HIVE Blockchain Technologies: Pivoting to AI? (NASDAQ:HIVE)

luza studios

Where should I start? In November, I wrote an article suggesting that HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE) can potentially mine bitcoin with a negative margin. I was also cautious because HIVE had continued to invest heavily against Ethereum mining equipment, right up to Proof-of-Stake (“POS”) mergeso there was potential for a large asset write-down.

Unfortunately, both of my concerns came to fruition in the months following my article.

Economy goes from bad to worse

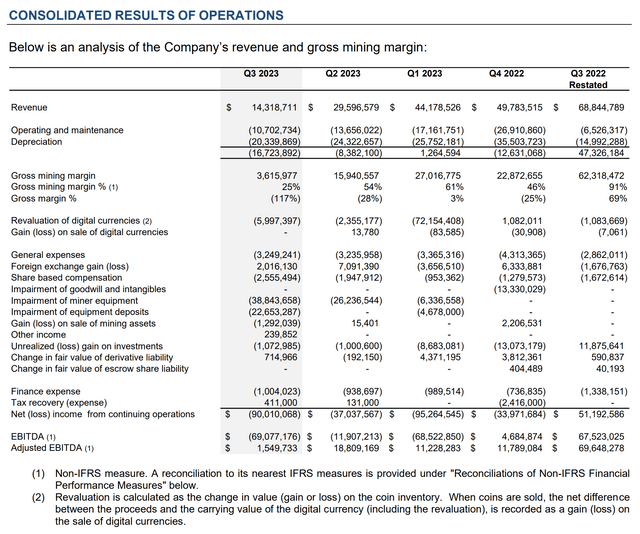

When digital currencies collapsed in the second half of 2022 due to a myriad of scandals and bankruptcies, including the bankruptcy of FTX, one of the largest crypto exchanges in the world, HIVE’s fortunes went from bad to worse. As we can see from Figure 1 below, HIVE went from a gross margin of 3% in fiscal year 1/2023 (June 30, 2022), to -28% gross margin in Q2 2023 (September 30, 2022) to -117% gross margin in Q3/2023 (December 31, 2022)!

Figure 1 – HIVE financial summary (HIVE Q3/23 MD&A)

The revenue HIVE brought in from crypto mining in Q3/23, $14.3 million, barely covered the electricity costs to run the mining equipment, let alone the depreciation of the mining equipment and G&A expenses of the company.

Furthermore, as I highlighted in my previous article, HIVE faced obsolescence costs on its Ethereum mining equipment when Ethereum switched from Proof-of-Work (“POW”) to Proof-of-Stake (“POS”). Indeed, in Q2 and Q3/2023, HIVE took a combined $87.7 million impairment charge on mining equipment and equipment inventories.

Crypto Mining is a terrible business

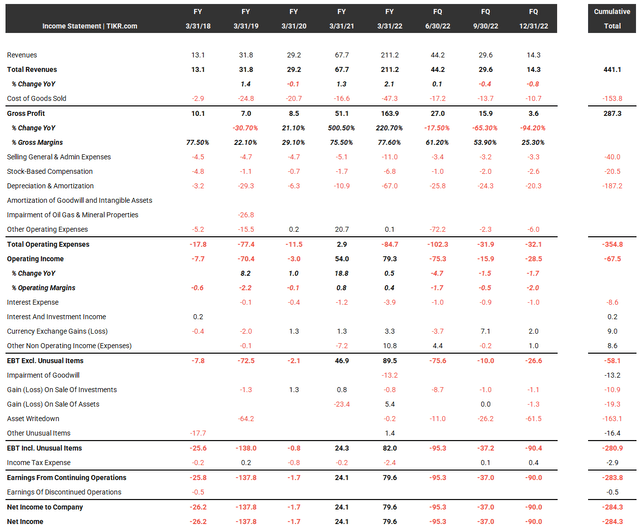

Is crypto mining a terrible business? HIVE’s cumulative financials since its IPO suggest so. HIVE has the dubious distinction of having lost $284 million since the company went public, despite the company having recorded $441 million in accumulated revenue from cryptocurrency mining (Figure 2).

Figure 2 – HIVE has lost money since the IPO (Author created with data from tikr.com)

Even ignoring write-downs and impairments, HIVE has generated a cumulative operating loss of $68 million since its IPO, as depreciation on electricity, SG&A and mining equipment have eaten up more than 100% of revenue.

Bitcoin Prices Have Jumped, Is Hive’s Future Looking Bright?

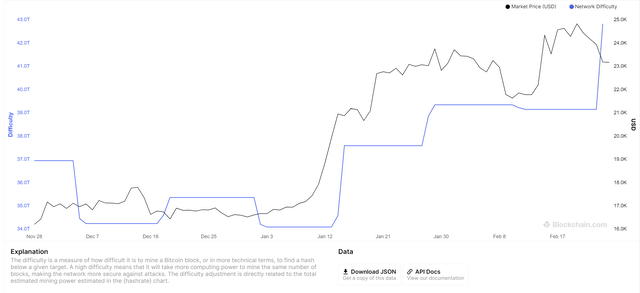

Since the end of 2022, bitcoin prices have staged an impressive 50% bounce, from ~$16ki December to ~$24k recently, does this mean HIVE’s future looks bright?

While bitcoin prices have risen considerably, bitcoin network difficulty has also risen ~20% since the turn of the year, so HIVE may not be seeing the full benefit of the rise in bitcoin prices (Figure 3).

Figure 3 – Bitcoin prices and difficulty have risen since late 2022 (blockchain.com)

In fact, in January HIVE produced only 260 BTC, down from 264 BTC in January 2022, despite bitcoin mining capacity increasing from 1.87 Exahash in January 2022 to 2.68 Exahash on January 31, 2023.

Due to the constant increase in mining difficulty, bitcoin mining is like running on a treadmill, miners have to spend millions in capital just to stand still.

Late filing adds confusion to the mix

On February 14, 2023, shareholders also received a Valentine’s Day surprise when HIVE reported that due to a tax filing for one of its European subsidiaries, HIVE would not be able to file its interim financial statements by the February 14, 2023 regulatory deadline.

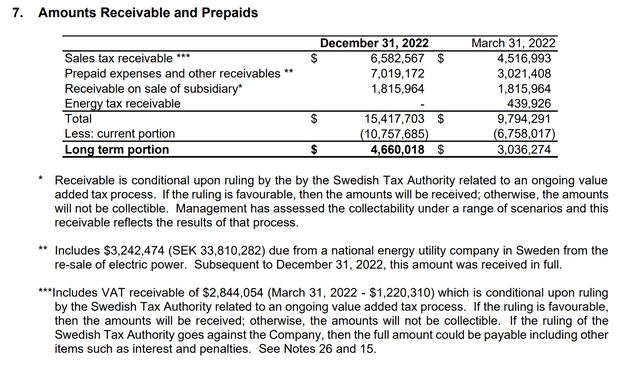

Fortunately, the company was able to publish its financial results on February 21, 2023. However, by reading the notes to the financial statements, we can see that the tax dispute regarding input VAT against equipment and other costs of SEK 338 million ($32 million) has not been resolved. Although the company has submitted a formal complaint to the Swedish tax authority, no guarantees can be given that HIVE will prevail when it comes to recovering VAT. In total, the disputed VAT charge amounts to 4.6 million dollars, which the company currently includes in accounts receivable (Figure 4).

Figure 4 – HIVE has 4.6 million dollars in disputed claims on VAT (HIVE Q3/23 Financial Statements)

Furthermore, if the ruling goes against HIVE, the company may be liable for the entire amount plus other items such as fines and interest.

Why conference calling without revenue?

In an era of transparency and accountability, it is notable that HIVE decided not to host a conference call after it released its Q3 2023 earnings report on February 21. This is particularly galling since the company reported a huge quarterly loss of $1.09/share and shareholders were no doubt looking to management for guidance and direction towards future results.

Perhaps the lack of an earnings conference call was to prevent analysts and investors from asking management tough questions?

Pivot to ‘AI’ a new source of growth?

An interesting positive development in the quarter was the introduction in the earnings press release of language related to “high performance compute” (“HPC”) and “AI” (author’s emphasis):

Frank Holmes, HIVE’s Executive Chairman, stated “We want to once again thank our loyal shareholders for believing in our vision to mine both Ethereum and Bitcoin. We are sad to see the higher margin from Ethereum mining gone, but our HPC strategy, which has taken longer to roll out, is now growing rapidly on a monthly basis. We are happy to share that our robust growth is scalable and could potentially increase 10x within the next year as the demand for our high quality chips due to the huge global demand for Ai projects such as GPT CHAT, medical research, machine learning and rendering.. Furthermore, HIVE was the first to use our software to help balance the electric grid and sell back energy when there is an increase in demand. This strategy has been good for society and HIVE. Even with a challenging quarter for the global digital asset ecosystem, where we saw the capitulation of crypto prices due to the implosion of FTX and the related contagion with other exchanges, lenders and hedge funds. Strategically, we have not borrowed expensive debt against our mining equipment or pledged our Bitcoins for costly loans, thus our balance sheet remains healthy to weather this storm. We believe our low coupon fixed debt; attractive green renewable energy prices and high performance energy efficient ASIC and GPU chips will help us navigate through this crypto winter. The latest unexpected challenge has been in Sweden, which we cover in more detail in our interim filings.”

As many investors are aware, “AI” has been the hot topic in recent months due to the introduction of Chat GPT, a generative AI chatbot that has taken the public’s imagination by storm (author’s note, Hive appears to have mixed up Chat GPT’s name in the press release above). Just the mention of ‘AI’ or ‘Chat GPT’ can send small-cap speculative stocks like C3.ai (AI) soaring 10-40% in a day, so it’s no surprise that HIVE wants to be associated with AI- the movement. However, it remains to be seen how applicable HIVE’s GPU farms are to real-world AI applications.

According to the press release, HIVE will launch the ‘HIVE Performance Cloud’ in calendar Q2 2023. Prior to the full-scale launch of HIVE Cloud, Hive’s proof-of-concept test of the GPU fleet was able to produce annual revenues of over $1 million performing high-performance computing performance.

At current market conditions, HIVE estimates that HPC is approximately 25 times more profitable than mining bitcoin, on a dollar per MWHR basis. By enlisting approximately 450 GPUs, HIVE was able to produce $3,500 in revenue per day with 80 kW of power consumption. In comparison, 80 kW Bitcoin ASIC miners would only produce about $175 per day of BTC.

While those are gaudy numbers, investors are cautioned against counting their chickens before they hatch. In the HPC realm, HIVE will compete against industry giants such as Amazon’s AWS, Microsoft’s Azure, and Google’s Cloud, not to mention dozens of dedicated competitors. It’s unclear what advantage HIVE’s GPUs have besides being idle.

Let’s wait until we see actual operational results from the ‘HIVE Cloud’ before assigning any additional value to the GPU fleet.

Risks of Bearish View

The biggest risk of being bearish HIVE is obviously that even if you get the fundamentals right, you can still lose money. For example, while the company has performed operationally just as I envisioned in my November article, the trajectory of the share price has been a different story. HIVE’s shares first fell from ~$2.50 to ~$1.40, then tripled to $4.20 in early January, before finally trading back to $2.50 in recent days (Figure 5).

Figure 5 – HIVE is an extremely volatile share (stockcharts.com)

This is because HIVE trades much more on investor sentiment towards bitcoin and risk appetite in general, rather than fundamentals.

For traders who can time the markets, HIVE can be a great trading tool. But for investors looking to invest in strong fundamentals, I would suggest they look elsewhere.

Conclusion

In summary, HIVE delivered exceptionally poor financial results to end the 2022 calendar year, as I had expected. Gross margins, which include depreciation of mining equipment, fell to -117% in Q3/F23. HIVE also took $88 million in write-downs against its outdated GPUs.

Looking ahead, I believe HIVE’s financials will see a relief back in Q4/F23, as bitcoin prices have rebounded in recent months. However, investors should keep in mind that the difficulty of bitcoin mining has increased, so the financial benefits may be less than what bitcoin prices suggest.

A ray of hope for HIVE is its recent pivot to ‘high performance compute’, which HIVE describes as 25 times more profitable than mining bitcoin. But until we see some real financial results, I think investors should stay on the sidelines.