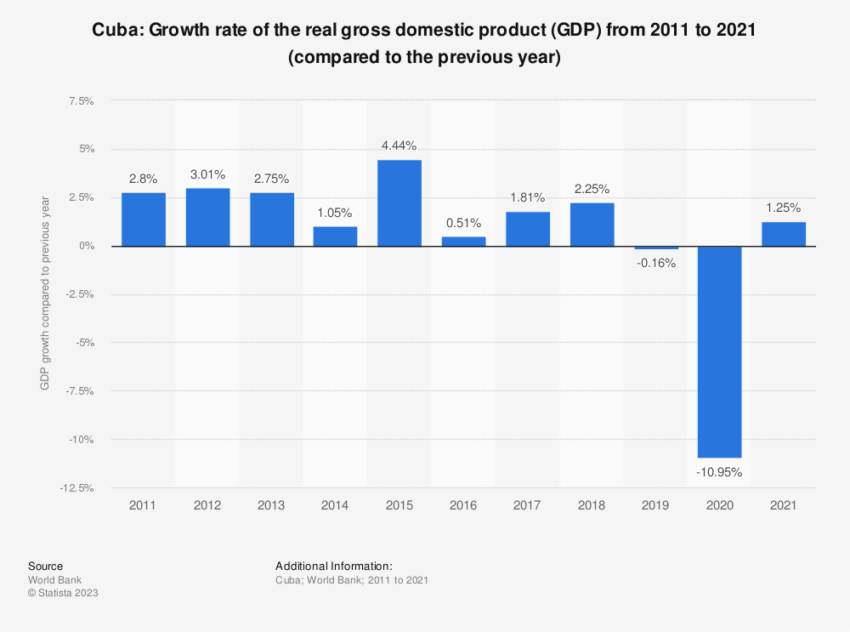

Cuba has witnessed an increase in interest in crypto, mainly driven by economic sanctions and an economic crisis. This has pushed the Cuban government to explore the possibilities of digital currencies.

In August 2021, the Cuban government announced plans to legalize cryptocurrency transactions. It recognized the need for a regulatory framework to deal with the country’s growing use of digital currencies. Cuba’s central bank was tasked with drafting the necessary regulations to govern the use of crypto for commercial and financial transactions.

This decision marked a significant shift in the Cuban government’s stance on cryptocurrencies. Indeed, it recognized the potential benefits of digital currencies in promoting financial inclusion and economic stability.

Legalizing cryptocurrency transactions could provide Cubans with alternative ways to preserve their wealth. And circumvent the effects of economic sanctions and currency devaluation.

Bitcoin is saving lives all over the world

Cryptos have emerged as a powerful tool not only for financial investment but also for saving lives. Not to mention empowering marginalized communities around the world.

From offering refuge in economic crises to providing financial inclusion for those excluded from traditional banking systems, the potential of digital currencies goes far beyond their monetary value.

By exploring the various ways cryptocurrencies have impacted the lives of individuals around the world, we gain a better understanding of the true potential of these digital assets and their role in shaping a fairer and more just world.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.