Hope is for the ignorant

- Bitcoin price prediction shows a weak retracement after last week’s sudden sell-off, although on-chain calculations suggest a bottom may be near.

- Ethereum price and the bullish narrative of the upcoming Merge swings as bears threaten to push prices down.

- XRP price is witnessing a reversal after a steep decline in the weekly trend. If a rally is going to happen, it’s now or never.

As August comes to a close, retail traders have spent the week deciphering the crypto markets’ true intentions. Since last week’s sharp decline, the market has been confined within a congested zone. The secular price action is likely to resolve into a sharp directional move that many analysts hope will be bullish. A further decline should nevertheless not be ruled out.

Bitcoin price is near the bottom

Bitcoin price has been trading sideways all week after last Friday’s 16% liquidation. At most, the peer-to-peer digital currency has recovered 3% of its incurred losses. The lack of effort shown after the decline is the first anomaly that merits questioning in the underlining bullish strength. The VolumeProfile indicator confounds the reasonable doubt as transactions continue to decline.

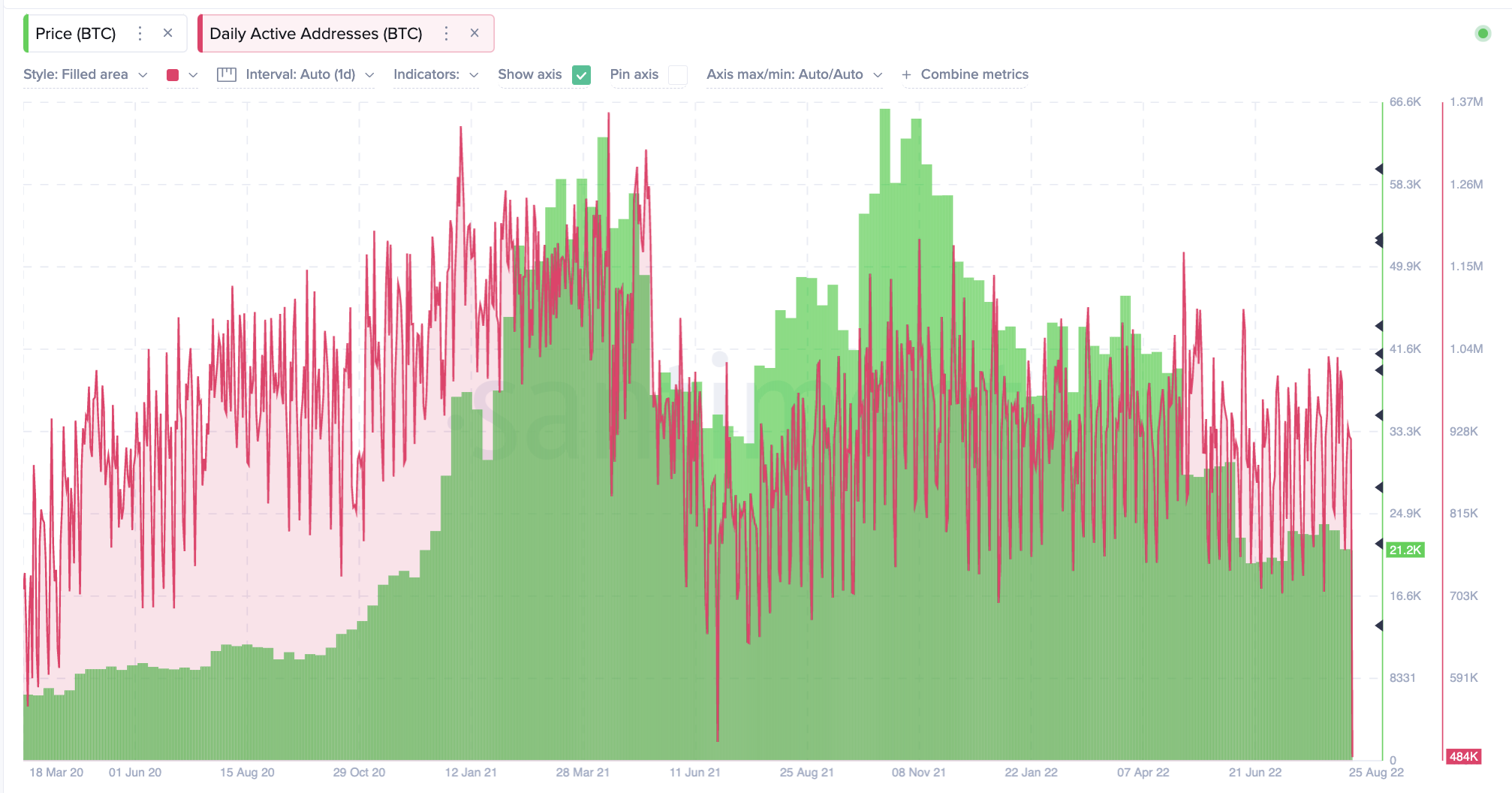

Still, on-chain analytics tools suggest more optimism is taking place under the hood of cryptocurrency. Specifically, Santiment’s Daily Active Addresses Indicator shows that large-cap players have gone dormant this week. With 484,000 active wallets, the reading is a new low in terms of activity for the year 2022. The June 2021 low, with a reading of 505,000 active wallets, resulted in another shallow move from $35,000 to $31,000. Bitcoin price then started a 100% increase in profits between July and November 2021.

Santiment’s price and active address indicator

In the following video, our analysts dive deep into Bitcoin’s price action, analyzing key levels of interest in the market – FXStreet Team

The Ethereum price suggests otherwise

The Ethereum price is currently trading at $1,606. Ethereum has dominated the cryptocurrency sphere in terms of performance, providing several profitable opportunities to hold on to throughout the weeks. The decentralized smart contract token has been a trader chart. Still, the textbook-like techniques are not meant to last forever. Analysis of the chain suggests that a very worrying event has just taken place behind the scenes.

Santiment’s Daily Active Addresses show the largest influx of active ETH participants this year. Currently at $1.08 million, the influx of participants is a third more than 2021’s annual high of 700,000. Shortly after the 2021 influx occurred, the ETH price plummeted from an all-time high of $4,500 to $2,400 just weeks later. Historically, the indicator shows that a high influx results in sharp sales. Specifically, the infamous crypto liquidations in both May and December 2021 and the 2018 peaks around $1,400.

When combined, the ETH price can stage a catastrophic sell-off that cannot be detected by traders solely using technical analysis.

Sentiment price and daily active address indicator

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key levels of interest in the market – FXStreet Team

The XRP price is already losing hope

The XRP price has been the underperforming digital asset for most of the summer. The digital remittance token, which saw a 30% price increase over the summer, has already lost 50% of its earned profits. Now the XRP price is hovering above a rising trend line, providing support through most of the summer. A closing candle below the rising support line could wreak total havoc on the Ripple price.

The XRP price is currently auctioned at $0.34. Unfortunately, there is no chain data from Santiment, IntoTheBlock or Glassnode. Therefore, traders can only use classic technical analysis. According to Bitstamp’s exchange, an influx of volume has entered the market near the rising limit, which is Mayday’s first warning signal. In addition, the bulls have lost support from the 8- and 21-day simple moving averages.

When put together, the XRP price suggests that more declines could happen in the coming days. Therefore, it is still bad to be an early buyer.

XRP/USDT 12-hour chart

In the following video, our analysts dive deep into the price action of Ripple, analyzing key levels of interest in the market – FXStreet Team