How a price battle between two heavyweight NFT exchanges pumps up prices

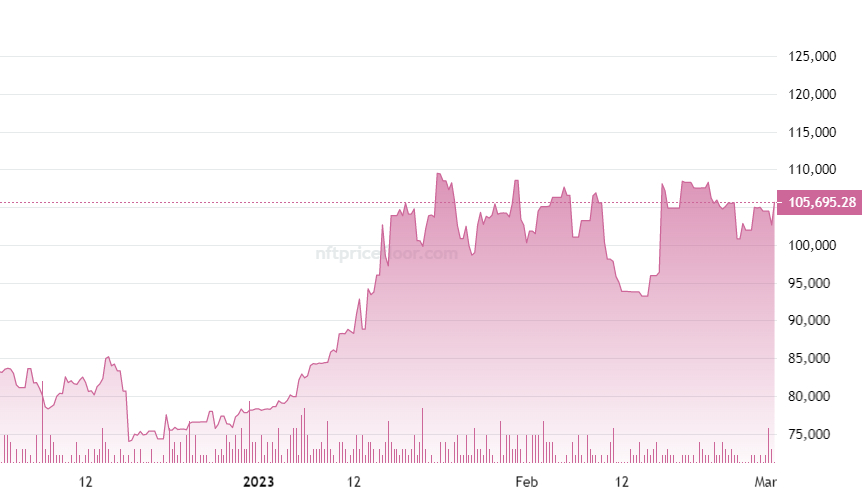

Despite the fact that the prices of most major cryptocurrencies have stagnated over the past 30 days, with the likes of Bitcoin and Ethereum only up 1.7 and 4.0% respectively and BNB and XRP down 3.9% and 7.0 % each according to CoinMarketCap, the prices of non-fungible tokens (NFT) have pumped. According to the NFT Price Floor, the price floor to obtain an NFT from the Bored Ape Yacht Club (BAYC) collection has jumped 17.5% over the past 30 days to $117,750.

The Bored Ape Yacht Club NFT collection is currently the most valuable in the NFT space, with a market value (according to the price floor) of around $1.177 billion. The minimum price to get hold of a CryptoPunk NFT is up around 5.5% over the same time period – CryptoPunk is the second most valuable NFT collection, with a market cap of over $1.0 billion.

NFT prices rally despite macro, regulatory headwinds

The rally in NFT prices comes despite broader derisking in traditional asset classes, with a string of strong US data releases last month adding to the Fed’s tightening efforts – with inflation heating up again and US economic activity and labor markets remaining robust, the Fed is now seen to take rates to around 5.5% by the middle of the year, against expectations that rate hikes stopped around 5.0% just one month ago.

Such a shift in the Fed’s tightening of expectations has typically been negative for digital assets, which are still viewed as a speculative asset class. In such circumstances, NFTs have historically been one of the worst-hit sectors in the crypto space. The price rise also comes amid an increase in regulatory pressure on centralized crypto firms in the US, with the SEC recently charging Kraken over its staking program and Paxos over the issuance of BUSD.

Increasing volume supports prices

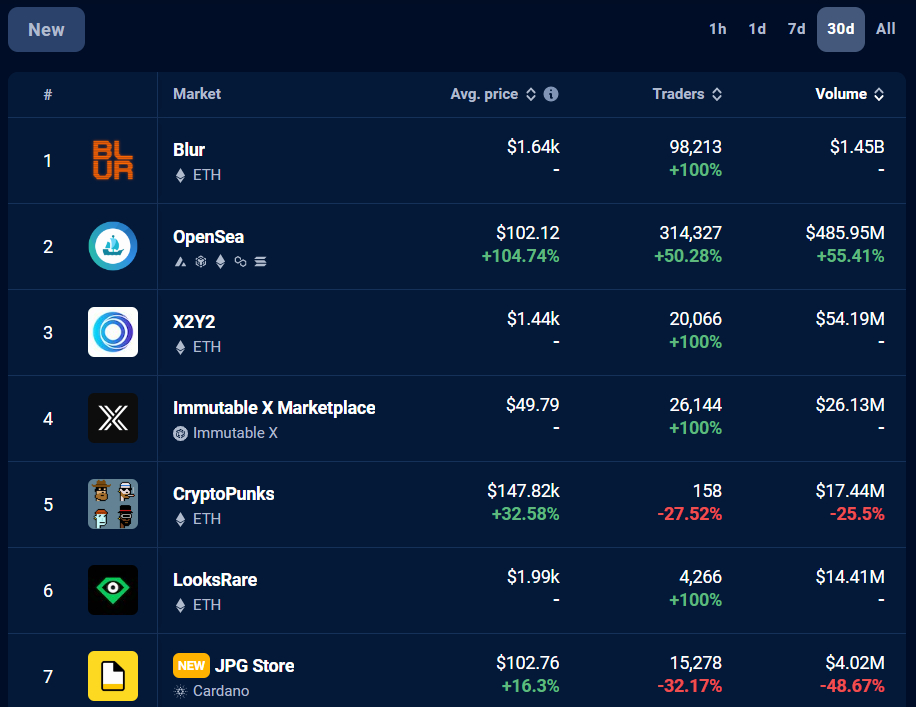

Prices have been able to remain resilient amid a surge in NFT trading volumes. According to a just-released monthly report from DappRadar, trading volumes exceeded $2.0 billion in February, the highest monthly trading volume since May 2022. Meanwhile, DappRadar’s website shows that over the past 30 days, the top seven NFT exchanges saw trading volumes exceed $2.0 billion, and new kid on the block Blur enjoyed a whopping $1.45 billion from those streams.

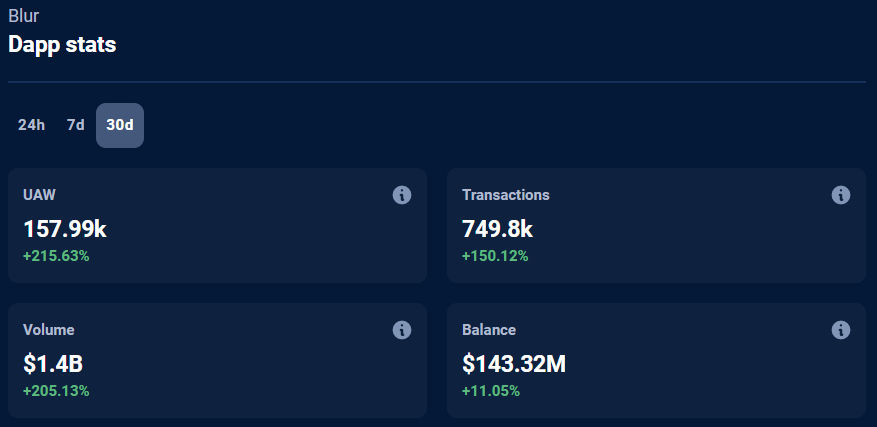

Blur launched its platform back in October and there was a lot of hype regarding the platform last month ahead of the platform’s token airdrop – BLUR was awarded to users of the Blur platform based on their trading activity. The exchange has seen stratospheric growth in the past 30 days – according to DappRadar, the platform has seen 158,000 UAWs (unique crypto wallets interacting with it), up over 200% over the previous 30-day period. In the same period, volumes are also up over 200%, while transactions increased by 150%.

Blur’s marketplace currently charges zero fees on trades, and its surge in popularity in February encouraged OpenSea, the established industry leader in the NFT marketplace, to also cut its fees to zero. Blurred airdrop hype and fee cuts from the biggest NFT market players have been attributed by many analysts as the main catalyst for the recent increase in NFT trading volume, as well as recent resilience in NFT prices.