HIVE Blockchain Technologies Faces a Challenging 2023 (NASDAQ:HIVE)

Sibani Das

Investment thesis

I have been following the cryptocurrency sector closely for over five years and I have published 2 bullish articles on HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE) – 17.8.19 and 5.11.20 the base case of which was the company worthy of some of your “spare money.” HIVE traded at $0.26 on the date of my first article, and has closed as high as $26.31, or 100X since then. My interest in this industry pioneer was largely based on:

- HIVE was the first public crypto mining company

- HIVE was the first crypto miner for both Bitcoin (BTC-USD) and Ethereum

- HIVE has a well-defined focus on green energy and ESG

- HIVE has a global presence (Canada, Iceland and Sweden)

- HIVE has a strategic HODL policy

However, HIVE has made a 180-degree pivot since my last article on On 12/31/22 bitcoin represented 99.9% (38.9/39.0) of their digital currencies compared to when bitcoin represented 25.7% (887/3,455) of their digital currencies. The increased froth in the cryptocurrency sector has resulted in a prolonged bear market. HIVE (like many other cryptocurrency companies) has achieved suboptimal financial results as shown in the company’s SEC filing of 2/21/23.

Stock performance

seekingalpha.com/hive

As the chart above shows, HIVE has dropped from $4.60 to $2.75, or 41.3% since 9/15/22, when Ethereum merged into proof-of-stake because it is better for implementing new scaling solutions, less energy intensive and more secure than the previous proof-of-work architecture. This performance is much worse than the 30.9% average decline of the 6 stocks the company referenced on the 2/28/23 earnings webcast. HIVE’s beta of 4.4 is higher than the average beta of 3.6 for its peers. The company has a quant rating of 1.77 which is a “sell” and is about the same as the average quant of 1.83 for its peer group. In my view, these sub-optimal metrics portend a challenging near-term future at both a company-specific and macro level (Bitcoin mining sector) as crypto winter drones into month 10, with storm clouds hanging on the horizon.

Q3 Form 6-K

Key takeaways from my review of the SEC filing above is that the condensed interim consolidated statements of financial position show that HIVE had a significant decrease in its current ratio from 3.17 as of 3/31/22 to a current ratio of 1.31 as of 31 /12/ 22. The company also had a significant decrease in working capital from $174.1 million as of 3/31/22 to $15.3 million as of 12/31/22.

The condensed interim consolidated statements of income (loss) and total income (loss) show that HIVE had revenue of $88.1 million for the 9 months ended 12/31/22 compared to revenue of $161.4 million for the 9 the months that ended 31.12.21. HIVE had a net loss of $222.3M for the 9 months ended 12/31/22 compared to a net loss of $113.6M as of 12/31/21.

The condensed interim consolidated statements of cash flows show that HIVE had net cash provided by operating activities of $46.8 million for the 9 months ended 12/31/22 compared to $52.6 million for the 9 months ended 12/31/21

summary

Based on my review of HIVE’s Q3 6-K, as of 12/31/22, the company is on track to report a record loss of over $235M for FY23, which ends 3/31/23. Since the price of Bitcoin is a de facto proxy for the sector, HIVE and the other Bitcoin miners will be affected by the incessant volatility of this widespread cryptocurrency, which fell by 65% in 2022. This price collapse is the main reason why HIVE recorded impairment charges of $98.8 million and a revaluation of digital currencies of $80.5 million for the 9 months ended 12/31/22. These write-downs had a material effect on HIVE’s balance sheet and income statement, as evidenced by their deteriorating financial calculations referred to above, and will further limit their ability to access the capital markets. To meaningfully recover from the 45.4% YTD revenue decline will require a significant increase in bitcoin, which seems unlikely. Other points of concern are that $2.8 million of the $6.6 million, or 42.4% of sales taxes received, is subject to a ruling by the Swedish tax authority related to an ongoing VAT issue and the 48.4% increase on an annualized basis ($9.8 million vs. $6.6 million) in general and administrative expenses.

2024 bitcoin halving

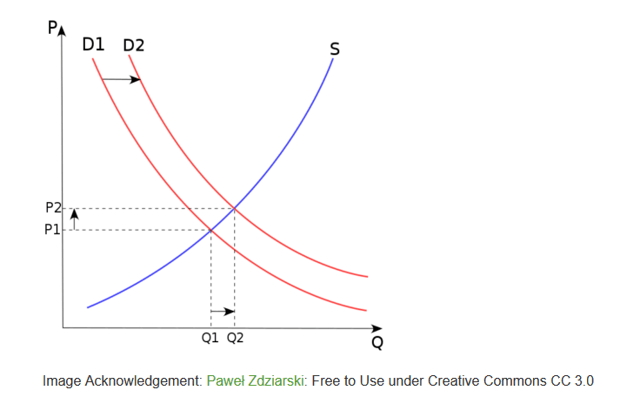

According to current forecasts, the next bitcoin halving event (which occurs approximately every 4 years) will occur in early 2024. Speculation that this event will result in a price increase in bitcoin and other cryptocurrencies is supported by the following graph:

www.commons.m.wikimedia.org

Based on my study of the Samuelson hypothesis as an economics major shortly after it was created more than 55 years ago, I believe that the upcoming bitcoin halving may very well serve as a litmus test of the Samuelson hypothesis as it applies to volatility in the cryptocurrency. sector. Former “bitcoin billionaires” and FOMO evangelists Cameron and Tyler Winklevoss can weigh in on the upcoming bitcoin halving narrative and thus add their perspective to the situation. In addition, a combination of other factors will contribute to a feverish froth in the sector as the bitcoin date approaches, thus supporting the validity of the Samuelson hypothesis.

Unfavorable risk/reward profile

2022 was a turbulent year for all Bitcoin miners – the FTX collapse, the Ethereum merger and pronounced volatility in the sector. HIVE managed to withstand this upheaval, but in my view, 2023 will be a watershed year for the company. The company has deployed 4,200 HIVE BuzzMiners powered by Intel Blockscale ASIC and is also launching its high-performance cloud computing business, which is 25 times more profitable than mining to meet the challenges of Bitcoin mining. But in my view these are commendable measures will not have a serious impact on profitability until the 4th quarter. Since HIVE is up 79.7% YTD, I believe the stock is currently “over the top” based on my assessment of the cryptocurrency sector. My back-of-the-envelope price target is below $2.40 or 12.7% less than the 3/3/23 price of $2.75 barring a Black Swan-like event that would implode the entire industry.

Conclusion

Based on the foregoing financial and operational analysis, HIVE Blockchain Technologies Ltd. facing many serious challenges ahead, highlighted by pronounced volatility, which is embedded in the DNA of the cryptocurrency sector. The following caveat that I stated in my 8/7/19 article is even more of a concern in the current environment:

- Investments in this sector are fraught with a number of dangers and pitfalls.

- The industry’s inherent volatility is reason enough that most investors should not allocate more than 0.005% of their portfolio to this area.

- The bottom line is that an investment in the emerging cryptocurrency sector should be limited to “mad money” and only suitable for those with a high risk tolerance.

Given the uncertainty in the bitcoin mining landscape, I believe that HIVE is a “hold” on a short-term basis and Caveat emptor (“let the buyer take great care”) is appropriate in the circumstances. The company’s fiscal year ends 3/31/23, which means their audited financial statements will be available on sec.gov. in the coming months. I may update this article as I expect more clarity on all things financial to be revealed by HIVE leadership, who have a history of an ambitious thought process. However, at the moment, my view is that HIVE Blockchain Technologies Ltd. is a “team”.