HEX Token Sees Over 37,000% Growth But Is It A Scam?

The 2-year-old cryptocurrency project offers a 38% stake reward. Is the project legit or a scam?

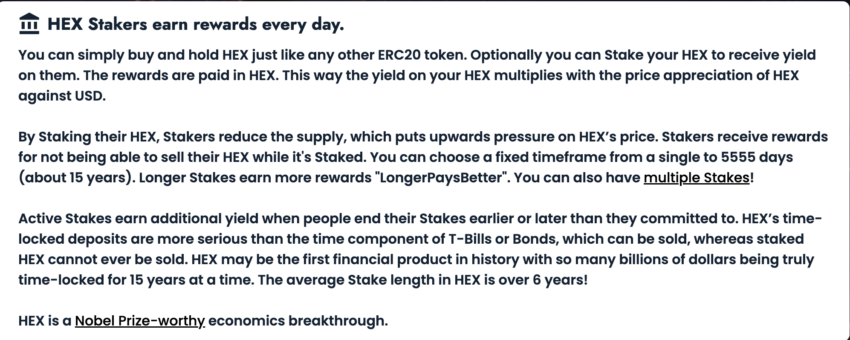

The HEX token is based on the Ethereum blockchain. Their website says they are the first blockchain proof of deposit. Those who stake HEX tokens get an average of 38% return. The number is lucrative because most American banks do not give more than 2% annual interest.

Who is the founder?

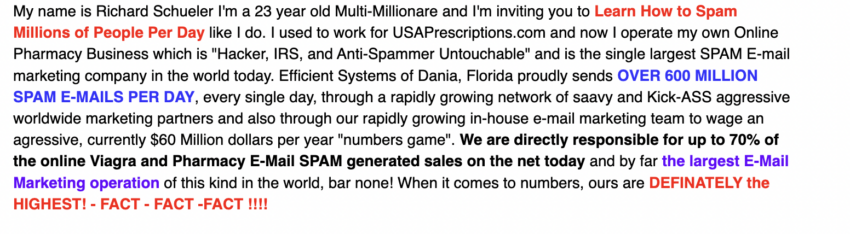

HEX was founded by Richard Schueler, who adopted the stage name Richard Heart. One of the steps to fundamentally analyze any project in Web3 is to check out the history of the founder.

Richard’s email archive shows that he used to teach a course on how to spam people. In fact, he was charged with invoking Washington State’s anti-spam law.

His Twitter bio read that he owns the most expensive Rolex, the world’s fastest Ferrari, and a few more who brag about his lifestyle. He has bends his wealth on several occasions on social media. When asked why he flexes his fortune, he replied that it was for views and commitment.

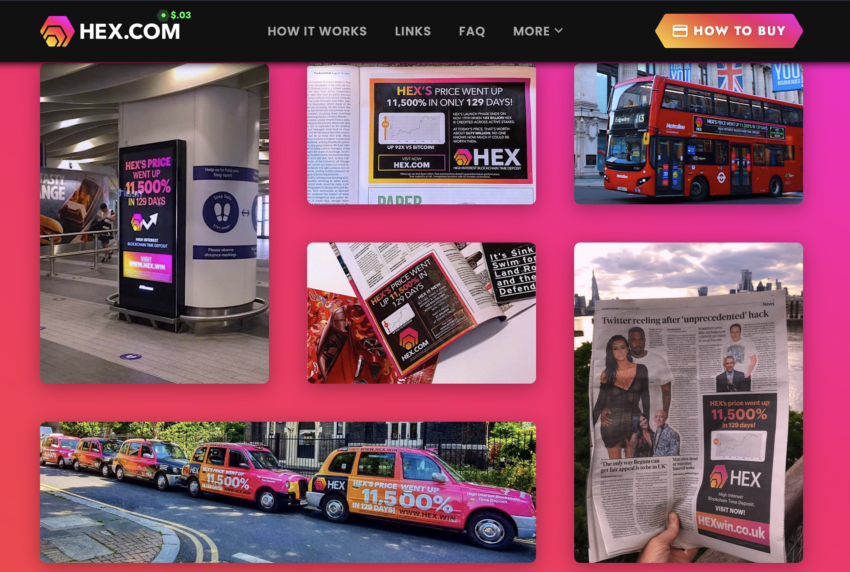

The aggressive marketing from HEX focused on price gains.

Twitter’s Name of the official account shows the gain in price and high stake rewards. There aren’t many real projects that focus as much on price gains as HEX does. In general, projects are concerned with building the best services for their community. Their social media handles do not promote how much the token’s price increased, let alone shout it through the handle’s name.

They also started one campaign #HEXBoughtThis on social media where shillers or early investors flex their wealth bought from HEX gains.

It is one of the most aggressively marketed crypto projects. The project has been advertised in newspapers, magazines, billboards and airports. All of these campaigns focus on showing how much the token’s price has risen. The approach is the same as everyone else get-rich-quick scheme, to cater to the greed of ordinary people. A Twitter user posted that HEX used customer records from the Ledger hack and sent marketing material by post to addresses taken from there. How many Web3 projects do their marketing on par with HEX?

The website claims that investors will create “life-changing wealth”. Genuine projects with strong products not primarily focus on the increase in their market price for marketing purposes. Bitcoin and Ethereum’s website does not discuss price fluctuations or creating “life-changing wealth” because they serve a purpose. Investors making money is a by-product of the larger purpose these projects serve.

The HEX buyers are encouraged to lock their capital for a certain period of time. There is a big penalty if someone unlocks them before the lock-in period is over. This effectively reduces the supply of tokens in the market and the demand is brought in through FOMO with the aggressive marketing campaign.

The effort rewards.

At the time of writing, the website shows stake rewards of 38%. Who gets the effort reward?

In the proof-of-stake consensus mechanism, the validators deposit a certain amount to the smart contract as collateral to keep the blockchain secure. They are rewarded for uptime and cut for being inactive for a long time.

Although there is no such thing with HEX, stakers do not stake their HEX to secure the blockchain or validate the transactions. The sole purpose of betting HEX is to reduce supply, which puts upward pressure on HEX’s price.

The argument of whether or not HEX is a scam is quite a hot topic of debate among the Twitter community. Along with critics, the project has attracted hardcore supporters. Well-known industry leaders believe that HEX is a scam zero.

HEX reached an all-time high in September 2021 of 0.51. That’s down about 94% from all-time. Most scam projects in crypto do not survive the test of bear markets. Will HEX survive the current bear market or will it go to zero? Perhaps only time can answer this.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.