How Bitcoin Can Help Solar Power Gain More Traction

HodlX guest post Submit your post

Although solar power continues to fall in price, it is still not as prominent as solar enthusiasts and environmentalists would prefer, given its intermittent nature, making it challenging to match the supply of solar power with the demand for electricity.

Furthermore, solar panels require far more land mass than other forms of energy production. Therefore, it is currently impossible to build solar energy infrastructure near those population centers with unfavorable geography.

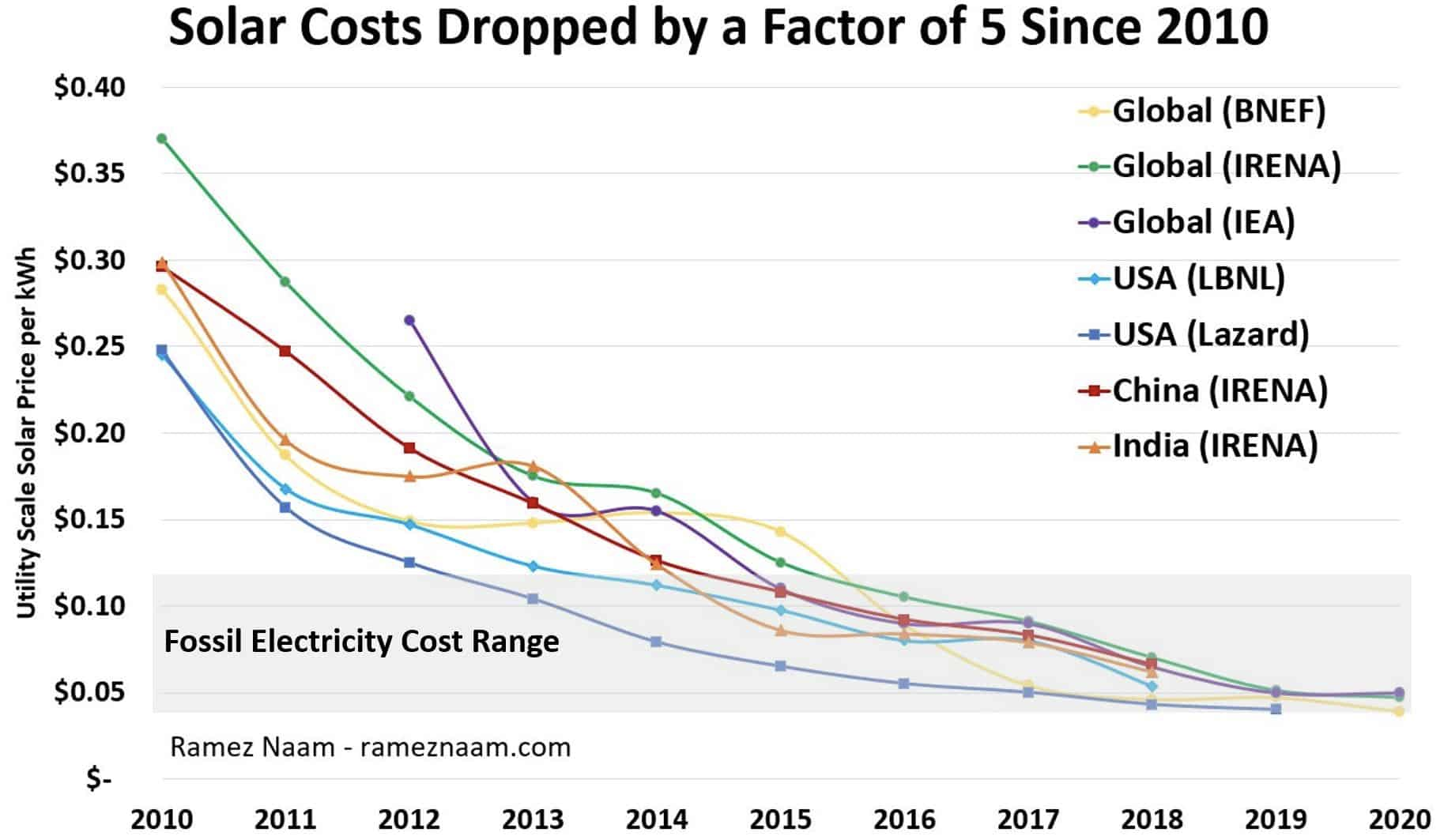

Finally, while the cost of solar has actually dropped by a factor of five over the past 10 years, it still requires a large upfront investment. This places an economic constraint on underdeveloped communities to start harnessing solar energy, even though it may provide a return on investment in the long run.

Fortunately, revolutionary technology has emerged in recent years that can drastically enhance the spread of solar energy. Bitcoin miners can work from anywhere, can shut down their machines on a whim, and are indifferent as to what energy source powers their activity. Miners act as the perfect buyer of last resort for the intermittent energy source, acting as a buffer for the intermittent energy source.

Bitcoin mining could supercharge the solar industry

The Intergovernmental Panel on Climate Change (IPCC) has outlined various energy mix profiles that the global economy must pursue if we are to prevent global warming from exceeding the critical 1.5 degrees Celsius or two degrees Celsius.

Some of their proposed pathways call for us to add the wind and solar equivalent of 1.4% of the global electricity supply annually, while even more aggressive pathways call for the solar equivalent of three percent of the global electricity supply annually.

Jessica Jewell, Associate Professor of Energy Transitions at Chalmers University of Technology, has recently calculated that the IPCC’s recommended pathways to a renewable future are only viable for a handful of countries. Without a paradigm shift in technology, the IPCC’s goals seem unattainable.

Although Bitcoin miners don’t care about which energy source they use, they do care a lot about the cost of each candidate energy source. Because the cost of solar power is largely in the upfront investment, solar panels are a fairly cost-effective means for Bitcoin miners to run their machines over long periods of time.

As reported in the Bitcoin Clean Energy Initiative’s whitepaper, the unsubsidized cost of solar power is between three to four cents per kilowatt-hour about. 2.5 cents per kilowatt-hour cheaper than coal or natural gas. For energy source agnostic miners, solar power is an easy choice.

Bitcoin miners can solve solar power’s devastating intermittency problem in at least two ways. First, they can agree to only consume electricity that is not demanded by others, assuring the population that miners will not compete with the local population for electricity when the solar supply is low. And second, miners can offer the grid their excess energy during unexpected demand peaks, such as during extreme weather events.

Ark Invest, a US investment management firm, has calculated that solar could only supply 40% of grid power without significantly increasing electricity prices due to solar intermittency.

However, Solar’s integration with Bitcoin mining allows energy providers not only to profit from the difference between the electricity price and Bitcoin’s price, but also allows the energy providers to continue to satisfy grid demand without reducing profitability.

Beyond theory

The association of solar energy and Bitcoin mining is not an idealistic hypothetical. Despite the current bear market, a young Bitcoin mining company has started mining Bitcoin at a solar-powered site in Colorado.

The company has chosen to go solar at a time when many Bitcoin miners are being washed out of the market due to rising energy prices and shrinking revenues (ie Bitcoin’s steep price decline).

Given the cost-effectiveness of using solar energy (see figure one in the image below), Bitcoin mining’s migration to the renewable energy source comes as no surprise.

Figure one

The Bitcoin mining company plans to build out even more Bitcoin mining operations that will utilize solar energy. Its second and third facilities will run on an 87-megawatt solar farm and a 200-megawatt solar park, respectively.

In Texas, three major companies are collaborating to build a Bitcoin mining facility powered by solar and battery storage technology. According to the CEO of one of these companies, this project will serve as a proof of concept for completely pure Bitcoin mining on a large scale.

Because Bitcoin miners can work from anywhere, they can subsidize renewable energy projects built far from population centers. As mentioned earlier, one of the problems with the solar industry is that it cannot be developed cheaply in busy geographical locations since it requires so much land mass.

Bitcoin miners are more than happy to locate themselves in remote locations next to solar infrastructure and cover the costs that solar providers bear by sending their energy to distant energy consumers. Bitcoin mining can really bring life to distant, renewable energy that would otherwise be unviable.

Kent Halliburton is the President and COO of Sazmining, the world’s first Bitcoin mining platform created to connect individual retail miners with carbon neutral/negative Bitcoin mining facilities. Kent is a business operator with deep expertise in Bitcoin mining and solar energy. Previously, he led sales and business development for a publicly traded solar company, leading a team of more than 100 people with a nine-figure sales target.

Follow us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia