HIVE Blockchains Swing Away from PoS Ethereum

Chunumunu

Introduction

Many readers were enthusiastic about HIVE Blockchain Technologies (NASDAQ:HIVE) following our coverage about a month ago. The only criticism against HIVE was that about half of HIVE’s revenue comes from Ethereum (ETH-USD) and that Ethereum is expected to switch from PoW (Proof-of-Work) to PoS (Proof-of-Stake).

We explained that we could not include such a discussion in previous coverage due to the depth of the issue. Therefore, this article is our long-awaited thesis on HIVE’s pivot away from PoS Ethereum.

HIVEs are swinging away from Ethereum

HIVE’s 2022Q1 report released in Q3 (formerly referred to as “The Catch”) contains management insights up to and including July 19, 2022.

This management’s discussion and analysis contains information up to and including 19 July 2022.

On July 15, 2022, Ethereum developers have already set September as the merge date. On the contrary, HIVE stated that they believe that Ethereum can still use PoW for years to come.

The company (HIVE) believes that the broader Ethereum ecosystem achieves resilience, decentralization and high security by Ethereum remaining a proof-of-work system, and expects it to remain so in the following years.

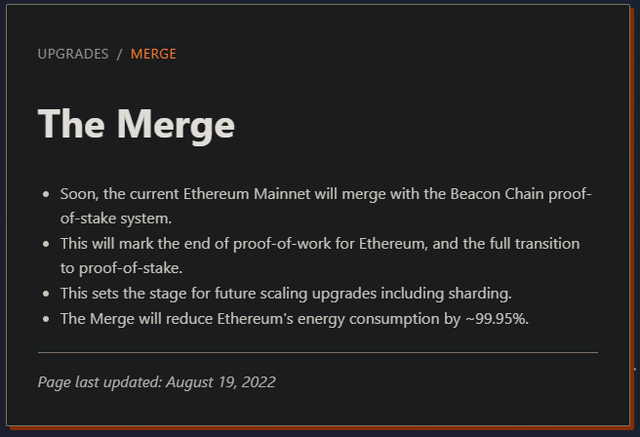

HIVE also defended the use of PoW over PoS, stating that PoW is safer, not as energy intensive as the public believes, and has less regulatory risk. Nevertheless, Ethereum developers confirmed that PoS would reduce energy consumption by ~99.95%.

We believe that HIVE’s statement can be justified because the transition process (known as “The Merge”) may be subject to further delays. Originally planned for 2019, the transition to PoS was delayed to June 2022 before being delayed again to 19 September.

Before the Ethereum Core Developer Meeting on August 18th, no one (not even the ETH developers) knew for sure when “The Merge” can be completed for Ethereum to transfer from PoW (Proof-of-Work) to PoW.

The only key indication we had was the completion of the merger. It is said that the completed merger should be more than 80% for the merger to happen in 2022Q2.

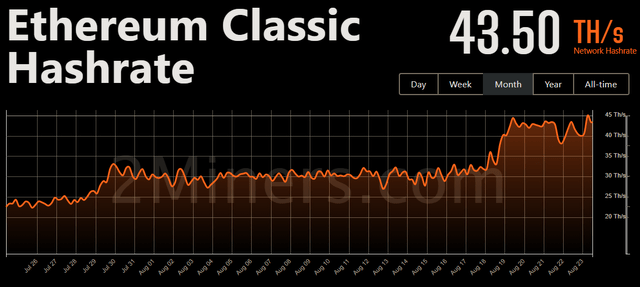

We can also say that HIVE is not ignorant to continue mining ETH even if ETH is bound to go to PoS. For example, Ethereum Classics (ETC-USD) network hashrate increased by 50% after the Ethereum Core Developer on August 18th. This suggests that many miners have already started switching to ETH. But switching over right now would mean that HIVE’s GPU mining yield would be reduced by a third (Fig 4). Therefore, this may justify HIVE’s persistence in continuing its ETH mining

Fig 1. Proof-of-Stake can reduce energy consumption by 99.95%. (Ethereum.org)

The confirmation

First, the gradual liquidation of HIVE’s Ethereum reserves. Our initial thoughts were that HIVE would accumulate more Ethereum so that HIVE could stake its Ethereum reserves for a return. However, HIVE is selling its mined Ethereum and liquidating its Ethereum reserves in favor of maximizing Bitcoin (BTC-USD) storage and capacity expansion.

Table 1 shows that the ETH reserve decreases over time while the Bitcoin reserve increases. This means that HIVE sells its reserves on top of all the Ethereum that is mined.

Second, the share of ETH production over total production (BTC + ETH) is decreasing QoQ. Finally, ETH production will be zero when HIVE explores GPU mining on ETH options:

HIVE believes there is intrinsic value in a broadly decentralized PoW blockchain with Layer 2 smart contracts, as the majority of such projects exist on the Ethereum blockchain. If NFT and DeFi developers realize that a secure PoW Layer 1 blockchain is the best playing field for their code-based projects, there could be an increase in Layer 2 applications on the Ethereum Classic blockchain, post-merger.

In short, what these tell us is that Ethereum is veering away from Ethereum entirely.

Table 1. HIVE Bitcoin & Ethereum Production, Reserves and Production Distribution

|

QR (CY) |

Bitcoins mined |

Ethereum mined |

Reserve |

ETH % Production |

|

2022Q2 |

821 |

7675 (517 BTC equivalent) |

7,667 ETH 3,239 BTC |

39% |

|

2022Q1 |

790 |

6,883 (501 BTC equivalent) |

16,196 ETH 2,568 BTC |

39% |

|

2021Q4 |

697 |

7.126 (523 BTC equivalent) |

23,290 ETH 1,813 BTC |

43% |

|

3rd quarter 2021 |

656 |

8,688 (577 BTC equivalent) |

25,154 ETH 1,116 BTC |

47% |

|

2021Q2 |

225 |

9,700 (542 BTC equivalent) |

25,000 ETH 1030 BTC |

71% |

Source: Author, HIVE Filings

The pivot

There are 3 things HIVE can do. Of the three, 2 were indicated by HIVE itself.

I. Replace ETH with other GPU-minable but ASIC-resistant protocols

First, HIVE will look for other GPU-minable coins/tokens that are also ASIC resistant.

HIVE believes there is intrinsic value in a broadly decentralized PoW blockchain with Layer 2 smart contracts, as the majority of such projects exist on the Ethereum blockchain.

If NFT and DeFi developers realize that a secure PoW Layer 1 blockchain is the best playing field for their code-based projects, there could be an increase in Layer 2 applications on the Ethereum Classic blockchain, post-merger.”

According to this statement, HIVE will look to existing layer 2 PoW protocols built on top of Ethereum. However, there is a higher chance that HIVE can start mining ETC as HIVE has conducted studies on ETC mining.

In HIVE’s July report:

The company has already started case studies, analyzing the hashrate economics of Ethereum Classic and other GPU-minable coins on an industrial scale. HIVE has also performed GPU optimizations throughout calendar 2022, which are proprietary and give the company a competitive edge.

Another piece of evidence to support this thesis is the 50% increase in the ETC network’s hash rate that coincided with the Ethereum Corer Developers meeting on August 18th. We now know that the merge progress is 96% complete as of a week ago and developers confirmed that Ethereum will move to PoS in September. Based on the 80% benchmark mentioned above, September 2022 will mark the end of ETH’s PoW era.

In other words, we can also say that the peak suggests that more miners expect a PoS ETH and are already switching to ETC as a replacement.

Therefore, ETC remains the most likely protocol for HIVE to recover. We will wait for further confirmation to begin reassessing HIVE’s profitability potential.

Fig 2. 50% increase in ETC network hashrate after ETH Core Dev Meeting (2miners.com)

ii. HPC (High-Performance Computing)

According to HIVE:

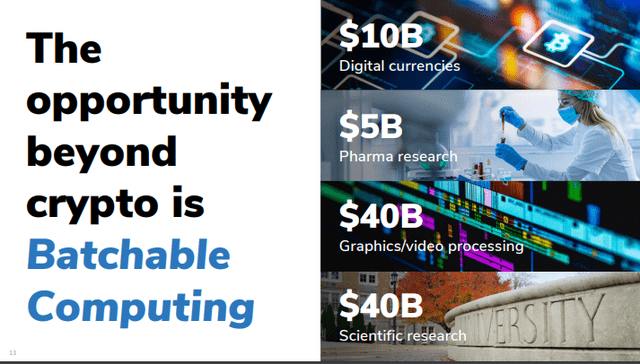

In addition to our cryptocurrency mining operations, the company has continued its efforts to upgrade and expand its facilities to enable HIVE to provide high-performance computing to companies in the gaming, artificial intelligence and graphics rendering industries.

This is very similar to Soluna Holdings’ (SLNH) strategy. According to SLNH, crypto mining companies powered by renewable energy can offer cloud computing services at a much lower cost (as much as 75% lower) than the likes of Amazon’s (AMZN) AWS (Amazon Web Services). This is especially true since HIVE is one of the most efficient crypto miners.

After all, HPC is not a new concept. For example, 10% of HUT 8 Mining (HUT) revenue was derived from HPC in 2022Q2, up from about 5% in 2022Q1 and 0% in 2021.

Soluna also noted that HPC can hedge against the crypto bear market.

Fig 2. Soluna hedge against BTC decline (Soluna) Fig 3. Addressable market for HPC or Batch Computing (Soluna)

Therefore, we expect HPC to contribute significantly to HIVE’s top line in the near future.

However, one thing to note is that revenue from HPC is not as scalable as crypto mining because HPC revenue is simply a fixed % markup from the cost of revenue.

Table 2: All-in Business Cost Per BTC or equivalent mined

Source: Author

iii. Downloading GPUs

This does not look likely yet, and there is no guidance for such action. Nevertheless, it is a common occurrence in a crypto bear market. Stronghold Digital Mining (SDIG) sold 26,000 mining machines to pay back its debt.

We don’t think offloading GPUs is a good idea. Due to the releases of next generation GPUs and the risk of recession, GPU prices dropped as much as 90% of their MSRPs. Therefore, HIVE will take on large losses that are difficult to recover from.

But more importantly, HIVE will not be able to catch up with the crypto market in 2024. Our thesis for Bitcoin is to reach a low of $10,000 by the end of 2022, then recover to $70,000 by 2023 before reaching new all-time highs in 2024 Bitcoin bull market is always followed by altcoin bull market.

Therefore, we believe that investors would benefit more if HIVE acquired more mining rigs instead of offloading them in the current market landscape. In this case, we believe that shareholder dilution (just like HUT) would be the lesser evil than unloading GPU mining rigs.

What should investors expect in Q4 and beyond?

Since ETC is HIVE’s most likely destination, let’s estimate how pivoting to ETC from ETH will affect HIVE’s profitability.

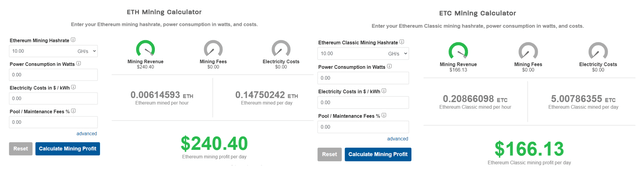

According to Table 1, ETH contributed around 40% of the total revenue. Based on www.coinwarz.com calculations (fig 4), ETH is 50% more profitable to mine than ETC. Assuming no downtime and seamless transition, HIVE’s non-BTC related revenue is expected to fall 31% or 13% of total revenue.

Fig 4. ETC is 31% less profitable than ETH (coinwars.com)

Of course, we expect HIVE to stabilize operations over a few quarters and do not expect such a minimal impact. But more importantly, HIVE will not be able to simply switch to a less profitable altcoin because the influx of hash power will increase mining difficulty and will reduce the profitability per unit of hash rate. Therefore, we should think about 13% as minimum reduction in income from the 3rd quarter onwards.

Summary

We showed how ETH is expected to complete the transition to PoS next month and how HIVE can tackle this problem. HIVE has guided investors that they are committed to replace ETH with other altcoins such as ETC and use part of their resource to provide HPC services.

We showed that HIVE’s revenue is expected to decrease by at least 11% due to downtime and an increase in mining difficulty due to the influx of hash power.

As of July 2022, HIVE’s market capitalization is $435mil and has around $75mil in crypto reserves and $214mil in deposits/equipment. This means that HIVE’s mining operations are valued at $146 million.

Based on 2022Q2 performance and the positive correlation between altcoins and Bitcoin, Bitcoin would need to be $54,280 to justify its current valuation based on a PE ratio of 5, compared to HUT’s $61,400.

We also had to mention that HIVE only has $4 million in cash at the end of 2022Q2 to handle such a massive operation pivoting away from ETH. This means that HIVE will have to raise funds through shareholder dilution or liquidation of crypto reserves (consisting of 6,820 ETH and 3,091 BTC valued at $75mil as at the time of writing). Both actions will devalue the company per share.

All in all, holding Bitcoin is still an overall better investment than HIVE.