How Biden’s Debt Relief Program Could Trigger the Next BTC Rally

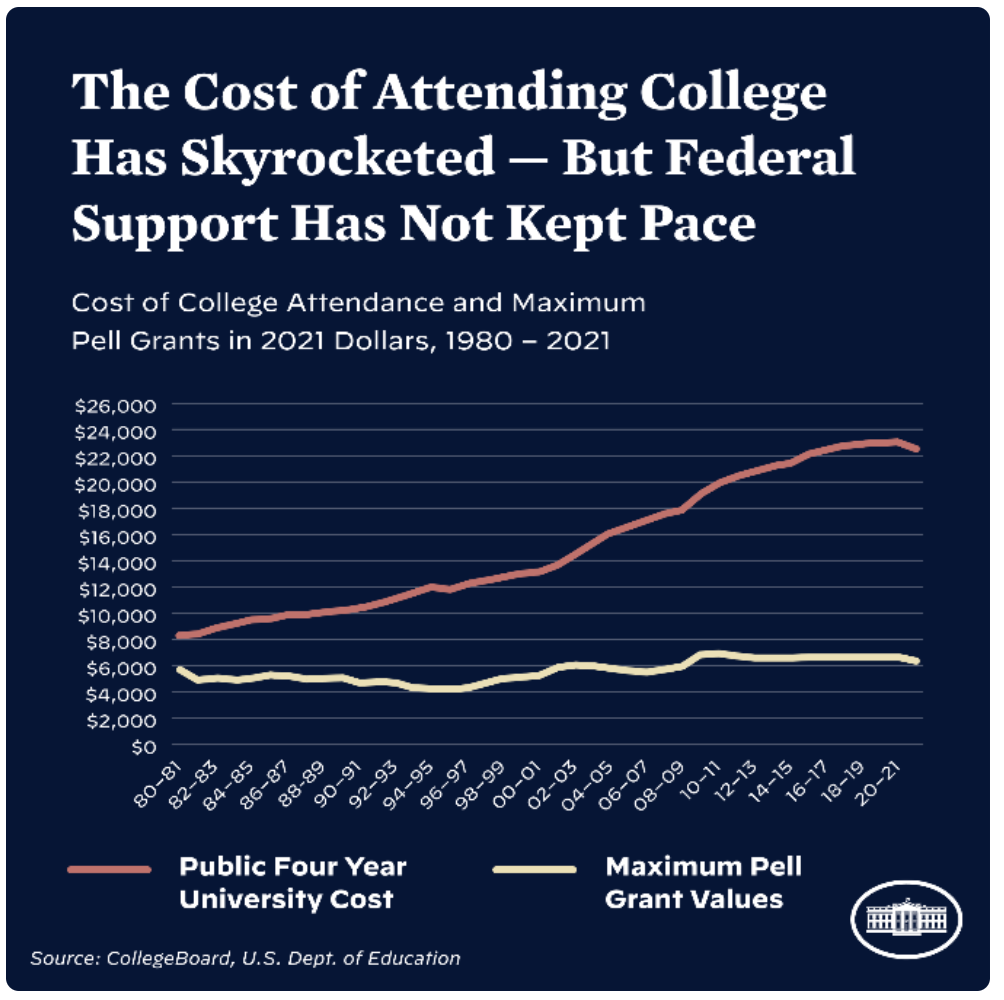

- President Biden is offering a student debt relief program that addresses the middle-class dilemma of rising college costs.

- Macro technical indicators suggest that a bull run for Bitcoin prices will be conservatively 2x from the current market value

- BTC price bullrun hinges on $13,880 price level remaining unmarked,

Bitcoin price macro potential is still very much intact. As a response to President Biden’s debt relief program, investors can finally brave the free markets again.

Will Bitcoin Price Get a Bid?

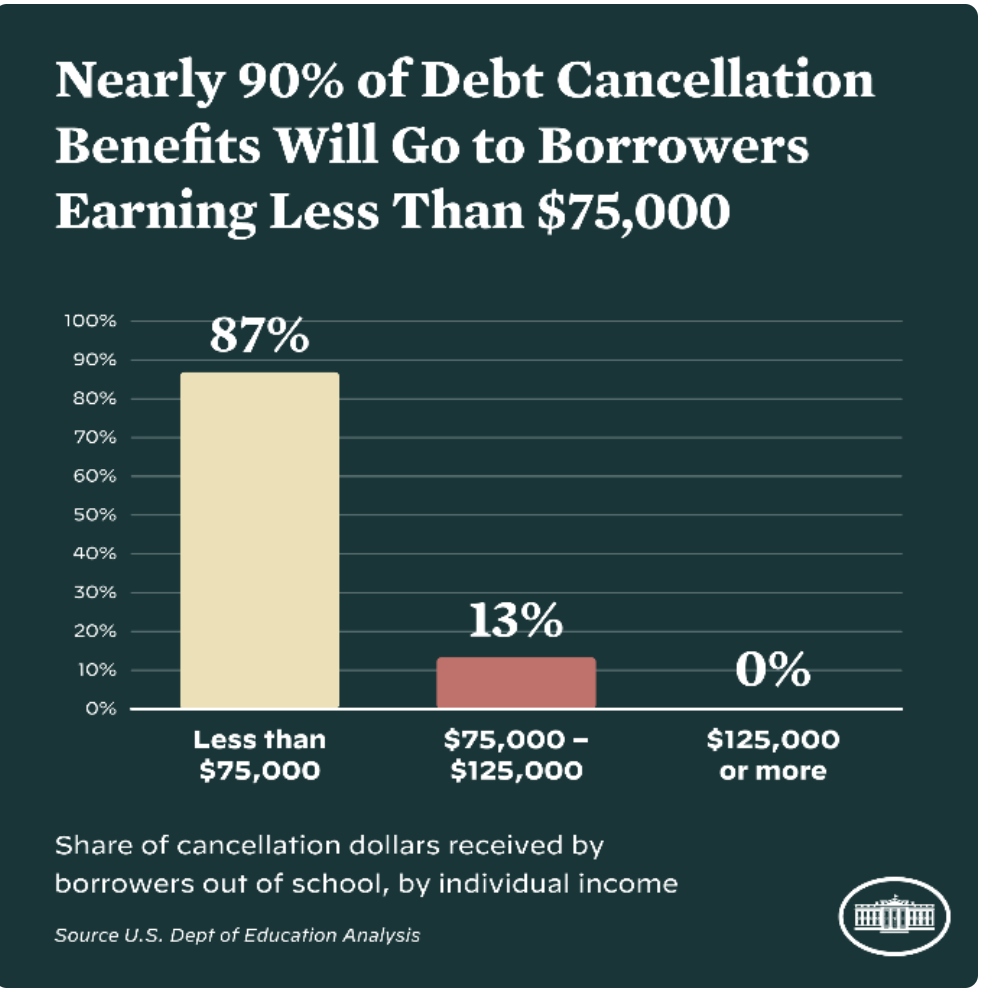

Bitcoin price has witnessed a shocking surge of positive market sentiment as President Biden has announced a college debt forgiveness program. According to the White House, USA federal government “will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education and up to $10,000 to non-Pell Grant recipients”.

The generous offer from POTUS will relieve and help nearly 45 million Americans net incomeand in theory should promote more liquidity in the free markets such as cryptocurrencies, real estate, stocks and bonds. \

Source- Whitehouse.gov

Since the disastrous cryptocurrency sell-off that took place in 2021, analysts at FXStreet have issued several technical forecasts to shed light on Bitcoin’s Macroeconomic Potential. As of August 25, the Bitcoin price is, at the time of writing, trading at $21,657, just a 38% decrease from its all-time high of 69,000 based on the logarithmic chart.

The Elliott Wave theory suggests that the BTC price is within a wave-4, with wave-5 price targets conservatively between $80,000 and $120,000. Based on previous Bitcoin bull runs, the next rally is likely to extend and blow past these targets.

BTC/USDT 1-week chart

Many investors believe that a Bottom in the Bitcoin market may be in place. The technicals confound this possibility as the BTC price hovers above a historical one Elliot Wave Trend Channel, which has played a significant role in the Bitcoin price since 2019. This is a hallmark of a market bottom, as many markets have produced similar signs before a blow-off-top-style bull run.

With optimism pouring in, inflation easing, and President Biden freeing up capital for average middle-class Americans, sidelined high-cap investors can finally begin to brave the free markets again. A Bitcoin bullrun is certainly bragging rights to help win millennials and Gen-Z’s vote in an upcoming re-electionion.

Source- Whitehouse.gov

Nevertheless, the markets are always evolving and you can never be 100% sure that the bottom is truly defined until afterwards. Thus, a dollar averaging approach is the safest way to approach investing in the Bitcoin price. Invalidating the bull run scenario relies on $13,880 remaining untouched in the future.

In the following video, our analysts dive deep into Bitcoin’s price action, analyzing key levels of interest in the market – FXStreet Team