Hive Blockchain Shares Up 100% YTD Deploys Intel’s Blockscale Chip for Bitcoin Mining Machines

The shares of Bitcoin (BTC) mining company Hive Blockchain ( HIVE ) has increased by more than 100% since the beginning of the year, while it recently deployed its first machines based on Intel‘s (INTC) block scale chips.

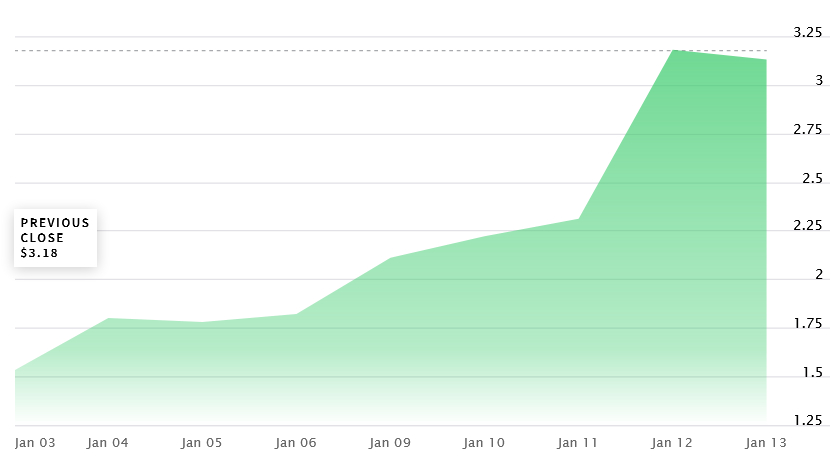

Between Tuesday 3 January and Friday 13 January 2023 HIVE shares rose 104.6%.

On January 3, a share stood at $1.53, while just 10 days later it went up to $3.13. The highest point since the beginning of the year was $3.18 seen on January 12th.

Hive Blockchain Technologies Ltd. Ordinary shares (HIVE), so far this year:

Meanwhile, on Friday, the miner announced its commercial deployment of HIVE BuzzMiner powered by Intel Blockscale ASIC, “after months of planning, engineering development, implementation of factory QA processes, field testing and global collaboration.”

According to CEO Frank Holmes, HIVE is the first public crypto miner to deploy its own ASIC mining rig. He added that

“HIVE BuzzMiner is our proof that Proof-of-Work is the most secure and robust consensus mechanism for digital assets, of which Bitcoin is the most secure.”

Aydin Kilic, President & COO of HIVE, stated that the company was able to optimize the functionality of HIVE BuzzMiner to satisfy demand response programs, allowing them to participate in grid balancing initiatives.

As far as the machines’ performance is concerned, the expected targets have been reached, says the press release. More than 1,500 HIVE BuzzMiners have been deployed in its data centers in Canada and Sweden, and HIVE said it retains the ability to produce more HIVE BuzzMiners.

A unique point of the HIVE BuzzMiner is the dynamic operating range, said Kilic, where the company can operate the machines from 110 TH/s to 130 TH/s, enabling it to optimize the profitability of the fleet by varying power consumption and machine efficiency. The first build of 5,800 HIVE BuzzMiners can produce between 638 PH/s to 754 PH/s, he added.

Kilic stated that

“We use advanced multivariate mathematical models to study ever-changing hashrate economics, and closely monitor the production costs of each Bitcoin at our various data centers, along with the ROI of our investments, which varies with ASIC mining performance. This is the key to navigating crypto bear markets with success, and maximizing profits in bull markets. We can now modulate ASIC mining performance with our HIVE BuzzMiners for optimal returns.”

Jose Rios, general manager of Blockchain and Business Solutions in the Accelerated Computing and Graphics Group of the American multinational company Intel, added that Intel is “excited about the potential” of HIVE’s BuzzMiner system developed in collaboration with HIVE’s engineering team, but also that it sees until the continued distribution of these systems in the years to come.

Per William Gray, CTO of HIVE, the company has the ability to develop its own application programming interface (API) calls, as well as collect test data at the microchip level and fine-tune the device to optimize performance — and this “sets the stage for future ASIC system development,” argued Gray .

Meanwhile, Intel said last February that it intended to contribute to the development of blockchain technologies with a roadmap for energy-efficient accelerators, with some of the first customers Argo Blockchain, BLOCK (formerly known as The square), and GRIID Infrastructure. Intel also formed the new Custom Compute Group, responsible for building “custom silicon platforms optimized for customers’ workloads, including blockchain and other custom accelerated supercomputing capabilities at the edge.”

____

Learn more:

– Nvidia Chipmaker Crypto-Related Revenue Beats Expectations Despite Bear Market

– Crypto Mining investments in Cuba have been severely affected by constant power outages

– Novogratz’s Galaxy Digital invests $100 million to prevent bankruptcy in Argo Bitcoin Miner Firm

– One of the largest Bitcoin mining companies just filed for bankruptcy – Here’s what it means for the crypto industry