How Amex is using Kabbage to help SMBs cash flow, and why regulators are cracking down on bank-fintech partnerships – Tearsheet

Stay well informed and receive your daily dose of financial developments with Tearsheet’s daily newsletter. Subscribe for free.

How Amex is using Kabbage as the ‘heartbeat’ of its strategy to help small and medium businesses with cash flow

In this episode of the Tearsheet Podcast, CMO Kabbage of American Express, Brett Sussman joins host Zack Miller, Tearsheet’s editor-in-chief.

American Express’ Kabbage is growing and developing. As a stand-alone company, we have known Kabbage as a small business lender, and following the acquisition, as part of Amex’s strategy, it is expanding its lending capabilities to become a cash flow home base for the firm’s SME customers.

Sussman talks about the opportunities and challenges facing SMEs and how Amex and Kabbage are working to support them. He discusses the evolution of Kabbage as a product, and Amex in general as it expands to meet the needs of small businesses. He also talks about Amex’s two-pronged strategy for growing cabbage.

Listen / read more

Why are regulators cracking down on bank-fintech partnerships?

Across the board, federal banking agencies appear to be preparing to crack down on market activity by enforcing financial industry regulations. Recently, the CEOs of the largest banks in America were summoned to Capitol Hill and probed on all manner of issues, from the war in Ukraine to their role in slavery.

Maybe it’s a political tactic to seem busy because of the upcoming election. Or a more cosmic shift is at play, with the new moon in Libra suggesting that new legal developments are in order. Not fans of speculation, Tearsheet reached out to Brian Graham, partner at Klaros Group, to help us understand what’s going on.

Read more (exclusively for Outlier members)

Just look at the charts

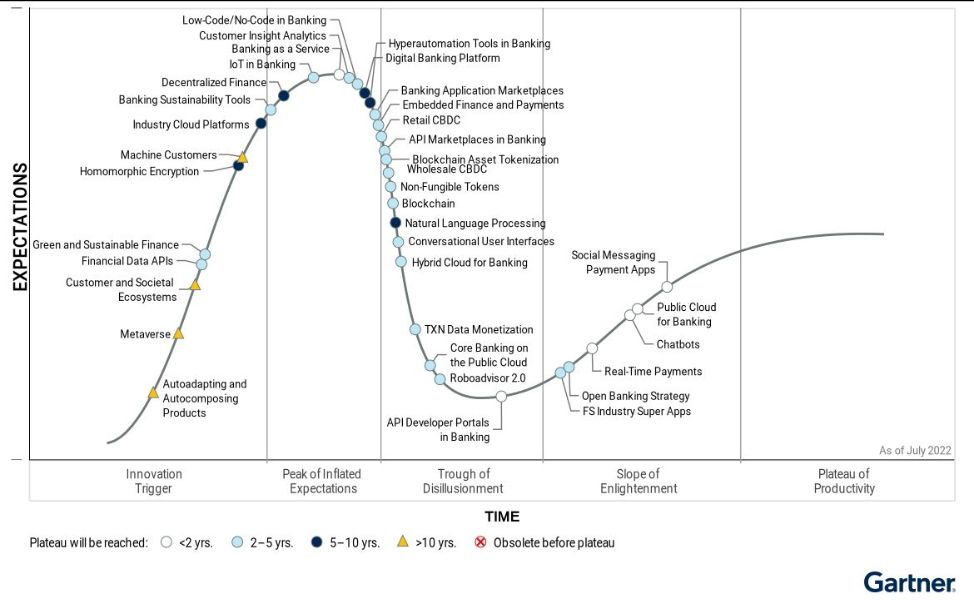

1. BaaS can hit mainstream adoption within 2 years

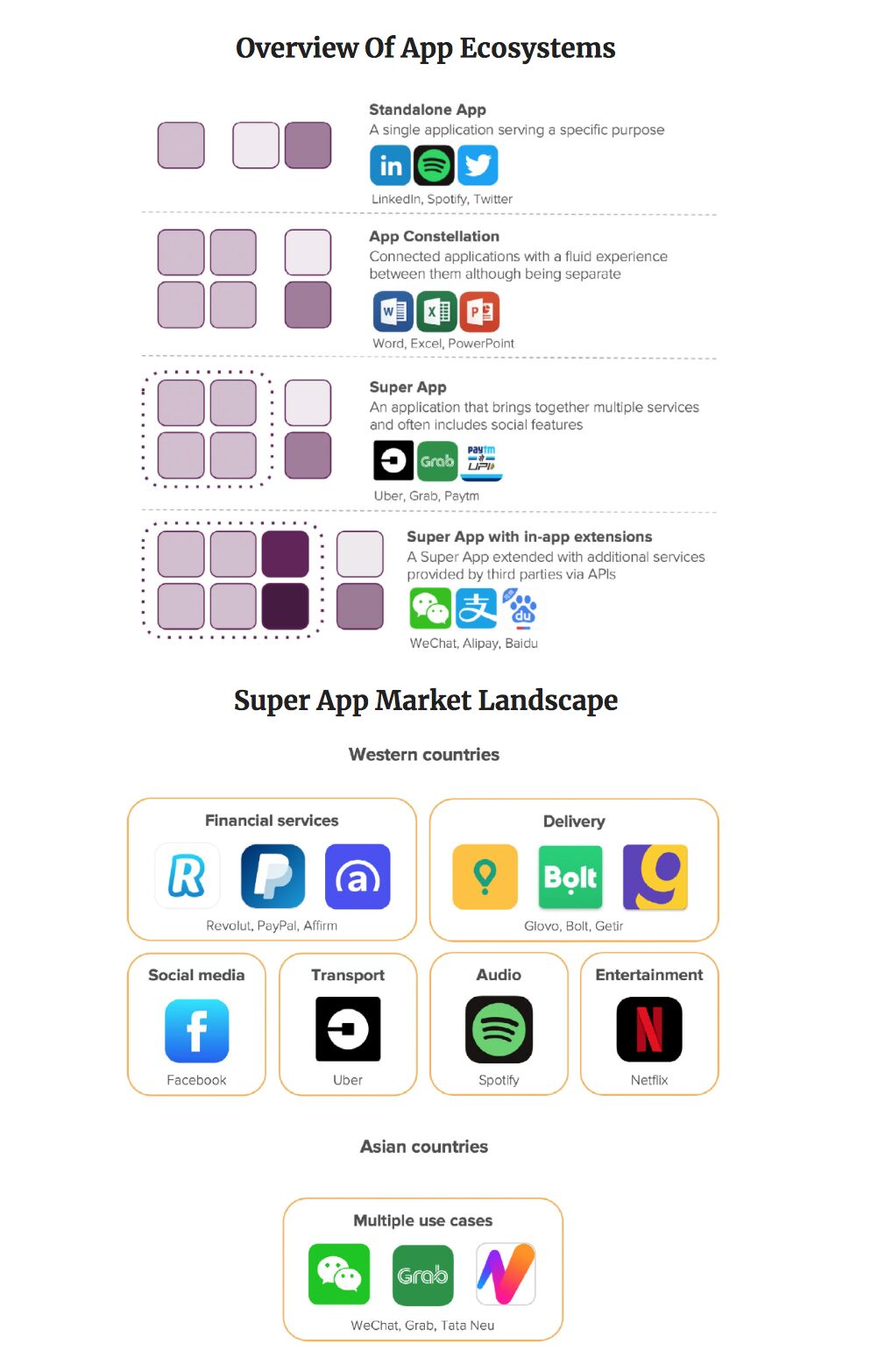

2. Key differences between traditional apps and super apps

Today’s stories

Buffett-backed Nubank reaches 70 million customers

Brazil’s Nubank has reached 70 million customers in its three operating countries. The digital bank, backed by investors including Warren Buffett’s Berkshire Hathaway and Softbank Group, had 66.4 million customers in Brazil, its main market, up from 62.3 million at the end of June. (Reuters)

How a “payday loan” option made a small bank famous

OneUnited Bank — the largest black-owned bank in the U.S. — created a small-dollar loan option for Covid-affected customers, leading the bank to star in the first segment of a new docu-series airing on CNBC. (The Financial Brand)

PNC acquires Linga to expand its digital resources

PNC Financial Services Group has acquired Linga, a sales and payment solutions company that offers a cloud-based restaurant operating system. The acquisition will expand PNC’s digital resources and enhance the bank’s ability to serve hospitality and restaurant industry customers. (Finextra)

Why two Goldman Sachs employees decided now is the time to go for fintech

Is this the right moment to leave your Goldman Sachs job to work in the fintech industry? It obviously depends in part on the job you do at Goldman and the type of fintech you join, but at least two people have recently taken the plunge. Brian Steele and Cyrus Mahler are the latest to announce their fintech move. (eFinancialCareers)

Stay ahead of the game with Outlier — Tearsheet’s exclusive content program for members and join the leading financial services and fintech innovators who read us every day.